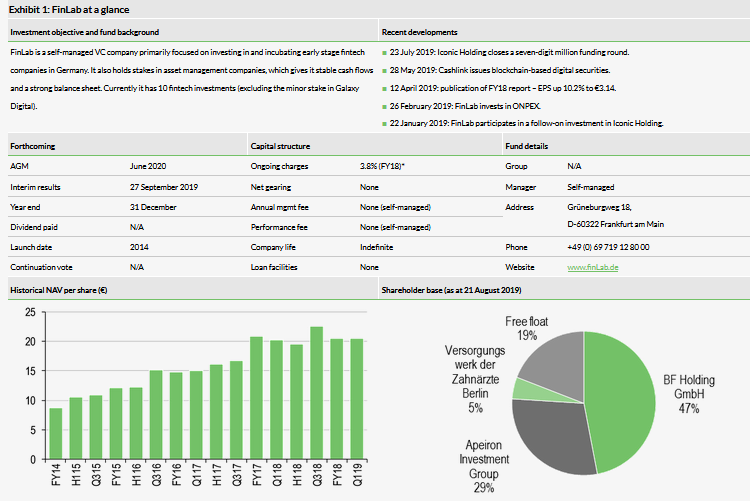

Finlab AG (DE:A7AGn) is a self-managed German venture capital (VC) investor and start-up incubator specialising in fintech companies. It holds a portfolio of 10 active fintech investments across several subsectors, including its main success story Deposit Solutions. The company also owns three asset management businesses generating steady cash flow from management fees, which fully cover FinLab’s ongoing expenses. Moreover, it holds a 45.3% stake in listed investment vehicle Heliad Equity Partners (F:HPBGn), which is currently undergoing restructuring. Since the beginning of 2015, when it started operating under the current investment mandate, it has delivered an NAV total return (TR) of around 20% pa.

Fintechs are reshaping the financial sector

Over the last few years, a number of disruptive, agile and tech-driven companies have started addressing the changing expectations for enhanced customer experience and personalisation, as well as the evolving regulatory framework in the financial services industry. FinLab is one of the VC companies that aims to leverage this trend, by either incubating fintech start-ups or investing c €0.55.0m per deal to acquire a 10–25% stake in an existing fintech company and actively drive its business growth.

Why consider investing in FinLab?

Solid NAV performance since early 2015 driven by a few success stories including Deposit Solutions, Kapilendo and Authada.

Active investment approach is underpinned by management expertise and its extensive network of entrepreneurs, investors and business partners.

Exposure to several fintech themes, including wealth management, lending, regtech and blockchain/cryptocurrencies.

Recurring income covering operating expenses and thus providing greater flexibility with respect to fintech portfolio funding and exits.

Risks to the above investment thesis include a relatively short track record, only one partial fintech exit concluded so far, uncertainties around HEP’s future performance and limited portfolio disclosure.

Valuation: Trading at a wide discount to NAV

FinLab’s shares currently trade at a 20% discount to last reported NAV of €20.51 per share (as at end-March 2019). Its stake in HEP (c 20% of FinLab’s NAV) is valued based on Heliad’s market cap, which is currently 31% below its NAV. Hence, FinLab’s discount on a ‘look through’ basis stands at c 26%.

Fund profile: A German VC fintech specialist

FinLab is a self-managed VC company primarily focused on incubating and investing in early stage fintech companies in Germany. The company was created from the restructuring of listed asset management company Altira Aktiengesellschaft (which was founded in 2000) and renamed FinLab in January 2015. Its headquarters are in Frankfurt, it is listed on the Frankfurt Stock Exchange in the Scale segment and employs 14 people at the holding level.

FinLab focuses exclusively on long-term capital appreciation and has not paid any dividends since its transformation back in 2015. Its portfolio consists of two types of constituents: holdings in asset management companies and stakes in German fintech businesses in incubation phase. The former generate steady fee income streams, which over the last few years stood at around €4–5m pa translating into dividend payments to FinLab. These allowed the company to cover its operating expenses (currently around €2.5–2.8m pa) and as a result provide a high degree of flexibility with respect to fintech portfolio funding and realisations. This represents a certain competitive advantage compared with other VC players.

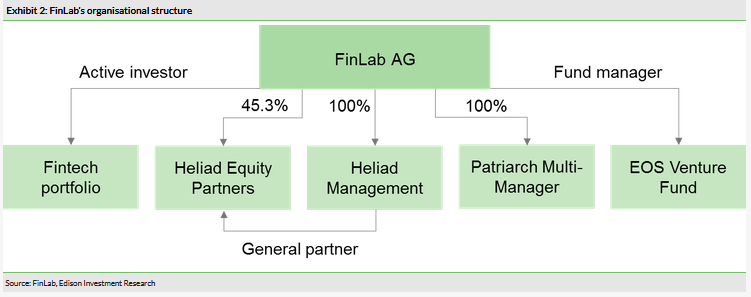

Asset management holdings

FinLab holds a 100% stake in Heliad Management (HM), which is the general partner (and thus investment manager) for Heliad Equity Partners (HEP), a listed investment company focused on listed and unlisted smaller companies in German-speaking countries with an NAV of c €66.7m at end-March 2019. Heliad’s investments typically comprise growth and venture-stage technology companies operating disruptive business models or addressing structural issues. Importantly, FinLab has also been HEP’s direct shareholder since its inception in 2000 and now holds a 45.3% stake (worth c €21m and representing 20% of FinLab’s NAV as at end-March 2019). HM is entitled to a fixed fee of 2.5% of HEP’s reported equity and a 20% performance fee of the company’s realised profits. Over the last three years, it received on average an annual management fee of c €2.0m and a performance fee of €1.0m. Moreover, Heliad distributed an annual dividend to FinLab of c €1.0m. Having said that, due to HEP’s weaker FY18 results (which recently triggered the replacement of its CEO with both members of FinLab’s management board), a dividend payment will not be made this year. HEP’s current NAV implies an annualised management fee of around €1.7m and we understand that HM does not intend to temporarily reduce or suspend charging the fee.

