- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

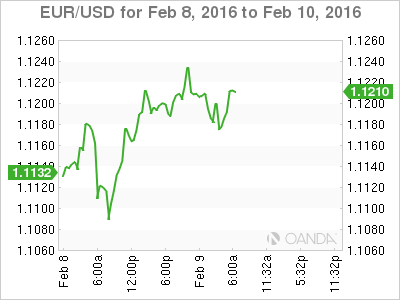

EUR/USD – Steady At 1.12, Markets Eye US Jobs Report

EUR/USD has posted slight gains on Tuesday, as the pair trades at the 1.12 line in the European session. On the release front, German Industrial Production disappointed, posting a decline of 1.2%. Today’s key event is US JOLTS Job Openings, with the markets expecting a reading of 5.43 million, which would be a slight drop from the previous release. On Wednesday, Fed Chair Janet Yellen will testify before the House Financial Services Committee in Washington. With the markets looking for clues regarding the timing of another rate hike, this event could be a market-mover.

As the largest economy in the eurozone, Germany is considered the locomotive of the bloc, so German releases are closely monitored by the markets. German manufacturing numbers continue to disappoint, as Industrial Production came in at -1.2%, compared to a forecast of +0.2%. This was the indicator’s fourth decline in the past five months. The soft reading comes on the heels of the December report for German Factory Orders, which posted a decline of 0.7%, compared to a gain of 1.5% a month earlier.

China is one of Germany’s largest trade partners, so the downturn which has gripped the Asian giant, the world’s No. 2 economy, has produced strong ripples across the globe and taken its toll on the German and eurozone manufacturing sectors. The contagion of the Chinese downturn could easily spread to other sectors of the German economy, which could weaken the high-flying euro.

The euro has surged in February, climbing some 330 points last week. This marked the pair’s strongest weekly gains since March 2015, as the euro trades at the 1.12 level. Eurozone numbers have not been particularly impressive, but the euro took full advantage of soft US numbers last week, as employment and service sector numbers were short of expectations.

ISM Non-Manufacturing PMI, a key gauge of the services sector, dipped to 53.2 points in January, its worst showing since March 2014. Unemployment claims rose unexpectedly to 285 thousand, above the forecast of 279 thousand. The week wrapped up with a dismal Nonfarm Payrolls report, with a small gain of 151 thousand. The markets had expected a much stronger gain of 189 thousand. No less worrying, this figure marks a sharp drop from the previous reading of 292 thousand. The soft labor data continued on Monday, as the Labor Market Conditions Index posted an unimpressive reading of 0.4 points, marking a four-month low.

EUR/USD Fundamentals

Tuesday (Feb. 9)

- 2:00 German Industrial Production. Estimate 0.2%. Actual -1.2%

- 2:00 German Trade Balance. Estimate 19.4B. Actual 19.4B

- 2:45 French Government Budget Balance. Estimate -70.5B

- 6:00 NFIB Small Business Index. Estimate 94.6 points

- 10:00 US JOLTS Job Openings. Estimate 5.41M

- 10:00 US Wholesale Inventories. Estimate -0.1%

Upcoming Key Events

Tuesday (Feb. 10)

- 15:00 Fed Chair Janet Yellen Testifies

*Key events are in bold

*All release times are EST

EUR/USD for Tuesday, February 9, 2016

EUR/USD February 9 at 6:00 EST

Open: 1.1189 Low: 1.1162 High: 1.1237 Close: 1.1207

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0941 | 1.1087 | 1.1172 | 1.1278 | 1.1349 | 1.1495 |

- EUR/USD has shown marginal movement in the Asian and European sessions

- 1.1172 is a weak support line. It was tested earlier and remains under strong pressure

- There is resistance at 1.1278

- Current range: 1.1172 to 1.1278

Further levels in both directions:

- Below:1.1172, 1.1087, 1.0941 and 1.0847

- Above: 1.1278, 1.1349 and 1.1495

OANDA’s Open Positions Ratio

EUR/USD is almost unchanged, consistent with a lack of movement from the pair. Short positions retain a strong majority of positions (62%). This points to trader bias towards the euro breaking out and heading lower.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

CHF/JPY Forex Strategy is Bearish: We are currently @ 166.78 in a range. If we can break slope support, we are looking for a continuation to the ATR target @ 165.97 area, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.