- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

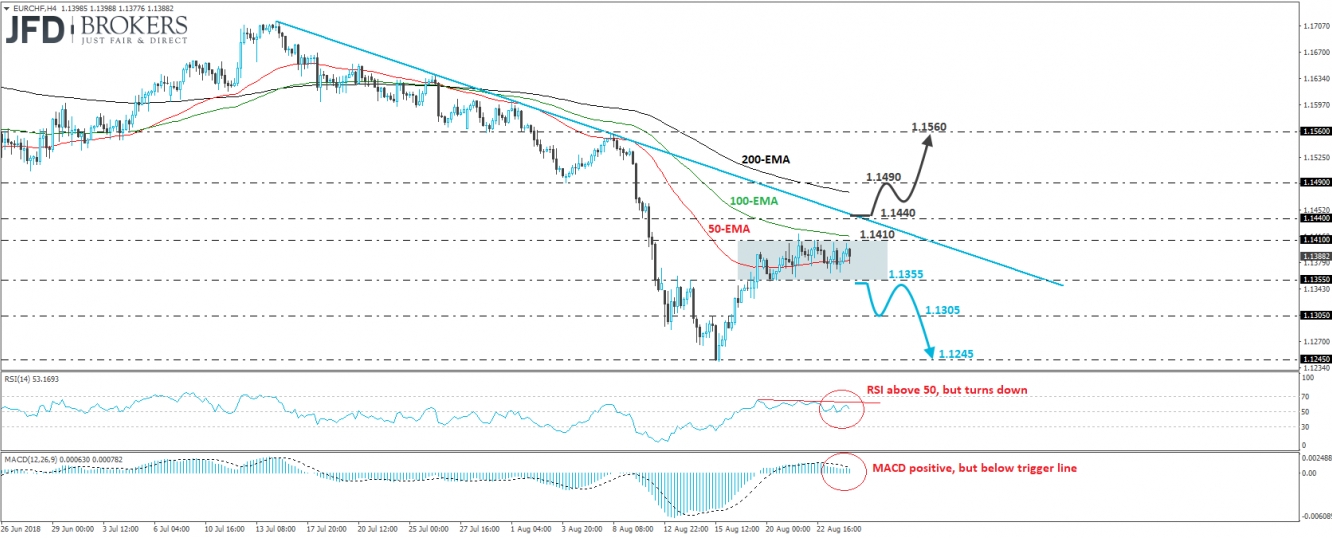

EUR/CHF Trapped Within Range

EUR/CHF has been trading in a sideways manner since the 17th of August, oscillating between 1.1355 and 1.1410. This keeps the short-term picture somewhat neutral for now but bearing in mind that the price action is still below the downtrend line drawn from the peak of the 16th of July, we see more chances for the pair to exit the range to the downside rather than to the upside.

A clear dip below 1.1355 could confirm the case and is possible to set the stage for our next support level of 1.1305, defined by the inside swing peak of the 15th of August. Now, if the bears prove strong enough to overcome that level as well, then we may experience more downside extensions, perhaps towards the low of that day, at around 1.1245.

Looking at our short-term oscillators, we see that the RSI, although above 50, stays below its respective downside resistance line and points down, while the MACD, even though within its positive territory, lies below its trigger line and looks to be heading towards zero. These indicators support somewhat the case for the bears to attempt a dip below 1.1355.

On the upside, even if the pair exits the short-term range through its upper bound, it could still meet strong resistance near the aforementioned downtrend line and then fall again. Thus, we would prefer to see a decisive move above that line and the 1.1440 level before we assume that the bulls have taken the driver’s seat. In such a case, we would expect a recovery towards the 1.1490 key resistance zone, the break of which could carry more bullish implications, perhaps opening the path for the 1.1560 obstacle, marked by the peak of the 8th of August.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

CHF/JPY Forex Strategy is Bearish: We are currently @ 166.78 in a range. If we can break slope support, we are looking for a continuation to the ATR target @ 165.97 area, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.