FinLab also owns 100% of Patriarch, a multi-asset manager that was previously part of Altira’s portfolio (similarly to HM and HEP) with assets under management in excess of €320m. It develops fund of funds solutions and asset management strategies for independent financial advisors, selecting managers for each mandate. In doing so, Patriarch provides investors with access to expertise that is normally only available to wealthier families and institutions. It also creates products for larger partners to rebrand. Over the last three years, Patriarch generated an average annual management fee of c €1.1m pa as well as a performance fee of c €0.2m pa. Dividend distributions to FinLab amounted to €0.3–0.5m pa over this period.

In March 2018, the company set up a US$100m EOS VC Fund together with Block.one, a software developer based on the EOS.IO blockchain protocol powered by the EOS cryptocurrency. Block.one has provided US$75m of funding while FinLab and other venture partners delivered US$25m. It is part of Block.one’s broader commitment to deploy US$1bn through four EOS.IO funds in partnership with VC investors to support the development of the EOS.IO platform. The fund invests in EOS-based projects in Europe that are in seed and early stage growth phase (up to series B) and have a ticket size of €1–5m. EOS VC Fund originates deals through its network, other venture funds, as well as through FinLab and Block.one. FinLab acts as the fund’s investment manager and charges a 1.5% priority profit share, which represents fee income of c €1m pa (the company booked its first fee in H119). Moreover, the company receives a 20% carry once all investor commitments have been paid back (no hurdle rate or high-water mark is being applied).

Fintech investments

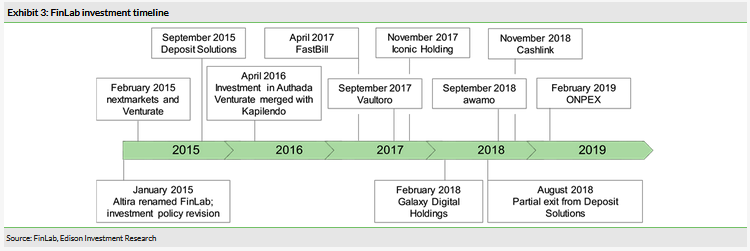

FinLab has so far invested in 10 fintech companies (excluding Galaxy Digital) that are active in various fintech segments (see the current portfolio positioning section for a more detailed elaboration). Its first investments date back to 2015 and since then it has conducted one to three transactions a year, with two new portfolio additions (awamo and Cashlink) and one partial exit (Deposit Solutions) executed in 2018 as well as one investment in 2019 so far (ONPEX; see Exhibit 3). FinLab aims at a portfolio of no more than 12–14 holdings, which is determined by FinLab’s active management approach (see below). It is worth noting that in 2017, its fintech portfolio consisted of only four holdings and the company planned to expand it to seven to 10 fintech investments within two years. This means that FinLab met its medium-term guidance, which illustrates the company’s abilities to grow the portfolio.

The manager’s view: Well positioned in the ongoing fintech market consolidation

PwC's recent analysis confirms FinLab’s view upheld for the past two years that the German fintech market is undergoing an extensive consolidation phase. The high level of M&A activity in H119 with 16 acquisitions of financial startups underpins this thesis. FinLab’s management believes that its portfolio is very well positioned to benefit from this trend.

So far, the company has been an active driver of these developments, as illustrated by both the merger of its portfolio companies Venturate and Kapilendo and the takeover of Savedo by Deposit Solutions. Over the next few months, FinLab's focus will therefore increasingly be on actively developing the existing portfolio by leveraging its network, onboarding investors and acquiring new customers.

However, because the fintech market itself remains very dynamic and attractive, FinLab also continues to look for new investments, especially in the B2B area. ONPEX is one of the company’s most recent investments and a good example of this approach. FinLab’s management sees open banking solutions as a promising investment case. The company is currently primarily focused on opportunities in the B2B rather than B2C sector.

In general, the fintech market offers great potential, as more established players and traditional financial service providers are entering the market, be it through acquisitions of fintechs or partnerships. The market is thus growing up, which the manager considers a favourable trend.

Fintech market overview: Varying business maturities

The fintech sector consists of a wide range of disruptive, tech-driven companies reshaping the financial services sector. The ongoing fintech revolution has been driven by increased customer expectations in terms of convenience (ie simplifying the customer experience) and personalisation, coupled with technological advancements such as platform models with open application programming interfaces (APIs), distributed ledger technology (DLT – in particular blockchain), robotic process automation (RPA) and artificial intelligence (eg used in chatbots).

