- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Expedia Enters Into Strategic Alliance With G6 Hospitality

Expedia, Inc. (NASDAQ:EXPE) announced on Wednesday, a strategic technology and marketing partnership with G6 Hospitality, owner and operator of economy lodging locations under Motel 6 and Studio 6 brands in the United States and Canada.

The partnership is aimed at providing Motel 6 and Studio 6 access to Expedia’s marketing, technology and data insight solutions while boosting Expedia owned sites and Expedia Media Solutions, the advertising sales unit of Expedia.

Melissa Maher, Senior Vice President, global partner group, Expedia stated, “Our focus in recent years has been to offer market-leading services and solutions customized for our partners that positively impact their bottom line, and we’re excited to work alongside G6 Hospitality to drive this further for the brand.”

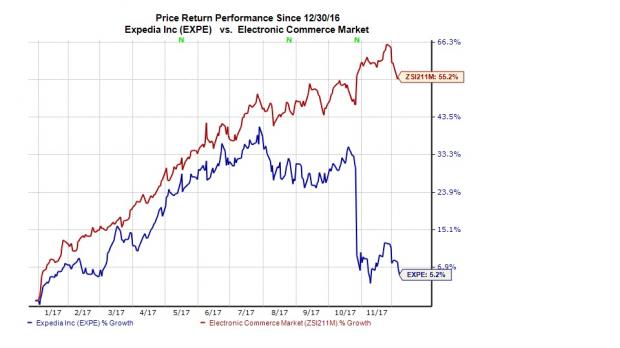

We observe that Expedia shares have gained 5.2% year to date, significantly underperforming the industry’s rally of 55.2%.

Deal Details

As part of the deal, Expedia Powered Technology will be available to Motel 6 and Studio 6. G6 Hospitality will offer loyalty enrollment and pricing to its My6 Members via Expedia-owned sites, corporate-level Expedia Media Solutions advertising program and Expedia’s Members Only Deals. The duo also has plans to explore an enhanced Rev+ solution and label Expedia technologies for G6 Hospitality properties.

Expedia, Inc. Revenue (TTM)

On the marketing front, Expedia market management will collaborate with G6 Hospitality to offer business intelligence and market insights to increase demand on Expedia sites. The offerings include partner education through Expedia Powered Technology; property, market and region-specific data-driven insights and assistance in price and value maximization.

Our Take

We believe that the partnership is part of Expedia’s increased focus and investments in technology and performance-based marketing. It is expected to boost Expedia’s lodging revenues, which include hotel and HomeAway revenues and currently constitute 71% of total revenues.

While these investments are expected to impact margins in the near term, the company will gain from technology, sales, and marketing investments made in the past years. Product enhancement is also expected to have a positive impact on margins, going forward.

Zacks Rank and Stocks to Consider

Expedia has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader technology sector include Activision Blizzard (NASDAQ:ATVI) , Red Hat (NYSE:RHT) and Five9 (NASDAQ:FIVN) , each carrying a Zacks Rank #2 (Buy).

Long-term earnings per share growth rate for Activision, Red Hat and Five9 is projected to be 13.8%, 15.8% and 20%, respectively.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Expedia, Inc. (EXPE): Free Stock Analysis Report

Five9, Inc. (FIVN): Free Stock Analysis Report

Red Hat, Inc. (RHT): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.