We issued an updated research report on

Eastman Chemical Company (NYSE:) on Nov 24.

Eastman Chemical saw higher profits in the third quarter of 2017, driven by its cost management actions, disciplined capital allocation and growth of high-margin products. Its adjusted earnings were $2.19 per share for the third quarter, up from $1.86 in the year ago-quarter. Earnings topped the Zacks Consensus Estimate of $2.03. Revenues rose around 8% year over year to $2,465 million in the quarter, beating the Zacks Consensus Estimate of $2,387 million.

Eastman Chemical has underperformed the

industry it belongs to over a year. The company’s shares have gained around 23% over this period, compared with roughly 28.3% gain recorded by the industry.

The company expects to drive growth on the back of innovation and high margin products amid an uncertain global business environment. Eastman Chemical expects adjusted earnings per share growth in 2017 to be toward the top end of the earlier projected range of 10-12% year over year, excluding the financial impact of the Kingsport operational incident.

The company’s Kingsport coal gasification area suffered an operational incident on Oct 4, However, there were no reports of any adverse impact on the environment or on human health. The company noted that all areas of the manufacturing facility have resumed operations with the exception of coal gasification operations. The coal gasification area is expected to be operational by the end of the fourth quarter.

Though Eastman Chemical is still assessing the financial impact of the incident, it is expected to reduce operating earnings to $50-100 million. The company expects costs associated with the incident to be around $100 million in the fourth quarter.

Eastman Chemical remains focused on cost-cutting and productivity actions amid a challenging operating environment. The company’s actions to improve its cost structure is contributing to its earnings growth. It also remains committed to reduce debt.

Eastman Chemical is also gaining from synergies of acquisitions, especially Taminco Corporation. The Taminco acquisition has provided attractive cost and revenue synergy opportunities.

However, the company continues to face pricing pressure. Prices of acetate tow remain weak, hurting the company’s Fibers unit. Hefty charges associated with the Kingsport facility is also expected to weigh on earnings in the fourth quarter. The company is also exposed to raw material pricing headwinds.

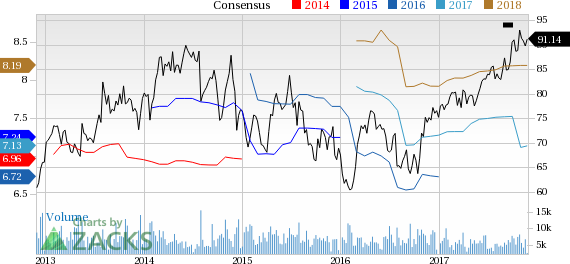

Eastman Chemical Company Price and Consensus

Eastman Chemical Company Price and Consensus | Eastman Chemical Company Quote

Zacks Rank & Stocks to Consider

Eastman Chemical currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Ingevity Corporation (NYSE:) , Koppers Holding Inc. (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 39% year to date.

Koppers Holding has expected long-term earnings growth of 18%. Its shares have rallied 20.8% year to date.

Westlake Chemical has expected long-term earnings growth of 10.6%. Its shares have moved up 68.9% year to date.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.