- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro-Skeptics Priced Into Market

There has been little negative reaction in the EUR to the outcome of the EU elections, where support for the anti-EU surged. Despite anti-austerity growing, the overall status quo prevails. The better showing for the euro skeptics was already well priced into the markets and some risks, like renewed political instability in Italy, did not materialize. The mainstream pro-Europe political parties continue to dominate, guaranteeing no imminent reversal of "the push towards deeper integration." If anything, perhaps the rise of the euro skeptic could be good for the markets – their "new" influence could help streamline the preverbal Euro bureaucratic red tape problems. While the Eurozone adopts an early risk on stance after the elections, geopolitics is again in the headlines with further casualties in Ukraine. This will keep some of the short-end EUR product curves better bid.

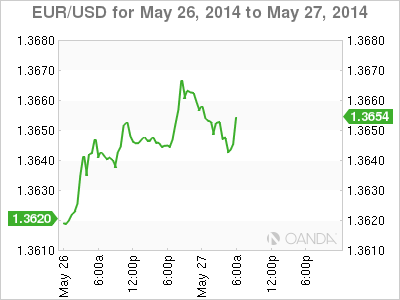

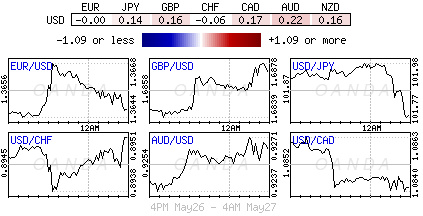

EUR/USD

Capital markets tend to have a single-minded focus and its primary concerns right now is not with the Euro electorate results. In fact, that can wait for another day, and when it becomes an issue it will have more of a domestic impact than a federal. Just ask the UK's PM Cameron and what he can expect at next years general election with the rise of UKIP or France's Hollande who will be going to battle with Marine Le Pen's National Front. With UK and US participants' just now returning from an extended weekend market complacency environment continues, highlighted by low volatility and low yields. Investor's primary focus is the potential policy action at the next ECB meeting on June 5th. So far, the potential of further easing is helping to fuel gains in equities and some weakness in the in the 18-member single currency.

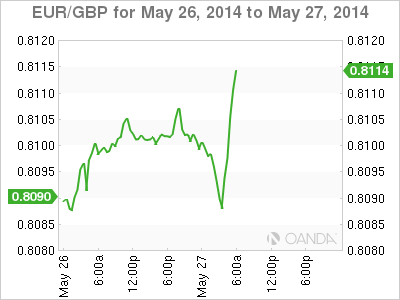

EUR/GBP

The ECB's 'Jackson Hole' style symposium this week in Portugal has a lot to do with discussing strategy ahead of next week's ECB meet. Euro policy makers need to come up with ways to stimulate lending to small businesses where credit channels remain blocked. Next week, Draghi and company is expected to announce "conventional" monetary policy measures (cuts to o/n and deposit rates), peppered with a few "unconventional" measures (stimulate lending). All ECB members are required to speak from the same script; obviously any dissent will favor the EUR and undermine the ECB's intentions. Euro-policy maker's credibility would be called into question very quickly, and this would allow the market to immediately "run riot" over all Euro initiatives.

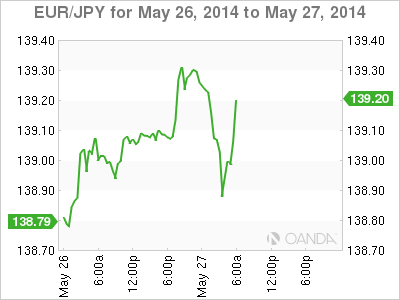

EUR/JPY

The positive reaction seen in EMU peripheral stocks and narrow yield spreads after the EU elections seem to be offering the EUR bull a lifeline. However, expect stronger market moves to take place after next week's ECB announcement, until then, resistance at €1.3670 needs to be cleared out to suggest that the single currency has somewhat bottomed out. Many of the market players favor staying short the single unit, preferring to trail their stop losses down from €1.3700. Last Thursday's high (€1.3688) weighs in the interim, and should stem most short-term corrective moves.

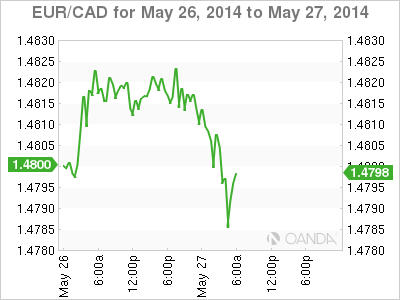

EUR/CAD

On this side of the pond, the US data front gets a bit more important for FX markets as the debate regarding Fed exit strategies gains momentum. Durable goods and consumer confidence data are set for release in today's session. However, large EUR expiries (€1B €1.3620-25, €1.3680, €500m €1.3700-05) have a nasty habit of containing a market. Decent market bids for the single currency still remain ahead of the psychological and option barrier located at €1.3600.

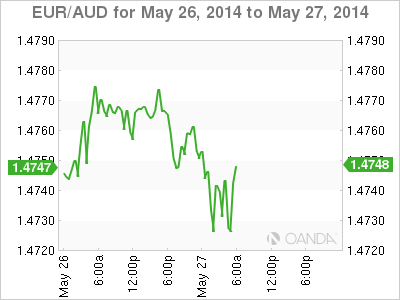

EUR/AUD

Pushing the ECB aside for one moment – month-end could again be an issue for many. Last month was unusual, with the euro-zone money market being very tight, but this month – May – is proving to be even tighter. The fixed income and money market desks note that the O/N EONIA rate averaged +0.425%yesterday, with one week at +0.28% - still above the refi-rate (+0.25%). Liquidity relief will not come until after the ECB delivers and they better deliver otherwise the market will compound volatility until the start of the World Cup.

Just before heading stateside, Italian consumer confidence continued to rise this month and is at its highest level since Jan 2010 (106.3 v 104.9e). Households remain optimistic about their future. It seems that PM Renzi is inspiring the national mood. Renzi is three-months in power, swept into office promising reforms to reduce record unemployment and lift their economy out of recession. Italy was one country that the Euro-skeptic could have been a problem, however, with Renzi having a stranglehold on power is good for their markets.

Related Articles

The euro has gained ground on Tuesday. In the North American session, EUR/USD is trading at 1.0515, up 0.45%. On Monday, the euro climbed as high as 1.0527, its highest level this...

The German election results initially boosted optimism, but uncertainty over coalition talks is keeping pressure on EUR/USD. Trump's confirmation of tariffs on Mexico and Canada...

ECB and BOC Monetary Policy Divergence – EUR/CAD Exchange Rate Fluctuations. RBA and BOC Monetary Policy Divergence – AUD/CAD Exchange Rate Fluctuations. Canada and Australia...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.