- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Emerson (EMR) Completes Multi-Year Automation Project For BP

Emerson Electric Co. (NYSE:EMR) recently announced the completion of a $90 million multi-year automation project for BP’s Glen Lyon floating production, storage and offloading vessel, located at Shetland.

Per the contract, BP (LON:BP) is currently leveraging Emerson’s operational support services to attain its target of generating 200,000 barrels per day from the North Sea by 2020. Also, the company has been the main automation contractor for the Glen Lyon. Emerson’s lifecycle services will enable BP to ensure safety and maximize availability, in addition to cutting operating costs.

According to an additional five-year deal, Emerson will also offer operational support services, predictive maintenance technologies and remote monitoring for the Glen Lyon as well as BP’s other North Sea mega project — Clair Ridge — which is expected to come this year. Additionally, Emerson will control BP’s fiscal metering systems on all North Sea assets that are crucial for custody transfer, fiscal accounting and taxation purposes.

Our Take

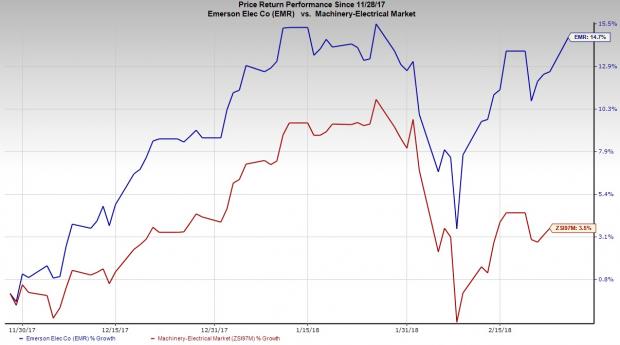

Emerson’s growth momentum is being driven by favorable trends in energy-related, hybrid and general industrial markets as well as strong demand in the HVAC and refrigeration markets. Moreover, the company is well positioned to benefit from global infrastructure growth as its core businesses hold dominant positions in markets tied to energy efficiency and infrastructure spending. In the past three months, this Zacks Rank #2 (Buy) company has returned 14.6%, significantly outperforming the industry’s gain of 3.5%.

Meanwhile, Emerson’s Automation Solutions platform has been witnessing particular momentum in recent times. Strong MRO demand along with small and mid-sized projects, focused on expansion and optimization of existing facilities, has boosted the segment’s top line as well.

Furthermore, the company remains optimistic about the prospects of its Commercial & Residential Solutions segment as it is witnessing improving trends in the United States, Europe and Asian construction markets. For instance, in fiscal first quarter, the company’s Automation Solutions platform reported an impressive 30.8% year-over-year growth. For fiscal 2018, the company expects underlying sales at this segment to grow in the 4-6% range, on the back of a favorable outlook for global demand within its served markets.

Additionally, the company has a solid history of clinching lucrative contracts in the energy infrastructure field that proves to be conducive to its top-line performance. We believe that such lucrative contract wins will remain a key growth driver, going ahead.

Other Stocks to Consider

Some other stocks worth considering from the same space include Applied Industrial Technologies, Inc. (NYSE:AIT) , DMC Global Inc. (NASDAQ:BOOM) and Avery Dennison Corporation (NYSE:AVY) . While Applied Industrial Technologies and DMC Global sport a Zacks Rank #1 (Strong Buy), Avery Dennison carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 10.9%.

DMC Global has outpaced estimates twice in the preceding four quarters, with an average earnings surprise of 19.1%.

Avery Dennison has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 6.8%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Emerson Electric Company (EMR): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

DMC Global Inc. (BOOM): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Original post

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.