- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FuelCell Energy To Supply Renewable Hydrogen To Toyota

FuelCell Energy Inc. (NASDAQ:FCEL) recently inked an agreement to sell renewable hydrogen to Toyota Motor Corp. (NYSE:TM) . This tie-up, better known as hydrogen and power off-take agreement, is in line with FuelCell’s strategy to actively market its distributed hydrogen technology. This will offer a hydrogen fueling solution for fuel cell vehicles like that of Toyota and in turn expand FuelCell Energy’s business.

Details of the Tie-Up

Per the terms of the deal, FuelCell Energy will install a multi-megawatt SureSource fuel cell power plant at the Port of Long Beach in California. Once operational, this plant will produce 100% renewable hydrogen which will fuel Toyota’s Mirai fuel cell electric vehicles (FCEVs) as well as Heavy Duty hydrogen fuel cell class 8 trucks (Project Portal).

Notably, FuelCell Energy’s distributed hydrogen solution produces hydrogen and clean power from methane-based fuels such as biogas as by products. The latest SureSource plant will also generate renewable power, which will be supplied to the grid under the California Bioenergy Market Adjustment Tariff (BioMAT) program.

Benefits of the Deal

Apart from strengthening FuelCell Energy’s ties with Toyota, this latest agreement reflects a key progress in building a sustainable hydrogen ecosystem that will facilitate in powering Port operations.

With the growing popularity of fuel cell technology, this deal will represent an innovative and replicable global model for building an affordable hydrogen infrastructure. The renewable transportation fuel will enhance the demand of fuel cell electric cars, trucks and buses.

More adoption of fuel cell vehicles indicate increased demand for fuel cell technology, which in turn will definitely benefit FuelCell Energy and attract more companies like Toyota, which aims at popularizing their FCEVs, to ink deals with it.

What’s Favoring FuelCell Energy?

To reduce carbon emissions from diesel-powered vehicles, demand for FCEVs is on the rise. Toward this, in California, Governor Jerry Brown announced plans to make 100,000 zero-emission freight-hauling machines operational by 2030, under his California Sustainable Freight Action Plan (according to Bloomberg). This in turn has boosted the market for fuel cell energy in the state.

Naturally, companies with significant operations in California will try to tap the growing market for fuel cell energy in the state. The latest deal between Toyota and FuelCell Energy is an example of that.

And not only California, realizing the need for vehicles with lower emissions, prospects of fuel cell energy producers has enhanced worldwide. Notably, the global hydrogen fuel cell vehicle market is expected to grow at a CAGR of more than 82% during 2017-2022. This indicates at more growth prospects for fuel cell makers like FuelCell Energy, Plug Power, Inc. (NASDAQ:PLUG) and Ballard Power Systems, Inc. (NASDAQ:BLDP) .

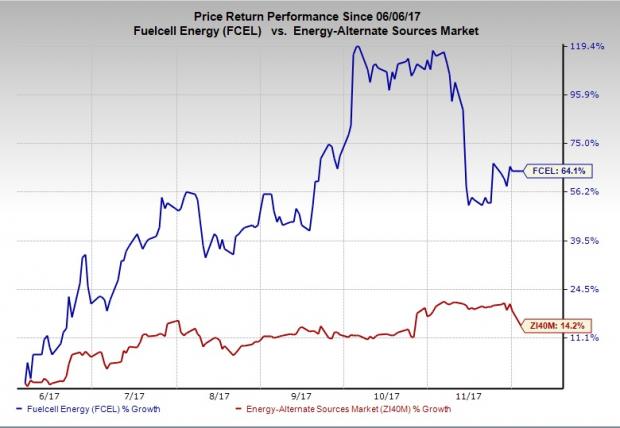

Price Movement

In the past six months, FuelCell Energy, has outperformed the industry. The company’s shares have gained 64.1% compared with the industry’s rally of 14.2%. This may have been driven by the rising demand for fuel cell technology in recent times.

Zacks Rank

FuelCell Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Ballard Power Systems, Inc. (BLDP): Free Stock Analysis Report

Plug Power, Inc. (PLUG): Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.