Fintechs are benefiting from their agility in terms of product launches, a customer-centric approach and the lack of legacy systems (as opposed to most traditional financial institutions). On the other hand, incumbent players have an extensive customer and funding base translating into significant scale, which fintechs usually lack. This has opened a number of interaction options between traditional financial institutions and fintechs. Acquisitions of mature businesses as well as corporate VC (CVC) investments represent one of the competitive responses, with their contribution to overall VC investments in fintechs rising to 33% in 2018 from 17% in 2014, according to CB Insights. Interestingly, apart from financial institutions, large tech players (such as Google (NASDAQ:GOOGL), Alibaba (NYSE:BABA) and Microsoft (NASDAQ:MSFT)), as well as payment platforms are also becoming meaningful investors in fintech companies. CVC activity may represent an interesting exit route for players such as FinLab. Having said that, even though corporate VC should remain strong, the emphasis of traditional financial institutions should shift somewhat to partnership models compared to standard direct investments, according to KPMG. This represents a perception shift for incumbents that initially treated fintechs predominantly as competitors rather than potential partners. Moreover, traditional banks and corporates are likely to grow their digital banking offering organically as well, often setting up standalone digital banks operating outside of the existing legacy systems.

Fintech market growth has been also determined by changes in the regulatory environment, which on one hand are aimed at promoting tech adoption and fostering innovation and competition, while at the same time putting pressure on both traditional financial institutions and fintech players to better manage their risks and compliance, as well as execute effective corporate governance. Particularly worth noting is the trend towards open banking, which in Europe is illustrated by the adoption of the Revised Payment Services Directive (PSD2), which came into force in January 2018 (except for Strong Customer Authentication, which is effective from September 2019). This regulation covers in particular:

Expansion of the regulatory scope to include new players providing online payment services, but which do not hold payment accounts of their customers. Under PSD2, they will now have access to customers’ bank accounts (with the customers’ prior consent) to make payments on their behalf. These are referred to as third-party payment (TPP) service providers. PSD2 has thus put pressure on banks to introduce application program interfaces (APIs) to facilitate open banking and introduce a level playing field for fintechs and traditional financial institutions.

Introducing strong customer authentication (SCA) in order to reduce the risk of electronic transactions, which involves customer authentication using at least two of the following independent elements: 1) something only the user knows (eg password or PIN), 2) something only the user possesses (key material, such as a mobile phone) and 3) something the user is (eg fingerprint, voice recognition).

Broadening of geographical coverage to include transactions in all currencies (except for cryptocurrencies) and ‘one leg out’ transactions (ie where at least one party is located within the EU).

All the above has translated into significant fintech investments in the global private markets (including VC, private equity and M&A), which reached US$111.8bn in 2018 vs US$50.8bn in 2017, according to KPMG. This improvement is largely attributable to the increased deal size, including megadeals such as the US$14bn late-stage VC funding of Ant Financial, the US$12.9bn acquisition of Worldpay and the US$17bn Refinitiv deal. In line with the broader market, fintech companies are exhibiting the preference to stay private longer. This is largely the result of the high amount of dry powder at VCs’ disposal and the increased number of mega-rounds of US$100m or more (even if high valuations somewhat constrain overall transaction volumes). The total value of VC-backed fintech deals more than doubled in 2018 to US$35.4bn based on KPMG data (US$39.6bn according to CB Insights Research). This allows even fintech unicorns (ie privately held start-up companies valued at more than US$1.0bn) to stay private and refrain from being subject to the disclosure requirements applicable to listed companies.In Germany, investors have become more selective amid some concerns about the saturation of the local fintech market, especially in the area of payments. Still, the market has seen fintech companies raising significant proceeds beyond series A and B rounds, eg N26 and Deposit Solutions completed large funding rounds of US$160m and US$100m, respectively. Traditional corporates remained active in 2018, focusing on fintech partnerships and solutions aimed at process improvement, customer response and more promising services from a profitability perspective.

Fintechs operate in a number of financial services subsectors (at different stages of the business life cycle) and although there are various ways of defining those and there is a certain degree of overlap between them, we believe that each fintech company may be generally classified into one of the groups outlined below. In our opinion, the most promising themes from a VC investment perspective at the moment constitute B2B solutions leveraging open banking, regtech, insurtech as well as blockchain with a specific product focus.

Payments/banking

Payments and banking covers companies offering services, such as money transfers, currency exchange (including cryptocurrencies), pre-paid cards and peer-to-peer payments. The group includes a number of fintechs that obtained a banking licence and expanded their offering to include banking products such as current accounts, debit cards or consumer loans (eg Revolut and Monzo). These companies are often referred to as ‘challenger banks’, though it is worth noting that this term not only covers such mobile/digital/app-based banks but also describes a much broader group of smaller banks (full-service banks, specialist lenders and retail banks operating under a non-financial brand) that entered the market following the financial crisis to challenge the large incumbent players. Some examples of challenger banks include Virgin Money (LON:VM), Metro Bank, OneSavings Bank and M&S Bank. Finally, it is worth highlighting that some fintech players in the payments/banking space focus on providing B2B services to merchants, banks and other corporates (eg nets, iZettle or FinLab’s ONPEX).

Payments/banking is one of the most mature fintech subsectors with a number of later stage companies, including some that have already reached the ‘unicorn’ status (eg iZettle, Monzo or Ant Financial). The largest players (such as nubank, Revolut, chime and N26) have already attracted several million customers each. As the number of competitors in this market has increased, the segment should experience stronger market consolidation aimed at realising economies of scale. Recent examples include the Nets-Concardis merger and the acquisition of Dotpay/eCard by Nets. Moreover, large players have started their international expansion (eg N26, Nubank, SolarisBank) and to broaden their product offering (eg Revolut expanding into deposits/lending). Investors (for instance in the US) are now more focused on companies adding value across the payments value chain or embedding payments into broader tech applications (in order to improve efficiencies or address gaps, eg in healthcare or accounting) rather than pure-play payment companies, according to KPMG.

