Thursday is a moderately busy day for economic news, including inflation updates for China and the latest on industrial production for Spain. These three releases today also deserve attention: the May edition of the ECB Monthly Bulletin, U.K. industrial production and weekly jobless claims for the US.

European Central Bank Monthly Bulletin (08:00 GMT) In its previous release, the ECB maintained that “a gradual recovery is projected for the second half of this year, subject to downside risks”. The risk side of the equation, it seems, has overwhelmed since that outlook was published, prompting ECB president Mario Draghi and company to cut interest rates last week. It’s too little too late in terms of juicing the Eurozone’s economy for the near term, but the symbolic value of the easing speaks volumes about ECB expectations. Today’s monthly report may further clarify the policy outlook and perhaps offer guidance on the odds for yet another cut at the bank's next monetary announcement, scheduled for June 6.

Pay close attention to how (if?) the ECB updates its inflation view. In the April bulletin, the bank advised that “inflation expectations for the Euro area continued to be firmly anchored in line with the Governing Council’s aim of maintaining inflation rates below, but close to, 2 percent over the medium term”. A month later, that goal has been lost, based on last week’s 1.2 percent flash estimate of Eurozone annual inflation, a sizable drop from 1.7 percent in March and a world below April 2012’s 2.6 percent pace. Disinflation is a real and present danger and it may lead to outright deflation in Europe if the ECB doesn’t take stronger measures to combat the negative momentum. Today’s monthly bulletin may tell us if that’s likely anytime soon.

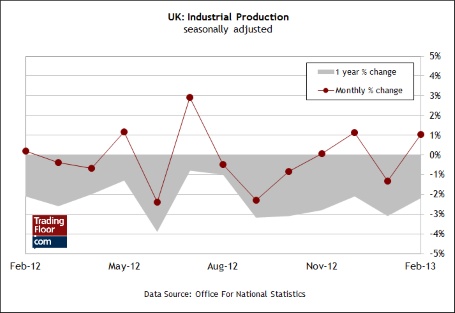

UK Industrial Production (08:30 GMT) No one will confuse Britain’s struggling economy as a poster child for growth, but it’s become fashionable lately to emphasize that the UK still looks pretty good compared with the Eurozone ex-Germany. Last week’s upbeat April report for the Markit/CIPS PMI survey for the country’s services sector didn’t do anything to threaten the relative comparison in favor of Britain. “Growth of business activity was solid and the sharpest for eight months, supported by the strongest rise in new work since last May,” Markit noted.

Does the better-than-expected survey data for services tell us anything about the rest of the economy? Today’s report on industrial production for March may have the answer. In the February release, industrial output rebounded sharply, rising 1 percent. The consensus forecast sees a milder gain of 0.2%, although another monthly increase would further stoke speculation that Britain’s economy is stabilising. In turn, that would strengthen the prevailing view that the Bank of England will leave interest rates unchanged at its monetary policy announcement that’s scheduled for today at 11:00 GMT.

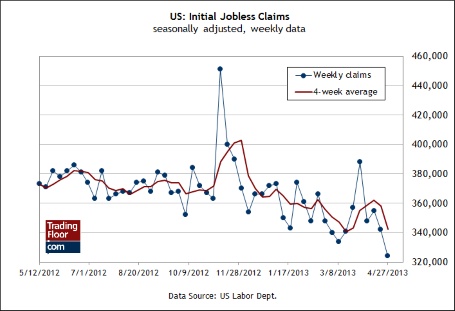

US. Jobless Claims (12:30 GMT) Today’s weekly update on new filings for unemployment benefits will be closely watched for signs that the previous report’s encouraging number -claims dropped to a new five-year low -was more than short-term noise.

If today’s estimate puts claims anywhere near the seasonally adjusted 324,000 reported for the week through to April 27, the case will strengthen for expecting the economy to maintain a modest pace of expansion. In fact, that’s basically what analysts are expecting — the consensus outlook anticipates that claims were 335,000 for last week, or modestly above the previous week's estimate. But weekly claims are a volatile lot and so the possibility of surprise is always lurking for this series. As a result, an especially large increase today, arriving just a week after one of the better reports in recent memory, would receive quite a lot of attention.

Editor's Note: Learn how to profit from the Non-Farm Payrolls Report, one of June's biggest market-moving announcements. Watch expert Steve Ruffley trade the NFP in real time on June 7, 2013 via our Special Live Event. Ruffley has an astounding record of 25 consecutive, profitable sessions during this event, so don't miss this chance to learn how to trade during volatile periods. To find out more, click here.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ECB Bulletin, UK Ind. Pro., US Jobless Claims

Published 05/09/2013, 06:55 AM

Updated 03/19/2019, 04:00 AM

ECB Bulletin, UK Ind. Pro., US Jobless Claims

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.