On Aug 19, Zacks Investment Research downgraded Employers Holdings, Inc. (NYSE:EIG) to a Zacks Rank #5 (Strong Sell).

Why the Downgrade?

Employers Holdings witnessed sharp downward estimate revisions after reporting disappointing second-quarter 2016 results. Shares of this accident and health insurer have been on a downtrend, losing 10% since it reported second-quarter results. Given its expected negative earnings growth rates for the upcoming quarters, it has more downside left.

On Jul 27, Employers Holdings reported earnings per share of 45 cents, missing the Zacks Consensus Estimate by 21.05%. Earnings also declined 12% year over year due to higher expenses.

Total expenses in the second quarter increased 6.3% attributable to higher losses and loss adjustment expenses and underwriting and other operating expenses.

New and renewal premiums slightly decreased due to the soft Southern California market.

The second quarter witnessed four large losses amounting to about $4.2 million or 13 cents per share. Employers Holdings’ combined ratio thus deteriorated 250 basis points. Underwriting income deteriorated owing to a higher current accident year loss estimate.

Return on equity also slumped 360 basis points to 12.8 while operating return on equity declined 150 basis points to 6.7%. Cash from operations through the first half decreased 34%.

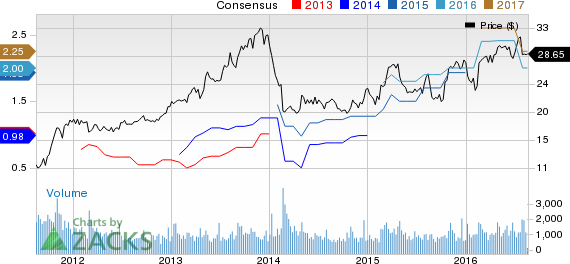

The Zacks Consensus Estimate for 2016 moved down 17% to $2.00 per share as all the estimates were revised down over the last 30 days. For 2017 too, all the estimates were revised down over the same time frame, which dragged down the Zacks Consensus Estimate by 13% to $2.25 per share.

Stocks to Consider

Not all insurers’ stocks are performing as poorly as Employers Holdings. Some better-ranked stocks are Genworth Financial Inc. (NYSE:GNW) , Primerica, Inc. (NYSE:PRI) and Universal American Corp. (NYSE:UAM) , each carrying a Zacks Rank #2 (Buy).

PRIMERICA INC (PRI): Free Stock Analysis Report

UNIVL AMERICAN (UAM): Free Stock Analysis Report

GENWORTH FINL (GNW): Free Stock Analysis Report

EMPLOYERS HLDGS (EIG): Free Stock Analysis Report

Original post

Zacks Investment Research