Non-bank lending

Non-bank lending represents companies leveraging a technology platform to act as an intermediary or balance sheet lender to retail customers or corporates (in particular SMEs). The lending marketplaces include peer-to-peer (P2P) consumer lending (eg Lending Club), crowdlending to SMEs (eg FinLab’s Kapilendo) and platforms to attract institutional and professional investors in SME lending (eg creditshelf). Although this subsector (especially the B2C segment) may also be considered relatively mature in terms of the number of players operating in the market, it seems to have a considerable growth potential on the SME side as illustrated by the unmet funding needs in this market segment. Having said that, the peer-to-peer lending sector is also facing some challenges and risks, as illustrated by the current situation in the UK market, which is experiencing high default rates.

Personal finance, capital markets and wealth management

Personal finance gathers companies that offer tech-driven services to improve the finances of retail customers, allowing them to monitor their spending and manage bills, optimise savings, track their credit score and accounts, etc. Capital markets and wealth management cover fintech players offering solutions in the areas of investment research and advisory, investment management, as well as recording, clearing and settlement of securities transactions to exchanges, brokers, investment managers, financial advisors and retail investors. Their value-add involves, among others, efficiency improvements, lower fees and/or a differentiated product offering. This is an interesting area to expand for fintech players from other subsectors, as illustrated by Revolut’s plans to set up a wealth management and trading division.

Regtech

Regtech consists of companies providing solutions to allow corporates to comply with regulations and reporting requirements, as well as protect them against employee and customer fraud. A good example of a regtech company is FinLab’s Authada (described in the current portfolio positioning section below). This group is still quite early in the business life cycle while benefiting from recent regulatory changes, including PSD2 (in particular the strong customer authentication requirement discussed above), General Data Protection Regulation (GDPR), MiFID II, new IFRS standards, etc. This represents a compelling combination that should drive a further uptick in investments into regtechs as the sector matures. Global investments in regtechs went up to US$3.7bn (in 104 deals) in 2018 from US$1.2bn (in 111 transactions) in 2017, according to KPMG.

Insurtech

Insurtech includes companies selling insurance products digitally or providing data analytics and software for (re)insurers. Insurtechs are gradually maturing and attracting larger funding, with 13 transactions over US$100m concluded during 2018, according to KPMG. Overall insurtech investments in the global private market stood at US$5.7bn in 2018 vs US$10.3bn in 2017 (though the latter was driven by a few large deals). Key expansion areas within this sector include claims management and the unbundling of insurance services and processes. Moreover, the sector has experienced an increased emphasis on platform-based models (JDC Group is a good example), which allow connection to distribution networks/payment systems and work with different insurers or banks (to facilitate the sale of bancassurance products). This also includes the development of white-label products and services. Another important trend is the changes to data management strategies of insurance companies to increase the extent of available information about the customers in order to facilitate more tailored solutions.

Real estate and mortgages

This fintech segment includes a large variety of businesses related to commercial and residential real estate markets. Fintechs are present in list and search services, leasing, property management, energy management, digital mortgage lending, as well as investment/financing through peer-to-peer platforms (eg lendinvest), crowdfunding (eg CS Crowdstreet) and robo-investing (eg Alphaflow).

Blockchain and cryptocurrencies

Blockchain is the most popular form of the open distributed ledger technology, which allows a permanent and incorruptible record of digital transactions. It is important to distinguish between cryptocurrencies (digital currencies based on blockchain) and the blockchain technology itself, which has a much wider range of potential applications both inside the financial services sector (where the majority of players intend to adopt blockchain by 2020 according to PwC) and in other industries (eg energy, telecoms or pharma). Development and investment in the fintech blockchain space has recently moved to a product focus following a period of ‘experimental’ and project-based approaches. Startups now tend to look at providing a specific product or solution and addressing certain challenges clients are facing, including privacy, anonymity, data segregation and scalability.

The cryptocurrency market experienced increased investor activity in H217, when the price of Bitcoin (the largest cryptocurrency by market capitalisation) increased from c US$2,800 in June 2017 to nearly US$20,000 in December 2017. Following the significant market corrections in January/February 2018 and late 2018, the price reached around US$3,000-4,000 in early 2019 and has now rebounded to c US$10,000-11,000. During 2018, the total number of initial coin offerings (ICOs) and security token offerings (STOs) doubled year-on-year to 1,132 deals, while the total amount raised nearly tripled to c US$20bn according to PwC. However, in H218 the number of deals and the volume decreased sharply due to deteriorating market sentiment. The expectations of some market participants of significant institutional crypto investments in 2018 did not materialise, as this asset class is still in an early stage of development.

Still, total capital invested in blockchain/crypto companies reached US$4.5bn (in 494 deals) in 2018 compared to US$4.8bn (in 218 deals) in 2017, according to KPMG. This represents a clear increase in comparison to 2013–16 when the total deal value did not exceed US$1.0bn per annum.

Investment process: Actively adding value

FinLab acts as an incubator for new fintech business models in Germany that could subsequently be rolled out across Europe. In these instances, it prefers to own a majority stake and subsequently (co-)finance them through new funding rounds. Apart from incubating new businesses, FinLab looks for innovative and disruptive fintech companies in Germany and abroad where it can acquire a significant minority stake of around 10–25% (usually representing an investment volume of c €0.5–5.0m). This allows the company to have significant influence over the portfolio holding, including representation on the supervisory board. FinLab usually participates in seed and series A rounds, though sometimes it joins series B rounds as well (but only if it already invested in the series A round).

Rather than taking small, passive positions in a large number of businesses, FinLab aims to hold a concentrated portfolio and add value to its portfolio holdings through its know-how in areas such as human resources and legal support (eg providing template contracts), joint marketing activities, as well as international expansion and strategic sales partnerships. FinLab’s team often has the role of a strategic sparring partner, ie a trusted partner acting as a sounding board for the company’s management.

