Last week's vote by the US House of Representatives has pushed out the budget debate into late spring, avoiding a repeat of August 2011 - for now. The Senate is likely to follow, approving the bill in its current form, with the Obama administration signing it into law.

Reuters: Wednesday's vote by the Republican-controlled U.S. House of Representatives to extend the government's borrowing power until May 19 was no different.

It temporarily removed a hazard - a potential default within the next month - that only existed because Republicans created it. They initiated Wednesday's vote after taking a beating in public opinion polls for engaging in budget brinkmanship over the "fiscal cliff," a series of budget deadlines that came together at the end of 2012, which could have resulted in huge tax increases and spending cuts had Congress not acted to either eliminate or postpone most of them.

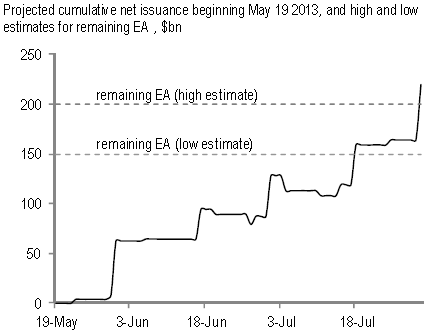

So how much time does the government have before the risk of "potential default" returns? After May 19th, the Treasury will begin taking the so-called "Extraordinary Actions" (EA), including tapping federal pensions, and other ugly temporary measures. According to JPMorgan, "these include suspending investments of the TSP G-fund and the Exchange Stabilization fund, suspending issuance of new securities to the CSRDF, and redemption of a limited amount of these securities, suspending of issuance of new SLGS, and replacing Treasuries subject to the debt limit with debt issued by the Federal Financing Bank." These are estimated to be "between $150-$200bn", providing some additional room as they did in the summer of 2011.

Based on the expected treasury issuance after May 19th (assuming we had no debt ceiling) it is possible to estimate at what point the Extraordinary Actions "juice" will run out.

We are looking at mid-to-late July before we have a potential repeat of August 2011. It's not difficult to predict what will happen in July however. The politicians will take the nation to the brink once again and at the last moment will kick the can down the road. We've seen this movie before. But for now, what Reuters calls "hazard" has been avoided.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Extraordinary Actions Will Keep The US Government Running

Published 01/28/2013, 02:26 AM

Updated 07/09/2023, 06:31 AM

Extraordinary Actions Will Keep The US Government Running

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.