- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR Halts Losses On Hopes ECB Will Not Lower Borrowing Costs

The euro halted a loss from yesterday on prospects European Central Bank officials meeting tomorrow will refrain from lowering borrowing costs. The 17-nation currency advanced versus the yen before a report that may show industrial production in Germany, the region’s biggest economy, rebounded in November. There’s not that same concern about the downside risk or a potential contagion, the euro’s not going to be plunging, but there’s no real reason to be overly bullish either. The euro bought $1.3076 after falling 0.3 percent yesterday.

GBP/USD

Take-home pay growth at Britain’s largest publicly traded companies slowed to the least in 21 months in the fourth quarter, reducing Britons’ spending power, Incomes after tax and other deductions rose 0.4 percent from a year earlier, compared with 0.9 percent in the three months through November. A separate British Retail Consortium report today showed shop-price inflation remained at an annual 1.5 percent in December.

The BRC said yesterday that Christmas was “underwhelming” for U.K. retailers, with sales barely rising, and the outlook for 2013 is little better. The pound fell toward the weakest level in a month against the dollar, the pound fell 0.5 percent to $1.6037 after declining to $1.6010 on January 4, the lowest level since December 7.

USD/JPY

The yen gained for a second day versus the dollar, extending a rally from a 29-month low, amid ebbing risk appetite and speculation the currency’s three-month slide already incorporates proposed stimulus measures. The yen gained versus all of its 16 most-traded peers even as Finance Minister Taro Aso said Japan will buy euro-denominated sovereign debt to help weaken the currency.

Yen’s lost about 5 to 7 percent of its value in the last few weeks, we could see just a little bit of unraveling of those positions, where the yen strengthens maybe another 50 to 100 basis points. Then you see the continued devaluation. The yen appreciated 0.8 percent to 87.15 per dollar after sliding on Jan. 4 to 88.41, the weakest level since July 2010.

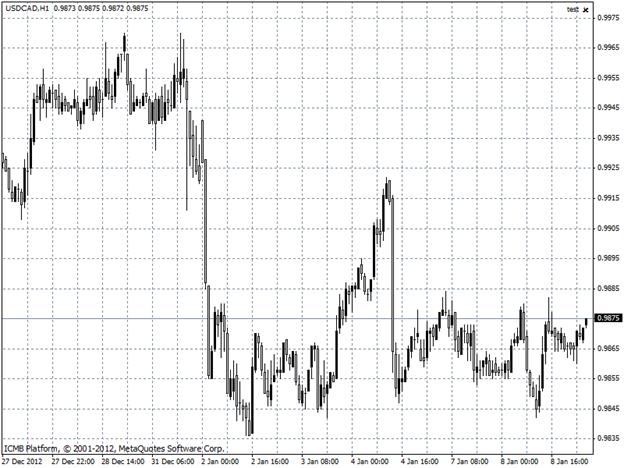

USD/CAD

The Canadian dollar fell against its U.S. counterpart for the first time in three days as global risk appetite declined. The currency erased gains from earlier today as stocks declined and futures on crude oil, the nation’s largest export, slipped. A report tomorrow is projected to show housing starts slowed in December, which may indicate the country’s real estate market is headed for a soft landing.

We had a bid for risk assets and the Canadian dollar overnight, but we’ve since come back, Risk appetite and equities still define the strongest correlation for the Canadian dollar. The loonie fell 0.1 percent to 98.67 cents per U.S. dollar after gaining as much as 0.2 percent. One Canadian dollar buys $1.0135.

Related Articles

Trump confirms 25% tariffs on Mexico, Canada, and a fresh 10% on China GBP/USD struggles as risk-off flows boost the U.S. dollar Core PCE inflation data in focus amid U.S. growth...

The Canadian dollar is calm in the European session, trading at 1.4438, up 0.02% on the day. Later today, Canada releases GDP and the US publishes the Core PCE Price...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.