- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Five Below (FIVE) Q3 Earnings & Sales Beat, Raises View

Five Below, Inc. (NASDAQ:FIVE) delivered better-than-expected top and bottom line for the fifth straight quarter, when it posted third-quarter fiscal 2017 results. The impressive results prompted management to provide an encouraging outlook. Consequently, shares of this Zacks Rank #2 (Buy) company increased 2.3% in after-hour trading session yesterday. In fact, the stock has surged 28.7% in the past three months, outperforming the industry’s growth of 2.6%.

Earnings of 18 cents per share surpassed the Zacks Consensus Estimate of 13 cents and also surged 80% year over year. Additionally, the bottom line exceeded the company’s guided range of 11-13 cents per share. The uptick can be attributable to higher sales and margin expansion.

Net sales grew 28.9% to $257.2 million from the year-ago quarter and also came ahead of the Zacks Consensus Estimate of $244.9 million. Also, the top line surpassed the company’s guided range of $241-$246 million. The improvement was due to solid comps growth and new store openings.

Comps increased 8.5% in the reported quarter and also exceeded the guided range of 3-5%. This was primarily driven by 7.1% growth in comp transaction, along with sturdy performance in its WOW product and incredible price points.

Margins

Gross profit improved 30.7% year over year to $83.6 million, while gross margin expanded roughly 45 basis points (bps) to 32.5%. The increase was mainly backed by favorable store occupancy costs.

Meanwhile, improved gross profit led operating income to jump 71.6% to $14.8 million during the third quarter. Further, operating margin increased 150 bps from the year-ago quarter to 5.8%.

Financials

Five Below had cash and cash equivalents of $54.9 million and short-term investment securities of $56.7 million as of Oct 28. Notably, the company had no debt and total shareholders’ equity was $381.3 million at the end of the reported quarter.

During the first nine months of fiscal 2017, the company generated net cash from operating activities of $17 million and incurred capital expenditures of $49.5 million.

Management expects to incur capital expenditures of roughly $75 million for the fiscal. This represents the introduction of new stores along with the leftover balance to be utilized in the company’s new Home Office, store remodels, distribution centers as well as infrastructure.

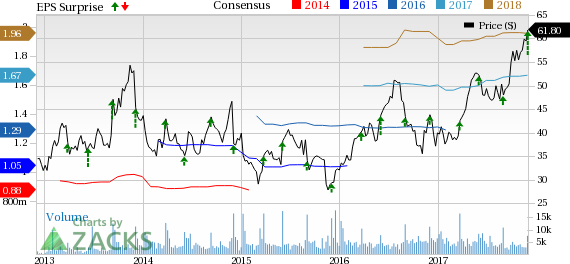

Five Below, Inc. Price, Consensus and EPS Surprise

Store Updates

In the quarter under review, Five Below introduced 41 stores in 24 states. The company plans to enhance footprint in the Southern California in the next two years.

During the nine months of fiscal 2017, the company highlighted that it had opened 103 stores. As of Oct 28, Five Below had roughly 625 stores across 32 states.

Outlook

Management remains impressed with quarterly performance, wherein the results beat expectations significantly. Going forward, the company remains committed to strategic initiatives such as enhancement of digital and e-commerce channels, improvement in customers’ shopping experience, store openings as well as marketing efforts.

Consequently, the company raised fiscal 2017 view and issued guidance for the fiscal fourth quarter. In fact, the fiscal includes 53rd week in the final quarter that is likely to contribute roughly $16 million to sales as well as 3 cents to earnings.

Five Below projects sales in the band of $1.264-$1.276 billion compared with earlier guided range of $1.236-$1.248 billion. The projected range reflects nearly 26-28% rise from fiscal 2016. Furthermore, comps are anticipated to increase 5.7-6.5% compared with 3.5-4.5%, guided earlier.

Earnings for fiscal 2017 are now envisioned in the band of $1.72-$1.79 per share compared with the previous range of $1.62-$1.66. The company delivered earnings of $1.30 per share in fiscal 2016. The consensus mark for fiscal 2017 is pegged at $1.67.

Fiscal fourth quarter sales are projected to be between $491 million and $503 million. Comps are anticipated to grow 4-6%, in comparison to 1% growth registered in the prior-year quarter. Earnings are expected in the band of $1.09-$1.16 cents per share compared with 90 cents in the year-ago quarter. The Zacks Consensus Estimate for the fourth quarter is currently pegged at $1.08, which could witness upward revisions in the coming days.

Other Stocks to Consider

Other top-ranked stocks which warrant a look from the retail space are KAR Auction Services, Inc. (NYSE:KAR) , Regis Corporation (NYSE:RGS) and The Michaels Companies, Inc. (NASDAQ:MIK) , each carrying the same Zacks Rank as Five Below. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KAR Auction Services delivered an average positive earnings surprise of 7.3% in the trailing four quarters and has a long-term earnings growth rate of 13.4%.

Regis has long-term earnings growth rate of 7%.

The Michaels Companies has an impressive long-term earnings growth rate of 10.4%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Regis Corporation (RGS): Free Stock Analysis Report

KAR Auction Services, Inc (KAR): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

The Michaels Companies, Inc. (MIK): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.