- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Federal Signal Announces Buyback Program, Launches Website

Federal Signal Corporation (NYSE:FSS) yesterday announced rewards for its shareholders in the form of a share buyback authorization. Concurrently, the company communicated that some of its existing products can be utilized for fighting the coronavirus outbreak. For this purpose, it launched a website for spreading awareness.

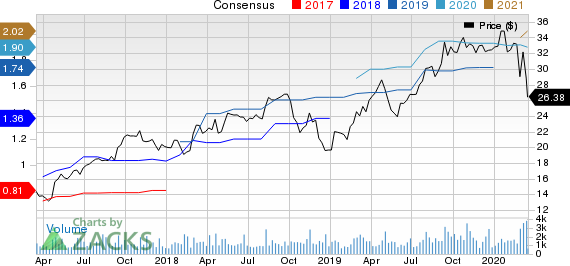

Notably, the company’s share price decreased 8.5% yesterday, ending the trading session at $26.38.

Inside the Headlines

Under the newly authorized buyback program, Federal Signal can buy back up to $75 million worth shares. The new buyback plan is in addition to the company’s repurchase program authorized in November 2014.

Ending 2019, it was left with the authorization to buy back $29 million worth shares from the 2014 program.

We believe that such disbursements vouch for Federal Signal’s shareholder-friendly policies and strong cash position.

In addition, the company launched a website — www.fedsigresponse.com — which provides information on how its existing products can be used for containing the coronavirus outbreak.

Federal Signal’s products — including Jetstream, TRUVAC, Elgin Sweeper and Vactor — can be used for sanitizing and cleaning parks, museums, recreational spaces, train stations, buses, railcars, bridges, and others. These products are made by Federal Signal’s Environmental Solutions Group.

Zacks Rank, Price Performance & Estimate Trend

The company currently has a market capitalization of $1.8 billion and a Zacks Rank #3 (Hold). In the past three months, the stock has fallen 18.4% compared with the industry’s decline of 27.9%.

Earnings estimates for Federal Signal have been lowered in the past 60 days. Currently, the Zacks Consensus Estimate for the bottom line is pegged at $1.90 for 2020, reflecting a decline of 1.6% from the 60-day-ago figures.

Federal Signal Corporation Price and Consensus

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Griffon Corporation (GFF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.