- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

General Mills (GIS) Down Despite Q3 Earnings Beat, Raised View

General Mills, Inc. (NYSE:GIS) released third-quarter fiscal 2020 results, wherein the bottom line declined year over year largely due to lower adjusted operating profit. Sales remained flat and missed the Zacks Consensus Estimate. Results were somewhat affected by the impact of coronavirus on Haagen-Dazs sales in Asia. Shares of the company dropped more than 3% during the pre-market trading session on Mar 18.

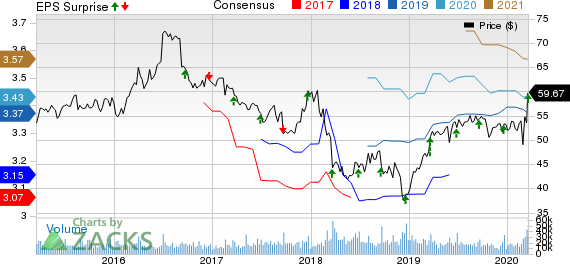

Nonetheless, earnings came ahead of the consensus mark for the eighth straight quarter. Also, management raised its earnings and adjusted operating profit guidance for fiscal 2020. Markedly, this Zacks Rank #3 (Hold) stock has gained 11.4% year to date against the industry’s decline of 26.4%.

Q3 Highlights

The company’s adjusted earnings per share of 77 cents declined 7.3% year over year, while it fell 6% on a constant-currency (cc) basis. Nonetheless, the bottom line beat the Zacks Consensus Estimate of 75 cents. The downside was a result of reduced adjusted operating profit, increased adjusted effective tax rate and greater average shares outstanding. This was somewhat compensated by a decline in net interest expenses and increased non-service benefit plan income.

Net sales of $4,180.3 million were nearly flat year over year and missed the Zacks Consensus Estimate of $4,195 million. Also, organic sales were flat as solid growth in the Pet segment was countered by softness in the North America Retail and Convenience Stores & Foodservice segments. Organic volumes declined, though net price realization and mix were favorable. Also, sales included an adverse impact of about 50 bps from reduced sales of Haagen-Dazs in Asia in February, led by the coronavirus. The outbreak weighed on traffic in Haagen-Dazs shops as well as foodservice outlets in the region.

Adjusted gross margin contracted 30 bps to 33.9% due to inflated input costs and elevated supply-chain costs. This was partly made up by HMM savings and improved net price realization and mix.

Adjusted operating profit came in at $675 million. The metric fell 8% at cc due to escalated SG&A costs, including greater media investments. Also, reduced contributions from ice cream sales in Asia (due to COVID-19) weighed on results. Adjusted operating margin collapsed 130 bps to 16.1%.

Segmental Performance

North America Retail: Revenues in the segment came in at $2,501.9 million, which dipped 1% year over year. Sales declined in U.S. Meals & Baking, U.S. Cereal, U.S. Snacks and U.S. Yogurt categories. Sales in Canada rose 5% at cc.

Convenience Stores & Foodservice: Revenues dropped 2% to $464.8 million due to weakness in non-Focus 6 products like flour and mixes. This was partially offset by improvements in Focus 6 platforms, including cereal, frozen baked goods and yogurt.

Europe & Australia: The segment’s revenues slipped 2% to $421.9 million, including adverse currency impacts of 1%. Further, sales declined 1% year over year on an organic basis. Softness in Yoplait yogurt and Haagen-Dazs ice cream was countered by strength in Nature Valley and Fibre One snack bars as well as Old El Paso Mexican food.

Asia & Latin America: Revenues declined 5% from the year-ago quarter to $408.2 million. The downside was caused by the adverse impact of divestitures in fiscal 2019 and currency headwinds. Organic sales remained flat as improvements in Latin America were offset by softness in Asia. The segment’s performance reflects the impact of coronavirus on Haagen-Dazs store traffic.

Pet Segment: Revenues came in at $383.5 million, up 11% year over year on the back of volume growth as well as favorable net price realization and mix impacts. A double-digit rise in the segment’s biggest product lines — Life Protection Formula and Wilderness — fueled growth.

Other Financial Aspects

The company ended the quarter with cash and cash equivalents of $606.9 million, long-term debt of $11,589.6 million and total shareholders’ equity of $7,575.1 million.

General Mills generated $2,159.8 million as net cash from operating activities in the first nine months of fiscal 2020. During the same time frame, the company made capital investments worth $269 million, paid out dividends of $895 million and lowered debt by $862 million.

Other Developments

Constant-currency sales from joint ventures of Cereal Partners Worldwide increased 1% in the quarter. In Haagen-Dazs Japan, sales dropped 5% at cc from the prior-year quarter.

Fiscal 2020 Guidance

The company expects to see organic sales growth in the fourth quarter of fiscal 2020, courtesy of an extra month of Pet segment results. Also, fourth-quarter results will include gains from an additional week or the 53rd week.

Management remains uncertain about the impact of the coronavirus pandemic on its fiscal 2020 outcome. However, its latest guidance includes the effect of increased orders from retail customers across North America and Europe following the third quarter-end. This, in turn, resulted from higher consumer demand for food. Also, the guidance takes into account traffic-related headwinds at Haagen-Dazs shops and other foodservice networks. Management further stated that its supply chain is expected to face minimum bottlenecks through the remaining part of fiscal 2020.

Considering all factors and the year-to-date show, management revised its guidance for fiscal 2020.

Organic sales are still anticipated to improve 1-2%. Moreover, the combined impact of divestitures, currency translations and contributions from the 53rd week is likely to boost net sales by nearly 1 percentage point.

Adjusted operating profit (at cc) is expected to improve 4-6% compared with the prior growth projection of 2-4%. Adjusted operating profit was $2.86 billion in fiscal 2019. The raised outlook can be attributable to HMM productivity savings, reduced forecasts for input-cost inflation and solid administrative cost control.

Courtesy of a raised adjusted operating profit guidance and expectations of lower interest expenses, management raised its bottom-line view. The company now envisions adjusted earnings per share (EPS) growth (at cc) of 6-8%, up from a 3-5% increase anticipated earlier. Currency translation impacts are expected to remain irrelevant to the adjusted operating profit and bottom line.

The company still estimates free cash flow conversion of a minimum 105% of adjusted after-tax earnings.

Don’t Miss These Solid Food Stocks

Campbell Soup (NYSE:CPB) , with a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 6.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ingredion Incorporated (NYSE:INGR) has a Zacks Rank #2 and an impressive earnings surprise record.

Hain Celestial (NASDAQ:HAIN) , with a Zacks Rank #2, delivered a positive earnings surprise of 7%, on average, in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

The Hain Celestial Group, Inc. (HAIN): Free Stock Analysis Report

Campbell Soup Company (CPB): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.