Yesterday’s quarter four Gross Domestic Product (GDP) numbers from Europe have set the tone ahead of the much-expected G20 meeting. As conventional monetary and fiscal policies have been rendered helpless, the currency solution - such as a currency war or exporting domestic recessions to other countries - is a potential major headache. The most-anticipated event today will be the statement coming from the G20, but it will probably be less important due to its politically correct wording. Mario Draghi, the European Central Bank’s president, speaks at 09:15 GMT and will surely provide headlines for the EUR/USD. The LTRO repayment announcement from the ECB at 11:00 GMT should not move the markets.

Eurozone December Trade Balance (10:00 GMT) Consensus expects a surplus of EUR 12.5 billion (versus November's EUR 13.7bn). Global data improved towards the end of the fourth quarter as the negative effects from Hurricane Sandy and the fiscal talks in the US receded. While the higher exchange rate for the EURUSD had a negative effect on the Eurozone’s external balance, the monthly indicators, especially for Germany, continued their slow upwards march. A trade surplus above expectations would be a positive for the EURUSD, but it should be remembered that Europe’s problems and large regional differences are too large to be simply exported away.

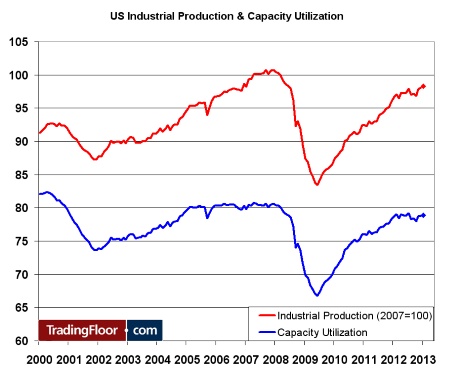

US January Industrial Production (14:15 GMT) Consensus expects a moderate increase of 0.2 percent (against December's 0.3 percent), with Capacity Utilization expected to increase slightly to 78.9 compared with 78.8 in December. Both measures are now getting close to levels last seen just before the housing crisis. While there are no practical limits to the growth of the industrial production, this is a good time to notice that the capacity utilization is naturally capped and approaching the long-term higher end. Traditionally, higher capacity utilization leads to inflationary pressures and pushes companies to increase productivity or invest more in fixed assets. I expect this talk to begin when we hit the 80 mark.

The blogs Econompic and Calafia Beach Pundit had a nice debate back in 2009 on the relationship between inflation and the capacity utilization. The former sees the dependency stronger, with changes in inflation following changes in capacity utilization with a lag of six months, while the latter sees the relationship more complicated. Globalisation (when capacity utilisation is high, production is moved overseas) and a more proactive Federal Reserve (when capacity utilization is high, policy is tightened) are some explanations why the relationship might have broken down. Here's a more formal discussion from the Dallas Fed’s pdf from 1997.

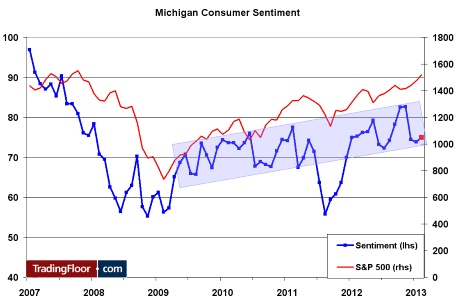

US February Uni. Michigan Sentiment (14:55 GMT) is expected to show a modest increase to 74.8 compared with 73.8 in January. Consumer sentiment is still somewhat depressed by the fiscal issues, but helped by the improved housing and job markets. The divergence between sentiment and the stock market is noticeable – and the two have usually been tightly correlated. The sentiment is still within its recent years’ range, highlighted in the chart. This is the very first data piece for February, so worth watching out for.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EU Trade Balance, US Industrial Production & Consumer Sentiment

Published 02/15/2013, 04:17 AM

Updated 03/19/2019, 04:00 AM

EU Trade Balance, US Industrial Production & Consumer Sentiment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.