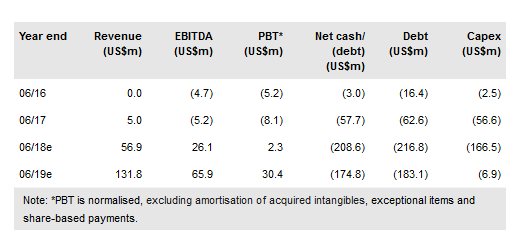

Elk Petroleum's (AX:ELK) acquisition of a 63.7% operated interest in the Aneth Rocky Mountain CO2 EOR project from Resolute Energy transforms the company into one of the largest producers on the ASX. Management forecasts 2018 net production of 11mboe/d. At US$160m, the deal is priced at a discount to our 1P estimate of proven developed reserve value of US$178m (excluding US$23m, which ELK retains in escrow to cover abandonment costs). The Aneth transaction was funded through new equity and debt, with rapid debt paydown expected from Grieve, Madden and Aneth cash flows. We update our valuation to reflect forecast Aneth cash flows, with our NAV rising to $A0.12/share from $A0.09/share.

Aneth adds reserves and production

The Greater Aneth Oil Field is one of the three largest CO2 EOR projects in the US Rocky Mountains, alongside Salt Creek and Rangely; oil initially in place is estimated at 1.5bnbbls (1.15bnbbls currently accessible), with 31% recovered to date. Remaining 2P reserves (net 58.8mmbbls) imply recovery of 37% of accessible volumes. Management sees potential to make modest investments in the asset in order to grow net production from 6mbopd to 11mbopd, with individual projects generating IRRs from 15% to 50%, at the current oil price. Aneth is a significant undertaking with ELK taking on an additional 100 employees/contractors at the asset level and key senior management personnel joining ELK in senior executive roles. The addition of key Resolute personnel should assist during the planned six-month transition period.

To read the entire report Please click on the pdf File Below: