- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FX Carry Trades Improve

Market Brief

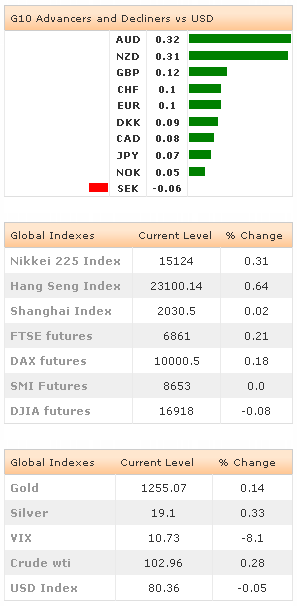

A quiet start to the week as the USD has been broadly unchanged against G10, yet slightly weaker verse EM FX. The lack of movement is following decent US payroll data on Friday and stronger than anticipated Chinese trade data over the weekend. Longer term, with the US economic data continuing to improve, the ECB heading towards an extended period of monetary accommodation and volatility at low levels, FX should be prepared for carry trades to improve. CFTC IMM CTA data showed that USD long positions are now at the highest level since March and net short EUR and JPY positions have increased. In this environment short USD/BRL remains one of our favorite carry fueled trades (see Weekly Report for World Cup rally).

Asia regional indices were stronger across the board as the Nikkei rose 0.31%, the Hang Seng 0.61% and the Shanghai composite rallied marginally to 0.10%. Asian yields followed US treasury higher as the US 10yr rose to 2.59%. On the data from China, trade surplus widened to $35.92bn vs. $22.6bn expected, the largest monthly surplus since early 2009. The results were a balanced rise in exports 7.0 % y/y, while imports fell 1.6% y/y. In Japan data showed that GDP Q1 grew 1.6% q/q vs. 1.4% expected (preliminary estimates of 1.5%). Business spending surprised higher rising 7.6% while consumer spending was in line at 2.2% q/q. In addition, Japan’s BoP current account surplus expanded to ¥187.4bn in April, but less than the expected surplus of ¥287.7bn. From the ECB, Executive Board member Benoit stated that Eurozone interest rates will diverge from rates in the UK and USA for years. As central banks in Britain and the US raise rates, the yield differential will help weaken the EUR which should assist in importing disinflation and hurting Europe's fragile economic recovery.

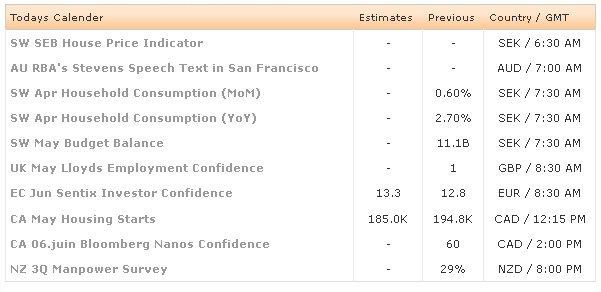

With a light economic data calendar, FX volatility continues to fall and with vacation in France, traders should expect FX to be range bound. Equity volatility has fallen near a seven year low. Traders will be watching Canadian housing starts, expected to fall to 185k vs. 195.3k revised prior read. The stronger CNY fix aided AUD/USD up but still below the 0.9356 high reported after the US NFP data release. AUD remains well bid in the crosses ahead of Thursday's RBNZ meeting where traders expected high probability of another 25 bps rate hike.

Currency Tech

EUR/USD

R 2: 1.3775

R 1: 1.3735

CURRENT: 1.3654

S 1: 1.3585

S 2: 1.3503

GBP/USD

R 2: 1.6996

R 1: 1.6882

CURRENT: 1.6817

S 1: 1.6780

S 2: 1.6693

USD/JPY

R 2: 103.02

R 1: 102.80

CURRENT: 102.41

S 1: 102.10

S 2: 101.45

USD/CHF

R 2: 0.9037

R 1: 0.8995

CURRENT: 0.8928

S 1: 0.8908

S 2: 0.8882

Related Articles

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

The dollar’s rebound faces a key test as traders assess Fed expectations, geopolitics, and slowing spending. With inflation cooling and rate-cut bets rising, markets eye jobs...

Eurozone inflation may have exceeded expectations, but it has slowed from the previous month. This allows the European Central Bank (ECB) to consider cutting its key interest rate...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.