FinLab’s team and supervisory board members have an extensive network of entrepreneurs, investors and business partners who may act as co-investors. This includes, among others, business relationships from the ABL Group FinLab was part of before the former was dissolved in 2012. An example here is Christian Angermayer, ABL Group’s co-founder, who has invested in a number of FinLab’s fintech holdings through investment vehicle Apeiron Investment Group as well as the Cryptology Asset Group. Another prominent FinLab co-investor is Peter Thiel, the co-founder of PayPal and Palantir Technologies. It is also worth noting that FinLab’s broader capital group (together with Heliad Equity Partner’s portfolio) includes a white-label bank with a full banking licence (flatex bank AG) and a broker. Finally, fintechs from FinLab’s portfolio obtain access to the expertise, customer base and product offering of FinLab’s other holdings.

An example of FinLab’s active investment approach is the open banking platform Deposit Solutions (discussed in detail in the Current portfolio positioning section). FinLab initially invested €3.0m in September 2015 and made a follow-on investment of €2.5m in July 2016. It has provided support during pitch deck preparation and fund-raising, and also helped onboard new investors (such as Peter Thiel). Furthermore, it has acted as the company’s strategic advisor and a sparring partner within the supervisory board. For instance, it assisted the company’s integration with flatex (a German online broker). FinLab conducted a partial exit in August 2018, realising €10m of proceeds and retaining a 7.7% stake valued at €33.5m.

FinLab also invests in and partners with other VC funds and incubators that focus on fintech investments, particularly in the US and Asia. In doing so, the company aims to increase its understanding and footprint, learn about new innovations and create co-investment opportunities. Galaxy Digital Holdings is an example of such a partnership (for further details please refer to the appendix).

FinLab’s deal origination process is a combination of proactive sourcing and incoming requests during various events and conferences, while also being based on the company’s venture partners and broader network built up over several years. The management highlights that it is in contact with around 50% of the 350 fintechs active in Germany and is receiving around 10 leads a week. The company has its own in-house due diligence team and states its pre-selected lawyers and partners facilitate a lean due diligence process with limited resources required at team level.

The company’s exit strategies represent the standard VC approach and cover first of all a trade sale to a strategic investor, sale to a PE player, as well as a secondary deal with other existing investors. Moreover, in selected cases it will consider an IPO (this may potentially be an exit route in the case of Deposit Solutions, Kapilendo and maybe nextmarkets).

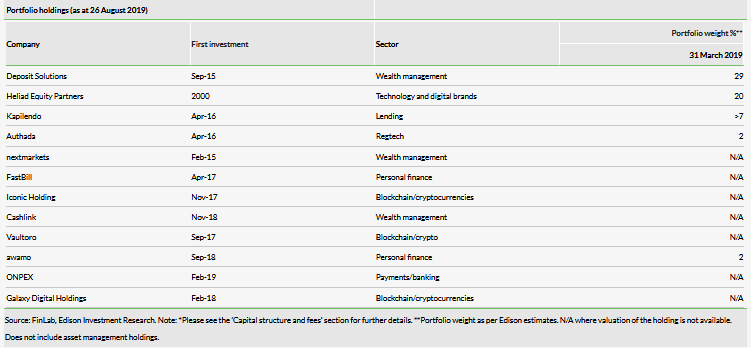

Current portfolio positioning

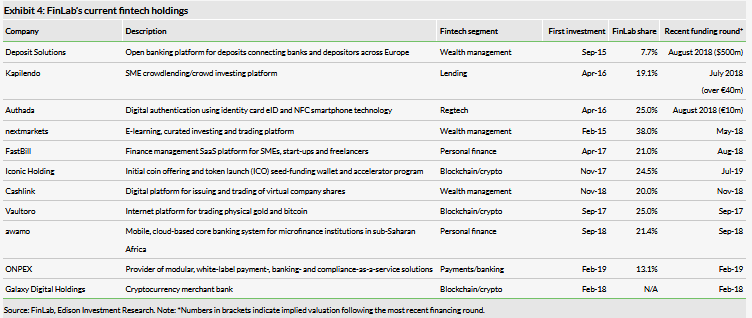

FinLab’s NAV at end-March 2019 stood at c €107.4m (or €20.51 per share), of which c €21m made up its stake in listed company Heliad Equity Partners. The remaining part is attributable to the value of its non-listed fintech portfolio, which currently consists of 10 actively managed holdings plus Galaxy Digital (see Exhibit 4), as well as its asset management businesses (Heliad Management, Patriarch and EOS VC Fund). The fintech investments are revalued upon completion of new financing rounds. FinLab’s largest fintech investment at the moment is the 7.7% stake in Deposit Solutions, valued at around €33.5m (based on the US$500m valuation implied by the recent funding round completed in August 2018).

The company has exposure to different segments of the fintech market, including lending (Kapilendo), blockchain and crypto space (Vaultoro and Iconic Holding), regtech (Authada), personal finance (FastBill, awamo), wealth management (Deposit Solutions, nextmarkets and Cashlink) and payments/banking (ONPEX). Moreover, the company holds a minor stake (ie below the usual 10–25%) in Galaxy Digital, which is considered part of a strategic partnership aimed at deal sourcing and co-investment opportunities rather than an actively managed fintech investment. Mike Novogratz (a former chief information officer at Fortress Investment Group and cryptocurrency investor) is Galaxy Digital’s CEO, founder and the largest shareholder with a stake of c 73% as of end-March 2019.

