Early hints of improving operations

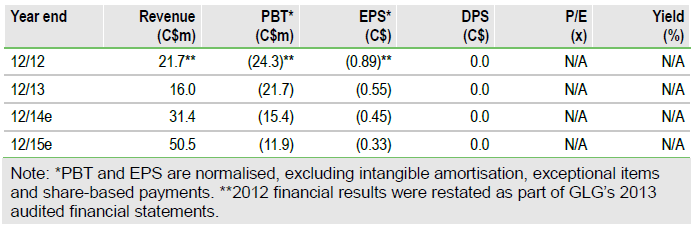

GLG Life Tech Corporation (GLG.TO) finished 2013 with its first quarterly gross profit since mid-2011, reflecting a product mix of higher-margin purity extracts and better cost containment. The firm also indicates its newer-generation Huinong 3 (H3) proprietary stevia leaf strain could deliver up to 30% higher glycoside yields than previously anticipated. We continue to believe the firm will return to generating consistently positive EBITDA in 2016, driven by its utilisation of high-yielding proprietary stevia leaves. A stronger than expected turnaround provides geared upside to our C$138m NPV.

H3 leaf showing higher than expected yields

GLG’s H3 proprietary stevia leaf is showing higher than expected yields of stevia glycosides. Whereas the firm previously projected the leaves would have ~11% glycosides by mass, it found that early samples are showing 13-15% glycoside content, which could translate into raw material cost savings of up to 25-30% (not yet included in our forecasts). We expect that by H214, H3 leaf will begin to account for the majority of processed leaf in GLG’s supply chain.

Sales outlook suggestive of increasing demand

As of 31 March 2014, GLG received purchase orders from international (ex China) customers that exceed 50% of 2013’s full year international revenue. International customers only accounted for C$4.8m (30%) of 2013 revenue. This is a favourable indication of increasing customer demand.

RebM GRAS filing targets carbonated drink market

GLG recently filed a generally recognised as safe (GRAS) notification with the FDA for its Rebaudioside M (RebM) extract; its clean taste profile in carbonated drinks has already attracted interest from large, global beverage players. GLG is also working on developing new strains to improve RebM yields and supply.

Valuation: NPV of C$138m, equity valued at C$64m

Our NPV of C$138m (up from C$131m previously, due to rolling our forecasts forward) is based on a DCF analysis using a 10% weighted-average cost of capital. Subtracting GLG’s Q114e net debt of C$74.0m from our NPV provides an equity valuation of C$64m, or C$1.91 per share. Given GLG’s high debt-to-equity ratio, our equity valuation is highly levered to our margin, penetration and stevia market size assumptions. Better than expected operating improvements under favourable market conditions may lead to many times upside to our equity valuation.

To Read the Entire Report Please Click on the pdf File Below