Shares of Ensco plc (NYSE:ESV) slipped to a new 52-week low of $6.67 on Sep 13, before closing the day higher at $6.89.

Ensco is a leading supplier of offshore contract drilling services to the oil and gas industry. It is one of the most geographically diverse offshore drilling companies, with operations and drilling contracts in approximately 15 countries on six continents. The company enjoys prominence in nearly every major offshore basin around the world. The markets in which the company operates include the U.S. Gulf of Mexico (GoM), Mexico, Brazil, the Mediterranean, the North Sea, the Middle East, West Africa, Australia and Southeast Asia.

Like its peer, Diamond Offshore Drilling Inc. (NYSE:DO) , Ensco’s most pressing concern is the sharp drop in oil prices and persistently weak commodity price environment. On Sep 13, West Texas Intermediate (WTI) crude slipped more than 3% to the $44.90 a barrel mark. This was owing to a recent projection by The Organization of the Petroleum Exporting Countries (OPEC) and The International Energy Agency (IEA) that oil market will remain oversupplied through 2017.

The prolonged weakness in crude prices has compelled the top energy companies to resort to spending cuts (particularly on the costly upstream projects) due to lower profit margins. This, in turn, means less work for drilling contractors like Ensco.

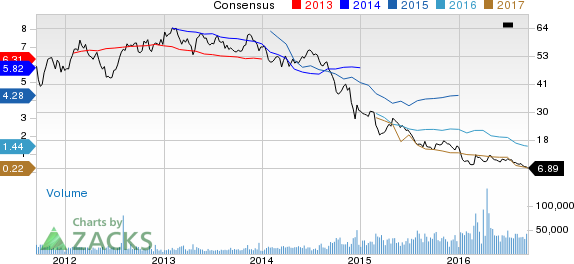

ENSCO PLC Price and Consensus

Moreover, the drilling space is witnessing intense competition, as multiple firms chase a single contract. This excess capacity, in turn, could lead to further lowering of utilization or dayrates.

Also, downward estimate revisions over the last 60 days added to Ensco’s concerns with the stock losing value in the market. Analysts have turned bearish on the company’s growth prospects and are therefore lowering estimates. The Zacks Consensus Estimate for current quarter of this year has moved south to earnings of 13 cents per share from 32 cents over the last 60 days.

Ensco currently holds a Zacks Rank #3 (Hold), which implies that it will perform in line with the broader U.S. equity market over the next one to three months.

Stocks to Consider

Some better-ranked stocks in the broader energy sector are Matador Resources Company (NYSE:MTDR) and NGL Energy Partners LP (NYSE:NGL) , each sporting a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ENSCO PLC (ESV): Free Stock Analysis Report

DIAMOND OFFSHOR (DO): Free Stock Analysis Report

NGL ENERGY PART (NGL): Free Stock Analysis Report

MATADOR RESOURC (MTDR): Free Stock Analysis Report

Original post

Zacks Investment Research