We note that the B2B profile of FinLab’s recent investments (ONPEX and Cashlink) is in line with the company’s strategy to explore new opportunities in this segment rather than the more saturated B2C space. At the same time, we acknowledge that the company has increased its exposure to the crypto space over the last few years with investments in Vaultoro in September 2017 and Iconic Holding in November 2017, as well as participation in the follow-on financing round at Iconic Holding in January 2019.

There seem to be several potential synergies between the respective portfolio companies. Possible product and customer synergies include, among others, 1) Vaultoro offering gold purchase to customers of Deposit Solutions; 2) Kapilendo providing crowd credits to SMEs through Fastbill; and 3) Patriarch offering its defensive portfolios to Deposit Solutions clients. Moreover, Authada is already providing its ID solution to all portfolio companies with KYC requirements. Finally, FinLab may also benefit from network/deal sharing synergies, especially between Iconic Holding, Vaultoro and nextmarkets with respect to ICOs, tokens and other cryptocurrency themes. For instance, Iconic Holding tokenized its equity as a crypto asset in partnership with Agora Innovation and FinLab’s Cashlink in May 2019.

FinLab has enough dry powder to conduct a few additional investments this year, with a cash position of €13.4m at end-2018 (even if part of it has already been spent on ONPEX and the new funding round of Iconic Holding in January). The company plans to execute one or two further transactions in the B2B segment in 2019. It believes that the most promising fintech sectors at the moment are regtech, open banking solutions, as well as blockchain. FinLab’s blockchain deal pipeline is quite full at present but given that it already has a meaningful exposure to this segment (through Cashlink, Iconic Holding and Vaultoro), it is refraining from further investments in this area for now. We understand that around three to four existing holdings may look for additional financing over the next 12 months, which may involve FinLab’s participation in their follow-on funding rounds. However, it is important to note that unlike many private equity companies, FinLab does not have any investment commitments and is free to decide if it wants to participate in subsequent funding rounds of portfolio holdings.

Below we elaborate on FinLab’s largest portfolio holdings in more detail, while we have included a description of its remaining fintech investments in the appendix to this initiation report. Please note that the majority of FinLab’s fintech investments are early stage companies whose financial disclosures are limited, which makes it difficult to analyse and predict their financial performance.

Deposit Solutions: An open banking play valued at US$500m

Deposit Solutions’ open banking platform allows banks to source customer deposits onto their balance sheets without having to incur the costs of setting up and operating their own retail infrastructure in each market, thus reducing their cost of funding. The product banks can choose to offer their deposit products through closed channels and selected distribution partners or through Deposit Solutions’ B2C platforms: ZINSPILOT and Savedo. At the same time, the company’s client banks can enhance their own offering with third-party products and as a result improve customer retention and loyalty (allowing them to retain their primary bank status). Moreover, the Deposit Solutions platform allows them to reduce potential excess liquidity from customers. Finally, depositors benefit from access to interest rates across Europe under the existing account relationship without having to open new accounts and switch between bank accounts. Deposit Solutions receives a fee expressed as a percentage of brokered deposits, which we understand is higher than 0.3% but lower than 1.0%.

As of July 2019, Deposit Solutions connected more than 95 banks from 17 countries and the number of depositors through various channels reached over 30 million. This translated into €14bn deposits mediated through ZINSPLOT and Savedo alone, which compares with more than €9bn mediated by September 2018 and €4.0bn by the end of 2017. The company’s growth was assisted by the acquisition of Savedo in August 2017, which was its competitor running a platform offering term deposits from foreign banks, as well as the opportunity to purchase and store physical gold and silver to German clients.

During 2018, Deposit Solutions expanded its operations into six new regions (including Austria; France and Benelux; Central and Eastern Europe; Iberia; Italy and Malta; and the Nordics and Baltics). In November 2018, it announced the plan to enter the US market. Moreover, the company launched Savedo in the first non-EU market (Switzerland) in February 2019. Deposit Solutions’ current strategy is to focus entirely on the core business and exploit opportunities related to the open banking space. The strategic focus was recently strengthened by the disposal of its rental deposit management division Deutsche Kautionspartner to Aareal Bank for an undisclosed amount in June 2019.

Deposit Solutions is the first and only fintech company FinLab has partially exited to date. The exit was coupled with a financing round Deposit Solutions closed in August 2018, which resulted in an additional US$100m and put Deposit Solutions’ value at US$500m. In the course of the transaction, the new shareholders acquired part of FinLab’s stake valued at US$11.5m. After the deal, FinLab retained a 7.7% stake in Deposit Solutions valued at €33.5m. FinLab’s management estimates the transaction represented a 7.8x money multiple and an IRR of 114%.

The company’s FY18 numbers are not publicly available yet. In FY17, Deposit Solutions generated sales of €5.7m vs €2.7m in FY16 and a net loss of €10.4m, compared with a €6.4m loss in the year before (mainly due to increased personnel costs of €8.9m in FY17 vs €3.4 in FY16).

Heliad Equity Partners: In restructuring mode

Heliad’s current portfolio is a combination of holdings in listed companies and privately held investments. The former include in particular the Fintech Group (an integrated online brokerage business), MagForce (a biotech player with approved nanotechnology-based therapy to treat brain cancer) and Elumeo (an online jewellery retailer with relatively weak performance lately). Heliad currently holds stakes in six non-listed companies: Springlane (which recently completed a new funding round), Spaze, Alphapet, Libify, Muume and Tiani Spirit.

