- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

G-III Apparel (GIII) Rises On Q3 Earnings Beat & Upbeat View

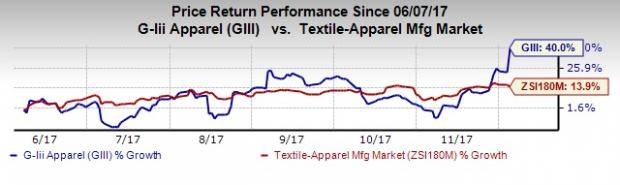

Shares of G-III Apparel Group, Ltd. (NASDAQ:GIII) surged nearly 14% after the company delivered better-than-expected third-quarter fiscal 2018 earnings. Moreover, the company raised earnings guidance for fiscal 2018 which further fueled investor sentiment. We believe robust results and optimistic view is likely to drive shares higher, which has witnessed a sharp gain of 40% in the past six months, compared with the industry’s increase of 13.9%.

G-III Apparel Group reported adjusted earnings per share of $1.67, beating the Zacks Consensus Estimate of $1.54 and also rose 11.3% year over year.

The company reported net sales of $1,025 million that increased 16% year over year but marginally came below the consensus mark of $1,033 million. Sharp gain in the top line can be attributed to robust performance of wholesale business which increased 22% year over year and also due to $88 million of net sales from the company’s DKNY and Donna Karan brands.

Sharp increase in wholesale business was primarily driven by rise in sales of Tommy Hilfiger, Calvin Klein and Karl Lagerfeld license products along with inclusion of nearly $87 million of net sales from fresh DKNY as well as Donna Karan product lines. Wholesale business witnessed a gain of 11% excluding the impact of the Donna, Calvin and DKNY brands.

Gross profit for the reported quarter increased 21.6% to $390.9 million, while gross margin expanded 170 basis points (bps) to 38.1%. The company reported operating income of $141.2 million, up 22.6% from the prior-year quarter.

Balance Sheet

G-III Apparel ended the quarter with cash balance of $68.2 million and stockholders’ equity of approximately $1,106.9 million. The company had a long-term debt of $726.6 million.

Guidance

Management raised fiscal 2018 earnings view and provided fourth-quarter guidance. For fiscal 2018, the company expects adjusted earnings per share in the range of $1.42-$1.52, sharply up from the earlier estimate of $1.28 -$1.38. The Zacks Consensus Estimate for fiscal 2018 is currently pegged at $1.36 and could witness upward revisions in the coming days.

The company continues to expect net sales of nearly $2.8 billion. The company now anticipates adjusted EBITDA in the range of $188-$196 million, compared with previous guided range of $180-$188 million. In the fiscal 2017, the company had reported adjusted EBITDA of $148.1 million.

For the fourth quarter, the company expects net sales of nearly $707 million compared with $603 million in the prior-year quarter. The company expects adjusted earnings per share in the range of 9-19 cents. In the prior-year quarter, the company had reported adjusted loss per share of 16 cents. The Zacks Consensus Estimate for the fourth quarter is currently pegged at 16 cents.

G-III Apparel currently carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement.

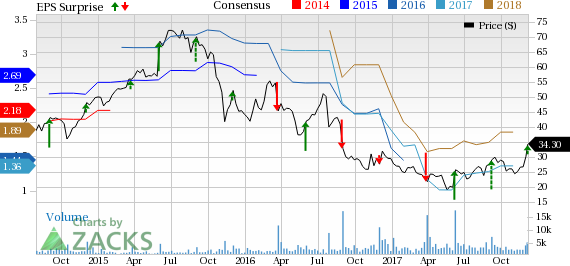

G-III Apparel Group, LTD. Price, Consensus and EPS Surprise

Stocks to Consider

Better-ranked stocks worth considering in the retail space include Guess?, Inc. (NYSE:GES) , Michael Kors Holdings Limited (NYSE:KORS) and PVH Corp. (NYSE:PVH) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Guess has reported better-than-expected earnings in the trailing four quarters, with an average beat of 28.2%.

Michael Kors Holdings has an impressive long-term earnings growth rate of 7.5%. It has also surpassed the Zacks Consensus Estimate in the trailing four quarters, with an average earnings beat of 23.7%.

PVH has reported earnings beat in the trailing four quarters, with an average of 2.6%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Guess?, Inc. (GES): Free Stock Analysis Report

PVH Corp. (PVH): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.