ExxonMobil Corporation (NYSE:XOM) won eight additional exploration blocks during Brazil’s 15th bid round. The oil major will operate six of the newly-awarded blocks.

With the latest awards, ExxonMobil raised its holdings in Brazil’s pre-salt basins by about 640,000 net acres. The company became one of the largest acreage holders among international players in Brazil with more than two million net acres.

Details of the Blocks

ExxonMobil has won rights to two blocks in the Santos area. The company will operate the blocks with partner Qatar Petroleum.

ExxonMobil has been awarded another four blocks in the Campos area. Of which, two will be operated by ExxonMobil along with partners Petrobras (NYSE:PBR) and Qatar Petroleum. The other two blocks will be operated by Petrobras along with partners ExxonMobil and Statoil (OL:STL) ASA (NYSE:STO) .

The remaining two blocks are located in the Sergipe-Alagoas area. These blocks will be operated by ExxonMobil along with partners Queiroz Galvao Exploraçao e Produçao (“QGEP”) and Murphy Oil Corporation (NYSE:MUR) . These awards are likely to boost the value of the already held adjacent blocks.

Seismic Data Coverage on the New Blocks

3-D seismic coverage on more than 4,000 square kilometers is intended to be released by ExxonMobil in 2018. These include all the company-operated exploration blocks announced in 2017 and are subject to permitting approvals.

About ExxonMobil

The latest awards enhance ExxonMobil’s deepwater portfolio by adding highly-prospective acreage. The company’s expertise in deploying deepwater services, backed by its partners, will develop world-class resources that will benefit Brazil for many years to come. ExxonMobil’s presence in Brazil dates back to more than ten decades. Currently, the company has interests in 24 blocks offshore Brazil.

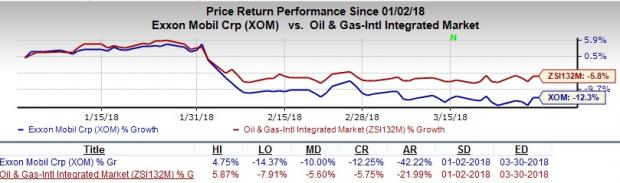

Price Performance

ExxonMobil’s shares have lost 12.3% in the last three months, compared with the industry’s 5.8% decline.

Zacks Rank

ExxonMobil carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Can Hackers Put Money INTO Your Portfolio?

Earlier this year, credit bureau Equifax (NYSE:EFX) announced a massive data breach affecting 2 out of every 3 Americans. The cybersecurity industry is expanding quickly in response to this and similar events. But some stocks are better investments than others.

Zacks has just released Cybersecurity! An Investor’s Guide to help Zacks.com readers make the most of the $170 billion per year investment opportunity created by hackers and other threats. It reveals 4 stocks worth looking into right away.

Download the new report now>>

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

Statoil ASA (STO): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Murphy Oil Corporation (MUR): Free Stock Analysis Report

Original post