The market valuation of FinLab’s 45.2% stake in Heliad has declined to c €21m currently from €33.7m in July 2018. This was accompanied by Heliad’s weaker results in FY18 when it reported a net loss of €56.6m versus a net profit of €39.1m in the previous year. The results were affected, among other things, by the reduced valuation of its listed companies and the resulting net revaluation loss of €51.0m compared with a net gain of €37.8m in FY17. We believe the major contributors were Fintech Group, Heliad’s largest portfolio holding with a current market cap of c €475m (share price down 45% in 2018), MagForce (15% in 2018, market cap at c €125m), Max21 (-45% in 2018, market cap at c €7.5m) and Elumeo (-85% in 2018, market cap of c €5m). In addition, the company reported some write-downs on non-listed holdings (€11.6m versus €7.7m in FY17) as well as an €8.1m write-down on listed company Sleepz. At end-December 2018, Heliad’s NAV stood at €6.20 per Heliad share, although it subsequently rebounded somewhat to €6.76 per share at end-March 2019.

Stefan Schütze and Juan Rodriguez should remain on Heliad’s management board and will focus on maximising the value of the existing portfolio while exploring opportunistic investments in the fintech, IT security, blockchain and digital brand sectors. We understand that Heliad will seek new private investments rather than invest in listed holdings (which are easily accessible directly for Heliad’s investors at a lower cost). Although we believe Heliad may retain its c 9.9% stake in Fintech Group (at least in the short term), we also acknowledge that the latter recently initiated a review of strategic options, including a potential sale of the business and onboarding of new investors. This could potentially represent an exit route for Heliad and (depending on the attractiveness of the actual exit price) translate into a significant disposal gain, resulting in a performance fee and dividend payment to FinLab. In the longer term, Heliad’s investment activity should become more aligned with FinLab’s approach and, in our opinion, it is possible that these two entities might be merged at some stage.

Kapilendo: Helping close the German SME funding gap

Kapilendo is an SME crowd lending and crowd investing platform covering both standard loans and subordinated/mezzanine debt, allowing private investors to gain exposure to German corporate credit. Kapilendo is addressing the considerable funding gap in the German SME market. This is illustrated by the fact that bank lending volumes to SMEs remained broadly flat over the last 10 years despite continued growth in GDP. Importantly, penetration of SME funding facilitated by fintechs is still marginal in Germany (below 1% according to creditshelf), compared with c 13.9% in UK in 2015 according to a study conducted by G. Dorfleitner and L.Hornuf on behalf of the German Ministry of Finance.

The funding volume per project on Kapilendo’s platform stands between €50k and €6.0m (between €125k and €6.0m in case of subordinated debt). Importantly, Kapilendo is a pure intermediary rather than a balance sheet lender. The company has an in-house ratings team that provides a rating system that enables investors to evaluate investment opportunities and risks. Kapilendo is now focused on developing its credit platform, which aims to reach a fast credit decision (its users now get the first interest offer after 10 minutes) and incorporate external partners’ data, including rating agencies and other providers, eg kontoblick (a web app for personal financial management).

Overall, Kapilendo’s business seems to be progressing well; we understand that the financing volume increased by 37.5% y-o-y to €14.4m in H119, while the cumulative financing volume since inception reached €55m. The number of active investors more than doubled year-on-year in H119, which we believe might have been partially supported by a new marketing campaign that Kapilendo launched in March 2019. The aggregate volume of requested loans stood at c €0.6bn in H119.

FinLab originally invested in crowdfunding platform Venturate in February 2015, which was then merged with Kapilendo in April 2016. In July 2018, Kapilendo finalised the second part of a series B financing round, with €6.0m raised from Axel Springer Media for Equity following the €7.0m collected in the first part completed in 2017. Following the funding round, Kapilendo’s value reached more than €40m according to FinLab.

An additional reference point for Kapilendo’s valuation may constitute another German direct online lending platform, creditshelf, which completed its IPO in July last year and currently has a market cap of c €88m. The aggregate volume of requested loans on the platform reached €0.6bn (similar to Kapilendo) and lending volumes in H119 reached €35.8m (up 132% y-o-y). It is worth highlighting though that creditshelf focuses purely on professional and institutional investors (with a minimum ticket size of €10,000) rather than facilitating crowdfunding from retail investors (minimum ticket size €100).

Authada: Regtech addressing the PSD2 regulation

Authada’s end-to-end two-factor authentication solutions enable real-time verification of existing and prospective customers via an electronic identity (eID) and smartphone near-field communication (NFC). These may be used as a mobile or an onsite solution in banking, insurance and e-commerce. Authada’s software-as-a-service (SaaS) solutions are available as both a white-label software development kit (SDK) and a standalone-app.

Authada’s offering is particularly compelling in the context of the PSD2 regulation (described in the fintech market overview section), specifically the introduction of the strong customer authentication (SCA) requirement effective from September 2019. Moreover, Authada meets all requirements of the EU General Data Protection Regulation (GDPR) and the Anti Money Laundering Act (AMLA). Interestingly, the eID-Core solution from Authada became the first identification procedure in Germany certified by the Federal Office for Information Security (BSI) in January 2018. As at March 2019, there were around 63 million personal eIDs and close to 10 million digital residence permits in Germany, which can be used in Authada’s verification processes. Germany should be fully covered with eIDs by November 2020.

We appreciate Authada’s several major client wins in 2018 and 2019, including the following developments:

In May 2018, its digital identification solution was introduced at the German/British social trading platform ayondo.

In July 2018, Authada’s eID-Core was implemented by Austrian paysafecard, one of the global market leaders in the field of online prepaid payment methods.

