Last week I got called in to discuss the recent market rally on Fox Business News. It is always interesting to listen to the other analyst's predictions but calls for a 10-15% rally by year end, from current levels, took me back a bit. Such a rally would put the S&P 500 at 1540 to 1610 which would be all-time highs.

During the interview I stated that while the markets have done better in July, and so far in August, than expected there has only been one sole driver - "hope" that the ECB, and the Federal Reserve, will act soon with further stimulative programs to boost the markets. Outside of this "hope" there is little in the way of fundamentals to support a further rise in asset prices at the current time.

1) 83% of pre-announcements have been negative and are at levels that are more indicative of market tops – also at the highest levels since the “Great Recession.”Bloomberg clip here

2) Corporate revenue has shown sharp declines in the recent earnings period with 2nd quarter growth of only 1%. Profits will decline by 2% this quarter. Economist

3) Economics are trending weaker from imports, trade, manufacturing, consumption and employment.

4) The ECB talks a great game but the problem still remains Germany which appears unlikely to act soon. Zero Hedge

The host responded with "yes...but the markets are climbing a 'wall of worry.'" This was a very interesting statement considering that line has been uttered just prior to every major market top. Whether it was the "Goldilock's economy" in 2007 or "...stocks have reached a permanently high plateau" in 1929 history is filled with examples of denial of the fundamentals and economics that drive markets over the long term. This denial has usually led to investor's misery more often than not.

However, after the interview, as I was driving back to the office to the do our daily radio broadcast, I started thinking about what the analyst said and trying to determine what could make such a prediction come true. What things would need to go "right?"

The List of Right-ousness

The first chart breaks down the potential year-end rally down into three possibilities of a 5, 10 and 15% rally from current levels. This yields year-end price targets of 1475, 1545 and 1615.

Let me be clear. I do believe that a rally is likely going into the end of the year, however, such a rally without a correction first is much less probable. Secondly, the market is going to run into major resistance at the multi-year secular bear market highs which leads me to believe that we can dump the 15% rally idea for now.

This leaves use two, more realistic, potentials of a bull rally for the remainder of the year. In order for this to occur from current levels, without a correction first, here is the list of what needs to go "right":

1) The Fed will need to act sooner, rather than later, with a third round of bond buying (Q.E.). This will mean that the Fed will need to give strong hints of action at the annual "Jackson Hole Summit" meeting at the end of this month. This program will need to be large, in excess of $1 Trillion, in order to be effective.

2) The ECB and Mario Draghi will need to back up his recent "...do anything" speech by following through with action. This would need to include direct bond buying through the use of EFSF and ESM funds with limited demands on the borrowers. This will need to occur fairly quickly particularly if yields in Spain and Italy begin to surge once again.

3) Germany will need to ratify the ESM (European Stability Mechanism) in September and immediately agree to provide bailouts, with few conditions, to Spain, Italy and Greece. In the meantime, German officials must become much more vocal about supporting the ECB in their efforts to "save the Euro."

4) The recessions in the Eurozone, and slowdowns in China, will need to be begin showing improvement. China will need to act with stimulative action and the slide in the Eurozone economies will need to start showing signs of tentative recovery.

5) In the U.S. - consumers will need to increase purchases by drawing on more credit and reducing savings to boost demand on businesses. This should be reflected by increases in revenue growth in upcoming quarterly earnings announcements. With earnings expected to grow sharply in the 4th quarter improvements will need to be seen by the 3rd quarter.

6) Oil prices will need to fall along with food based commodity prices. This will provide an income boost to consumers such as we saw in the 3rd and 4th quarters of 2011.

7) Investors need to switch from buying bonds back into buying stocks.

If these things can go "right" then there is a very real possibility of a sharp rally through the end of this year and into 2013.

Will The Fed Act?

The "hope" of Fed intervention is what is currently driving the markets higher. Up to now each meeting has come and gone without action - yet "hope" remains that action is inevitable at the next meeting. While it is entirely possible that the Fed will act the question is when?

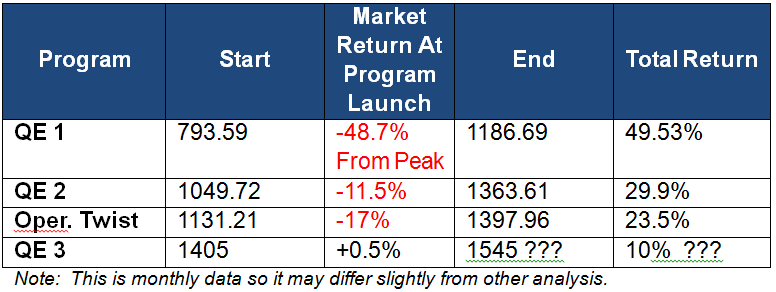

The table details the start points and effects of each program to date. There are two things to take away from the table: 1) There has been a diminishing rate of return for each intervention that has occurred. This has been discussed by Bernanke during each of his last several speeches, and; 2) each previous intervention came with the markets trading down sharply as opposed to currently. This supports my premise that it is unlikely that the Fed will act with the markets already pricing in a bulk of the effect that any program launched at this point would have. If the Fed acts it will be later in the year after a correction in the markets first.

What About The Presidential Election Year?

