- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Geron's (GERN) Q4 Earnings And Revenues Surpass Estimates

Geron Corporation (NASDAQ:GERN) incurred a loss of 15 cents per share in fourth-quarter 2019, narrower than the Zacks Consensus Estimate of a loss of 20 cents. In the year-ago quarter, the company had incurred a loss of 4 cents per share.

Quarterly revenues came in at $0.17 million, slightly beating the Zacks Consensus Estimate of $0.14 million. Notably, the top line comprised royalty and license fee revenues received under various non-imetelstat license agreements. In the year-ago quarter, revenues had totaled $0.38 million. Revenues declined as the number of active license agreements fell due to expiry of patents of Geron’s underlying technology.

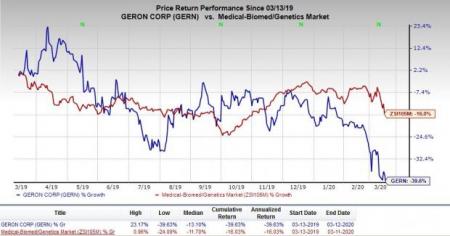

Despite the better-than-expected results, shares of Geron were down almost 6.1% in after-hours trading on Mar 12 amid bloodbath in broader markets related to the coronavirus outbreak. In the past year, the stock has declined 39.6% compared with the industry’s 16% decrease.

R&D expenses were $24.9 million compared with $5.1 million in the year-ago quarter as well as $11.1 million in the previous quarter. The significant year over year increase in R&D expenses was due to transition costs and higher clinical activity related to its lead pipeline candidate, imetelstat.

General and administrative expenses rose 8.2% to $5.3 million, reflecting legal costs related to patent litigations and recruitment expenses for additional headcounts.

Geron ended the fourth quarter with $159.2 million in cash and investments compared with $159.3 million at the end of the third quarter 2019.

Full Year Results

Geron incurred a loss of 36 cents in 2019 compared with loss of 15 cents in 2018. Revenues for the full year were $0.46 million, down from $1.1 million in the year-ago period.

2020 Guidance

Geron provided its guidance for 2020. The company expects full-year operating expenses to be in the range of $70-$75 million. The company expects its cash resources to be sufficient to continue with the phase III IMerge study on imetelstat in 2020 and initiate a proof-of-concept study in the year.

However, the company expects that the coronavirus pandemic may impact its enrollment timeline as well as hamper drug supply related to its clinical studies.

Pipeline Update

Following the termination of the agreement with Janssen, a subsidiary of J&J (NYSE:JNJ) , in September 2018, Geron regained global development rights to imetelstat and decided to continue developing imetelstat independently. The transition activities, including ex-U.S. clinical and regulatory responsibilities, were completed in the third quarter of 2019.

In October 2019, the company initiated dosing in the phase III study, IMerge, in patients with lower risk myelodysplastic syndromes (“MDS”). The company expects to complete enrollment by the end of 2020 and anticipates top-line data from the study in mid-2022.

Geron completed an end of phase II meeting with the FDA in the fourth quarter of 2019 related to development of imetelstat as a treatment of myelofibrosis (“MF”). Based on the FDA’s feedback, the company plans to submit a phase III study design to evaluate imetelstat in MF patients in the second quarter of 2020. Any decision related to late-stage development plans for MF will be announced by mid-2020.

The company is also planning to develop imetelstat in additional hematologic myeloid malignancies. It is planning to initiate a proof-of-concept studyby the end of the fourth quarter 2020 to evaluate imetelstat in intermediate-2 or high-risk, or higher risk, MDS and acute myeloid leukemia.

Zacks Rank & Stocks to Consider

Geron currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the biotech sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Vertex carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings estimates have moved up from $26.83 to $28.73 for 2020 and from $28.09 to $30.20 for 2021 in the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with the average beat being 1.44%. Share price of the company has increased 5.6% in the past year.

Vertex’s earnings estimates have moved up from $6.68 to $7.57 for 2020 and from $8.61 to $9.62 for 2021 in the past 60 days. The company delivered a positive earnings surprise in all the trailing four quarters, with the average beat being 21.76%. Share price of the company has increased 9.9% in the past year.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Johnson & Johnson (JNJ): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Geron Corporation (GERN): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Original post

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.