Authada’s app attracted the first bank, comdirect, and its identity solutions for the bank’s customers went live in December 2018.

In May 2019, Authada announced that it launched its onsite customer identification and legitimation application in several German savings banks (Sparkassen) in partnership with SMarkt & Mehrwert.

Moreover, as announced in July 2019, AUTHADA-app will also run on iPhones and be available not only in the Google (NASDAQ:GOOGL) Play Store but also in the App Store from September 2019 (following the release of the iOS 13 update). Authada states this opens a new market for the company, as iOS users obtain open access to the NFC interface that so far has been available only for a fee.

It is worth noting that in April 2019, Jörg Jessen, one of two of Authada’s management board members, left the company and Andreas Plies, its CEO and founder, has taken over his responsibilities. That said, Authada confirmed it will continue with its current strategy. The company’s growth should be supported by an undisclosed seven-figure sum FinLab and Commerzbank (DE:CBKG) Group invested in the company in August 2018 that has driven the company’s value to c €10m.

Performance: NAV return at around 20% pa

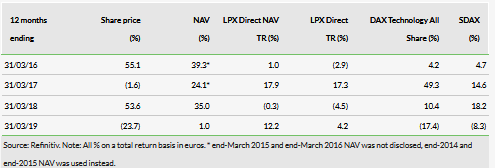

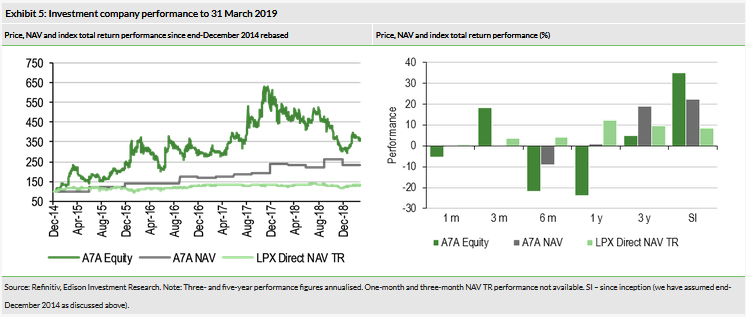

We measure FinLab’s NAV performance since end-2014 as the date coincides with FinLab’s renaming from Altira, which was coupled with the company’s strategic reorientation to a VC investment fund focused on the fintech sector (as announced in mid-January 2015).

FinLab does not use any official performance benchmark but we believe investors may compare it to the LPX Direct Index, which illustrates the global performance of listed private equity companies pursuing a direct investment strategy. However, it must be noted that since FinLab is a VC rather than a private equity fund, this benchmark is obviously not a perfect reference point. Moreover, we note that while most private equity funds revalue a large part of their portfolios on a regular basis primarily using the multiples method, FinLab only revalues its investments upon completion of new funding rounds by their respective portfolio companies.

FinLab has achieved an NAV TR of 22.4% pa at end-March 2019 since end-2014 (in euro terms), which was significantly ahead of the 8.8% pa NAV TR for the benchmark. We understand that this was largely driven by a few success stories, in particular Deposit Solutions. The company’s share and NAV performance lagged the benchmark over the last six and 12 months, negatively affected by the subdued performance of Heliad Equity Partners.

Discount: Trading visibly below last reported NAV

Since inception, FinLab’s premium/discount to NAV has been volatile, occasionally moving to a discount in excess of 30% or rising to an over 40% premium. This is associated with the fact that FinLab is reporting its NAV on a quarterly basis only, while the company’s share price is subject to a number of catalysts between NAV publication dates. Apart from the broader sentiment in German equities, this specifically includes the share price performance of Heliad Equity Partners, which has on average comprised around 40% of FinLab’s NAV since end-2014 (as of end-March 2019 the stake decreased to c 20% though). Moreover, we believe that FinLab’s premium or discount to NAV was influenced by the market sentiment towards the cryptocurrency space, especially as FinLab invested in two crypto-oriented companies, Vaultoro and Iconic Holding, in September 2017 and November 2017, respectively. This coincided with FinLab’s premium to NAV moving to c 55% in December 2017. The subsequent premium decline to c 20% could be at least partially associated with the correction in the broad cryptocurrency market.

Since August 2018, FinLab’s discount to NAV has gradually widened and as of 26 August 2019 levelled off at 20% to last reported NAV per share of €20.51 (as of end-March 2019). This was accompanied by a 32% decline in Heliad’s share price in the period (the company is now traded at a c 31% discount to its own NAV, which stood at €6.76 per share at end-March 2019).

Heliad’s discount has been gradually narrowing in the longer term and even though we believe the trend may not persist due to recent challenges Heliad is facing, it is instructive to consider the impact on FinLab’s NAV if Heliad’s assets were reflected at NAV per share level. If the discount were removed, FinLab’s NAV (at end-March 2019) would rise to €22.25 per share, suggesting that the shares would trade at a c 26% ‘look through’ discount to last reported NAV. At the same time, if we reflect the share price movements of major listed holdings within Heliad’s portfolio (Fintech Group, MagForce and Elumeo) from end-March 2019 and subsequently remove Heliad’s discount to NAV, Finlab’s discount is at 10%. This is largely a function of the 24% price appreciation of Fintech Group’s shares since end-March 2019.It is also worth pointing out that in the case of some private equity companies (eg Deutsche Beteiligungs), which apart from direct investments also manage third-party funds, the market is ascribing some value to their asset management business, and as a result the companies may trade at a premium to NAV.

To read the entire report Please click on the pdf File Below..