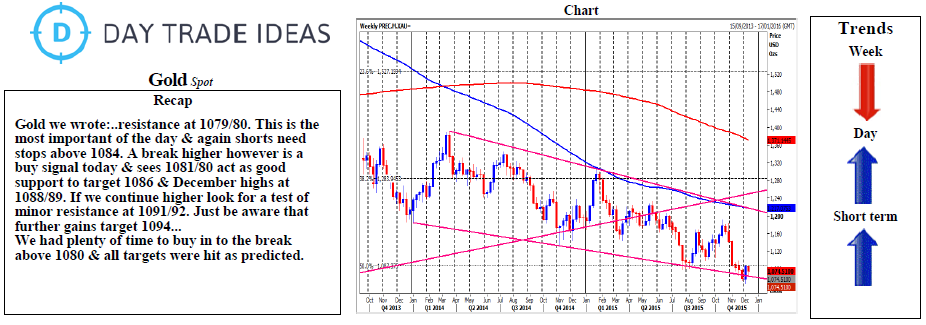

Gold short term outlook now very positive on the break above 1080 of course but we are overbought short term. Minor support at 1090/89 but better support at 1087/86. However if we continue lower look for an excellent buying opportunity at 1082/81. Longs need stops below 1076. Just be aware that a close below 1079 would be more negative going forward and suggest a false breakout yesterday.

Holding above 1089 keeps bulls in full control and re-targets 1091/92 then 1094. Be ready to buy a break above 1096 if not already long to target 1098 then strong resistance at 1101/02. This is the main challenge for bulls today and is likely to see a high for the day. For a short term position, try shorts with stops above 1105 but on a break higher look for a test of the 100 day moving average resistance at 1109.