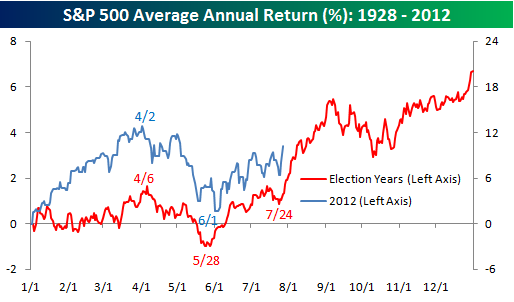

Markets historically tend to perform better during Presidential election years. However, currently the markets are very overbought on a short term basis. This should not be surprising after a sharp two-month rally and makes chasing the markets at current levels much more dangerous. However, with seasonally strong time of year approaching we should expect declines to be somewhat limited. The chart, from Bespoke Investment Group, shows the average return of all Presidential election years. (Note: There is an error in the chart. The 2012 return is the right axis rather than the left as labeled.)

As you can see Presidential Election years tend to have a positive effect on stock market performance as expectations of policy changes, etc. push market participants to make bets on the outcome of the election. There are a couple of important points to be made about where we currently are in the market:

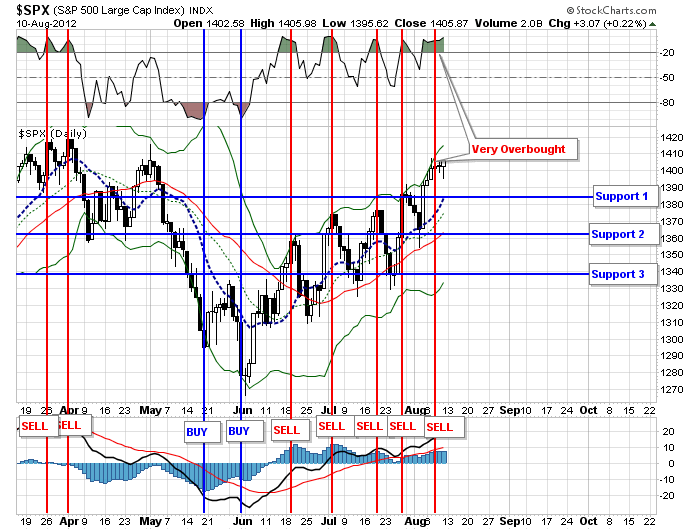

The first level of short term support is 1385. While this level could hold - we doubt that this will be the case as it simply does not provide enough distance to work off the overbought condition that currently exists.

The second level of support is 1365. This moving average has acted as good support during the entire advance from the June lows. This is likely to be a good level of support for a short term correction even with action by the Fed.

The third level of support is where the market reaches 2-standard deviations of being oversold. That level, currently at 1340, should provide a decent oversold opportunity to add exposure if the Fed fails to act in September. Should the market sell off to these levels due to "disappointment" , it would theoretically give the Fed enough room to enact a stimulative program to try and stabilize a weakening economic environment.

The following are the risks to this analysis.

1) If both the Fed and the ECB fail to act - it is likely that the markets could test much lower levels.

2) The continued weakness in the economy and the fundamentals are not supportive of current price levels or further advances. Further deterioration in the economy and earnings will become an issue for the markets eventually. This is particularly the case if there is any perception that the Fed, or ECB, may not act in the weeks ahead.

3) Market participation is still very weak which could lead to a more dramatic decline. Much of the "hope" rally has been due to short covering which can quickly reverse.

4) A resurgence of the Eurozone crisis will provide further downside risk to the markets.

Recommendations For Uncertainty

Bob Farrell's Rule #9 rings in my head: "When all experts and forecasts agree - something else is going to happen." Markets are rallying on expectations that further bailouts are coming. Market experts take this as a sign that markets are rallying because stocks are undervalued and this is the time to "buy." The problem is that both of these arguments leave a lot to risk.

It is clear that deteriorating fundamentals and economics are going to have to be dealt with by the markets – particularly if expectations of a year-end economic recovery fail to materialize. In 2011 the economy and earnings were saved by rapidly falling commodity and natural gas prices and an unseasonably warm winter. This year, the opposite is the case, as oil and gas prices have increased sharply on expectations of Q.E. and a drought has sent food prices soaring. These events only serve to negatively impact the consumer's budget and threatens economic growth in the months ahead.

That is the nature of the markets – they can remain irrational longer than expected and the market has already done what our analysis said, earlier this year, was unlikely. With this in mind here is what we are doing for our clients currently:

1) Reducing underperforming assets and raising cash to hedge off portfolios against the expected pending correction.

2) Increasing weighting to fixed income. Bond prices have reached targeted "buy" zones and we are still expecting yields to reach 1% on the 10-year treasury when the Eurozone crisis restarts again.

4) We have restructured our portfolio management processes to be more adaptive to continued interventions.

5) Risk management processes, likewise, have been reworked to further increase sensitivity to market changes without increases in overall volatility.

This overhaul in our management processes, as a result of the effects of continued artificial manipulation by Central Banks, does not change our overall investment discipline of capital preservation and risk adjusted returns. However, as with any process it must be adaptive to environmental changes. Whether it is continued Central Bank interventions, high frequency trading, demographic shifts or balance sheet deleveraging - these environmental changes have changed the historical investing relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Everything Needs To Go Right

Published 08/14/2012, 02:39 AM

Updated 02/15/2024, 03:10 AM

Everything Needs To Go Right

The following is a condensed version of this past weekend's full discussion which goes into much more technical detail.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.