Dunkin' Brands Group, Inc. (NASDAQ:DNKN) is benefiting from the use of digital technology through DD card, DD mobile app, DD Perks rewards program, On-the-Go ordering and delivery.

In fourth-quarter 2017, the company posted solid results having surpassed the Zacks Consensus Estimate on both earnings and revenues front.

Notably, Dunkin' Brands has also outpaced the consensus mark in three of the trailing four quarters, delivering a positive average earnings surprise of 3.5%. Over the past 30 days, the consensus mark for the current quarter has moved up 2% to 52 cents.

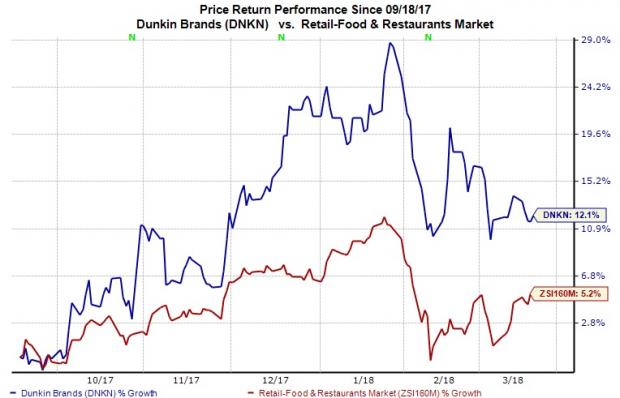

In the past six months, shares of Dunkin' Brands have rallied 12.1%, significantly outperforming the 5.2% gain of the industry it belongs to.

Loyalty Program and Refranchising Boosting Growth

Dunkin' Brands DD Perks Loyalty Program continues to be a major sales driver, primarily backed by the company’s brand recognition. Currently, the program has 8 million members including 2 million that were added in 2017.

Also, it is encouraging customers to use the DD Card and enroll as Perks members so that they can benefit from the convenience offered by the On-the-Go platform. This makes it easier for the company to retain customers. It is using speed of service as a key differentiator against competition to ensure comps growth and store level profitability.

Moreover, re-franchising a large chunk of its system reduces Dunkin' Brands’ capital requirements and facilitates earnings per share growth and ROE expansion. Meanwhile, free cash flow continues to grow, facilitating reinvestment to increase brand recognition and shareholders’ return. Notably, since a major portion of its business is re-franchised, Dunkin’ Brands is less affected by food cost inflation compared to its peers.

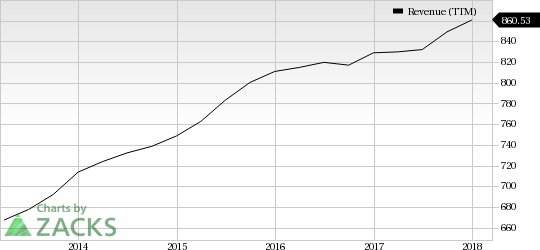

Dunkin' Brands Group, Inc. Revenue (TTM)

Competition and Soft Consumer Spending Remain Woes

Dunkin' Brands is facing competition from larger fast-casual companies, which offer healthier menu options and are gaining popularity. Further, the company’s coffee offerings face intense competition from one of the coffee giants like Starbucks (NASDAQ:SBUX) that boasts a much larger scale of operations. In addition, companies like Jack in the Box (NASDAQ:JACK) and McDonald's (NYSE:MCD) are gaining traction with their breakfast platter, which in turn is weighing on Dunkin' Brands breakfast segment revenues.

Over the past few quarters, weak traffic due to soft consumer demand and sluggish comps growth in restaurants have also affected the company’s performance.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Starbucks Corporation (SBUX): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Jack In The Box Inc. (JACK): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post

Zacks Investment Research