- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR/USD Finds Support At 1.3650

EUR/USD

After placing some pressure on the resistance level at 1.38, the euro has since fallen sharply down to its lowest level in two weeks moving back through 1.37 however it has found some solid support at 1.3650. It had enjoyed a solid move higher over the last couple of weeks before easing back to finish out last week. This move higher saw it return to a wall of resistance at 1.38 and in doing so move to a six week high. In the last few days the euro has challenged the 1.38 resistance level again before being turned away yet again. A couple of weeks ago it moved very well away from the key 1.3550 level and back to 1.38. To finish out the week a few weeks ago the euro settled right around the 1.36 level after earlier in that week moving up strongly through the resistance at 1.3550. In the week prior the euro did well to bounce strongly off support at 1.34 and recover the lost ground from the previous couple of days which saw it fall from the resistance level around 1.3550. This was after a few weeks which saw it move steadily higher from a support level at 1.33 back up to a three week high just above 1.3550. Over the last month or so 1.3550 has been a key level. Towards the end of October the euro enjoyed a strong surge higher to move through to its highest level in nearly two years just above 1.38 before spending that week content to consolidate around this level. Over the following three weeks it fell heavily down to a support level at 1.33 before recovering well over the last few weeks. It moved quite well throughout the middle of October after breaking higher from its sideways range. For the month leading up to that, the euro traded within a narrow range between 1.3450 and 1.3650 before the range narrowed down to between 1.35 and 1.36. The former level of 1.35 was strongly tested a few weeks ago and has resurfaced as a significant level presently.

Throughout August the 1.34 level had been causing the euro headaches however several weeks ago it surged higher and moved through there to its then highest level since February just shy of 1.3570, which was past a couple of weeks ago moving to just shy of 1.3650. About a month ago the euro fell strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Looking at the bigger picture the euro spent a lot of August and September trading within a range between 1.32 and 1.34 before recently pushing its range to between 1.3450 and 1.3650. Back in early July the euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there.

Throughout May and most of June the euro surged higher to a four month high above 1.34. Before that in the first half of May, the euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the euro has moved very strongly in both directions. Throughout February and March the euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

european leaders opened a two-day Brussels summit on Thursday with Angela Merkel, the German chancellor, facing stiff resistance to her plan to force structural reforms on the ailing economies of the eurozone. The summit was preceded early on Thursday by EU finance ministers agreeing on a compromise on how to rescue weak eurozone banks, or close down rotten ones. While ministers and senior EU officials hailed the accord as "revolutionary" and "historic", the complicated deal, resisted by Germany, meant there would be no quick leap to a common eurozone system of bailing out bad banks. Germany had resisted key elements of the bank resolution plans for 18 months, but yielded slightly by agreeing to phase in pooled responsibility for the eurozone over a decade from 2015. It foiled French-led attempts to have the eurozone's €500bn bailout fund serve as a "fiscal backstop" for winding up or recapitalising bad banks. "We wanted a backstop," said Pierre Moscovici, the French finance minister. "We are working on its definition, which will evolve over time."

EUR/USD December 19 at 21:50 GMT 1.3664 H: 1.3691 L: 1.3651

During the early hours of the Asian trading session on Friday, the euro is trying to rally a little higher up from the support level at 1.3650 after spending the last 24 hours doing very little. Current range: just above 1.3650 around 1.3660.

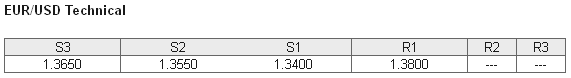

Further levels in both directions:

• Below: 1.3650, 1.3550 and 1.3400.

• Above: 1.3800.

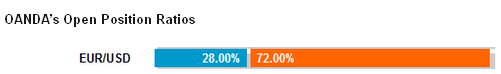

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio continues to sit below 30% as the euro remains above 1.3650. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 09:30 UK Current Account (Q3)

- 09:30 UK GDP (Final) (Q3)

- 09:30 UK Index of Services (Oct)

- 09:30 UK Public Borrowing (PSNB ex interventions) (Nov)

- 13:30 CA CPI (Nov)

- 13:30 CA Retail Sales (Oct)

- 13:30 US Core PCE Price Index (3rd Est.) (Q3)

- 13:30 US GDP Annualised (3rd Est.) (Q3)

- 13:30 US GDP Price Index (3rd Est.) (Q3)

- 15:00 EU Flash Consumer Sentiment (Dec)

- JP BoJ MPC - Overnight Rate (Dec)

- US S&P Index Quarterly Review become effective

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.