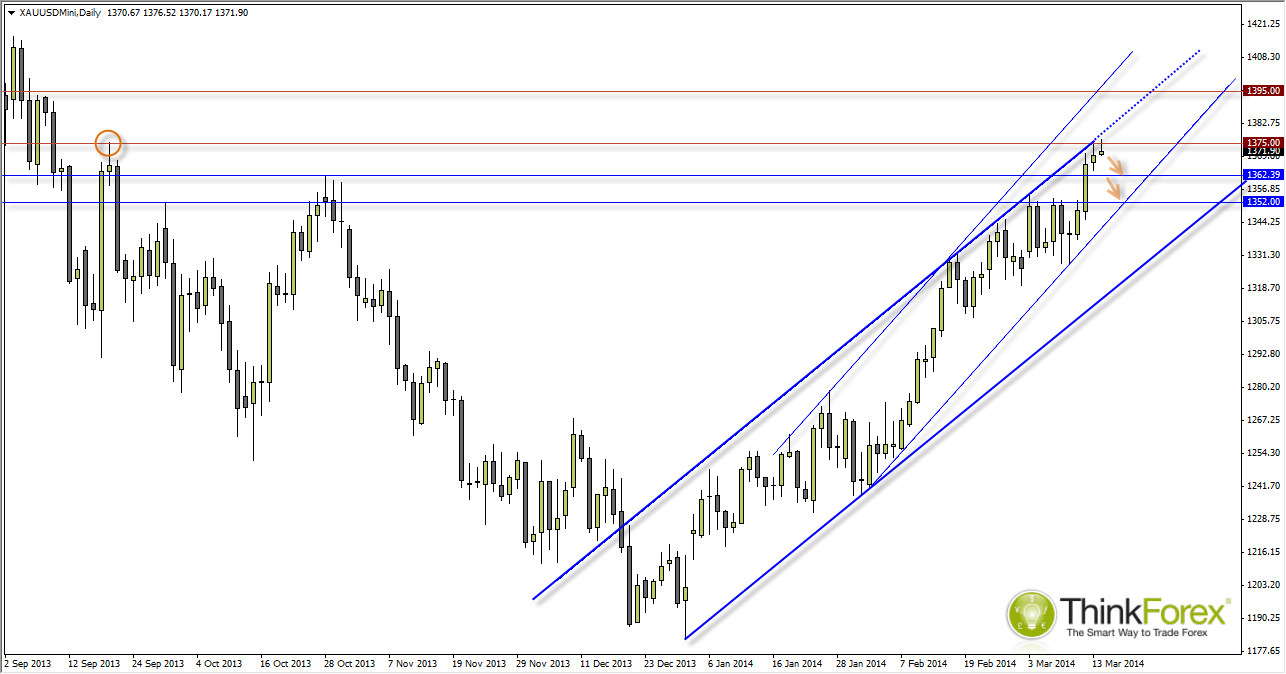

After a $194 bullish run and currently trading at 6-month highs the temptation to keep buying, must be present. Whilst I believe the run does still have legs in it, going into this weekend my bias is for a minor retracement before a trend continuation.

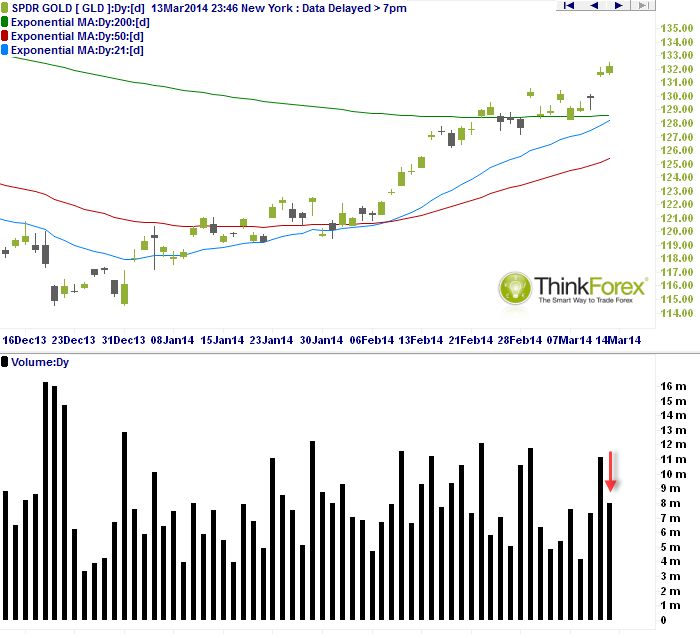

The chart above is the ETF for Gold which allows us to use the volume as a proxy for buying/selling pressure on XAU/USD. We continue to trade to new highs and whilst volume is still above average, we reached a new high yesterday on lower volume. In itself this is no major concern (unlike the Euro Chart posted today) but as we have failed to break above resistance it does raise the odds of a minor pullback at least.

XAU/USD Mini Daily" title="XAU/USD Mini Daily" height="242" width="474">

XAU/USD Mini Daily" title="XAU/USD Mini Daily" height="242" width="474">

Yesterday's candle was a Spinning Top Doji on lower volume and whilst today’s trading did see an intraday spike above yesterday's high we are now trading back below this resistance level. We are relatively light on 'red news' tonight as we only have US PPI and consumer sentiment. If we are likely to see any substantial moves across the markets it is more likely to be Ukraine related, however my current bias is for a retracement towards 1362.40.

In the event we break above 1375 we have the upper channel which may act as resistance as we creep up the channel. However going into the weekend expect positions to be closed so stay nimble.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.