For the 24 hours to 23:00 GMT, EUR rose 0.09% against the USD and closed at 1.3558, as risk-appetite among investors increased after the International Monetary Fund (IMF) raised its global growth outlook to 3.7% this year, 0.1% higher than its October estimate of 3.6%.

For the Euro-zone, the IMF stated that “the Euro area is turning a corner from recession to recovery” and that it now expects the common currency bloc to register a growth of 1.0% this year and 1.4% in 2015. However, at the same time, the agency also warned that “rising risks of falling prices threaten the economic recovery of the region” and noted that the “southern Europe to be the more worrisome part of the world economy.”

On the economic front, Euro-zone’s ZEW economic sentiment index advanced to a reading of 73.3 in January, more than analysts’ expectations for a rise to 70.2 and compared to a level of 68.3 registered in the previous month. Meanwhile, ZEW economic sentiment index for Germany unexpectedly declined to a reading of 61.7 in January from previous month’s level of 62.0. However, the ZEW survey – current situation index in Germany advanced more-than-expected to a level of 41.2 in January, from a figure of 32.4 recorded in December.

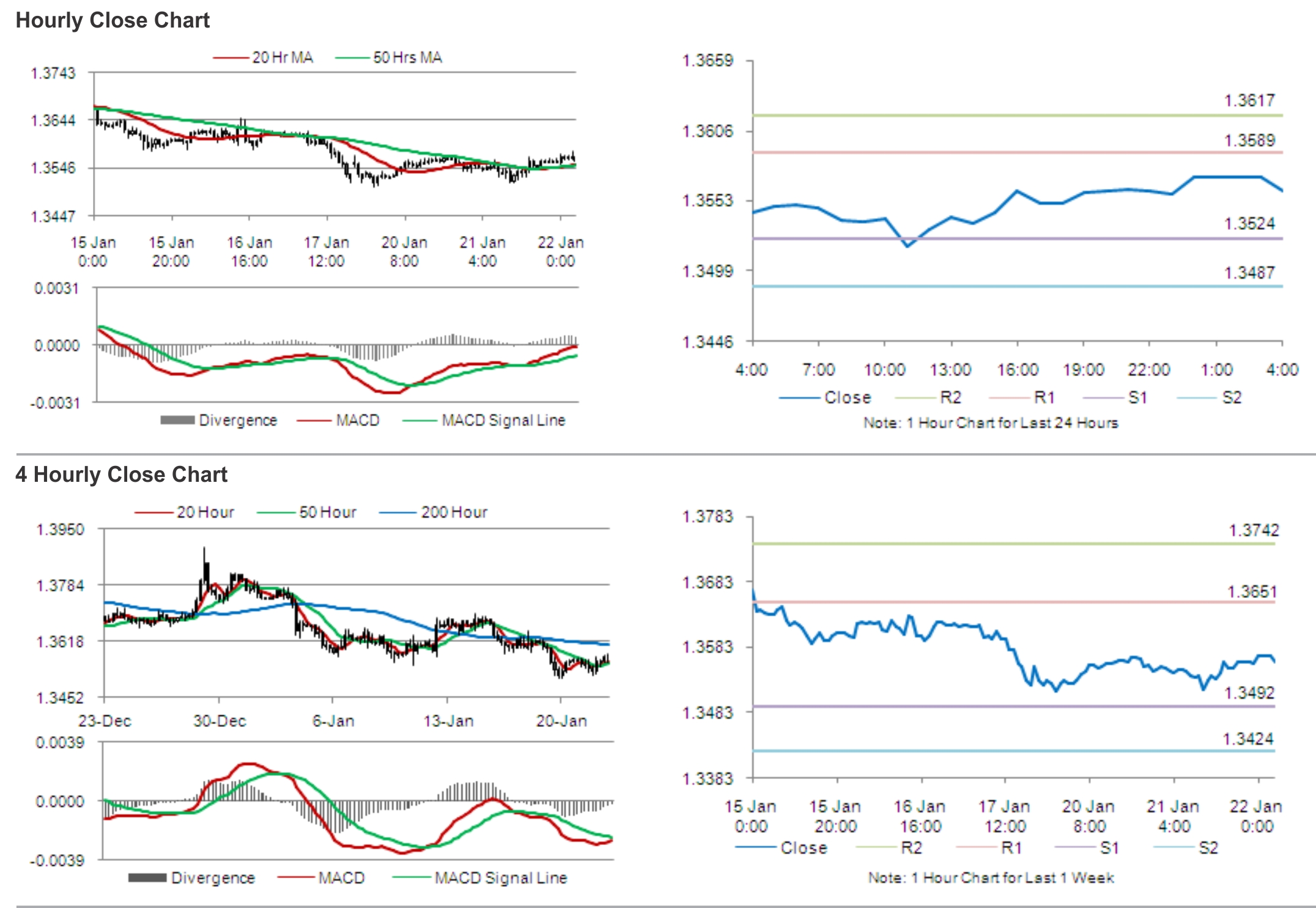

In the Asian session, at GMT0400, the pair is trading at 1.3560, with the EUR trading tad higher from yesterday’s close.

The pair is expected to find support at 1.3524, and a fall through could take it to the next support level of 1.3487. The pair is expected to find its first resistance at 1.3589, and a rise through could take it to the next resistance level of 1.3617.

Amid lack of major economic releases from the Euro-zone today, investors would turn their attention to PMI data from France, Germany and the Euro-zone later tomorrow to get clues about the economy of the bloc.