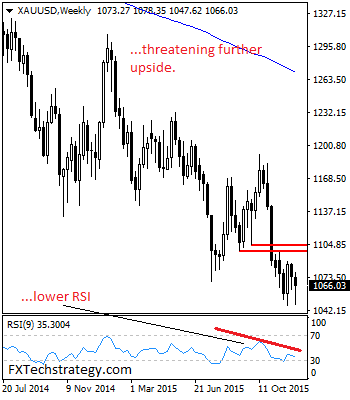

Gold: With the commodity turning back to close on a rejection candle ahead of the 1046.30 level the past week, gold faces risk of more strength on price rejection. On the downside, support comes in at the 1050.00 level where a break will turn attention to the 1040.00 level. Further down, a cut through here will open the door for a move lower towards the 1030.00 level. Below here if seen could trigger further downside pressure targeting the 1020.00 level. Conversely, resistance resides at the 1075.00 level where a break will aim at the 1085.00 level. A turn above there will expose the 1095.00 level. Further out, resistance stands at the 1105.00 level. All in all, gold faces risk of more strength as it looks to extend its past week price rejection.