- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Donaldson's (DCI) Earnings & Revenues Beat Estimates In Q1

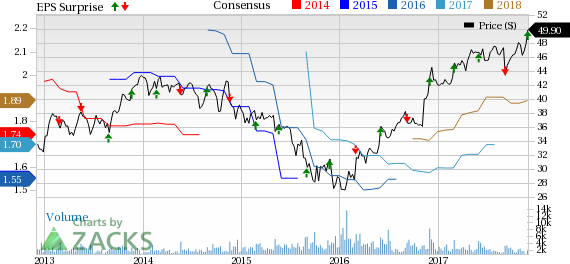

Donaldson Company, Inc. (NYSE:DCI) reported adjusted earnings per share of 46 cents in first-quarter fiscal 2018, which beat the Zacks Consensus Estimate of 42 cents by 9.5%.

The bottom-line figure was even more impressive compared with the prior-year quarter tally of 38 cents, reflecting an increase of 21.1%. Earnings were driven by strong revenues performance and favorable market conditions, particularly in Industrial Filtration Solutions business.

Inside the Headlines

Donaldson reported total sales of $644.8 million, up 16.6% on a year-over-year basis. Also, revenues came ahead of the Zacks Consensus Estimate of $600 million. Strong performance in both the Engine Products and Industrial Products segments drove record first-quarter revenues. Moreover, currency fluctuations and acquisitions resulted in an increase of 1.7% and 1.6%, respectively, in the year-over-year increase in sales.

Revenues at the Engine Products segment recorded an impressive increase of 24.9% year over year to $442.1 million. Three of the four sub-segments under Engine Products — Off-Road, On Road and Aftermarket — recorded a jump in sales, which led to the overall strong performance. Sales in Aftermarket, On-road and Off-Road business increased by 24.7%, 25.6% and 37%, respectively. However, sales in Aerospace and Defense recorded a decline of 0.5%.

Revenues at the Industrial Product segment were up 1.8% year over year to $202.7 million. Sales in Industrial Filtration Solutions and Special Applications business increased by 6.5% and 4%, respectively. However, sales in Gas Turbine Systems declined by 19.1%.

Donaldson’s adjusted operating margin expanded 30 basis points (bps) year over year to 14.1%. Additionally, the company’s Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) were $108.8 million compared with $103.4 million recorded a year ago.

Liquidity & Cash Flow

Donaldson exited the quarter with cash and equivalents of $349.6 million compared with $262.2 million as on Oct 31, 2016. The company had long-term debt of $631.7 million as on Oct 31, 2017, compared with $537.3 million as on Jul 31, 2017.

Share Repurchase Program

During the fiscal first quarter, the company returned $23.4 million to shareholders through share dividends. Additionally, Donaldson repurchased shares worth $42.6 million, which represents 0.7% of its outstanding shares.

2018 Guidance

Concurrent with the earnings release, the company provided guidance for fiscal 2018. Donaldson currently expects fiscal 2018 GAAP earnings in the range of $1.90-$2.04 per share compared with its earlier projection of $1.79 to $1.93. Based on the current market scenario, the company expects a 10-14% year-over-year increase in full-year sales.

In terms of segments, Donaldson projects Engine Products sales to increase in the range of 13-17% compared with the prior year. Growth in Aftermarket, Off-Road, On-Road as well as Aerospace and Defense sales are expected to act as tailwinds for growth in Engine Products.

Donaldson anticipates Industrial Products sales to increase in the range of 4-8% compared with its earlier guidance of flat to up 4% increase, mirroring strong performance from Industrial Filtration Solutions as well as Special Applications.

Conclusion

Going forward, the company believes that strong sales in almost all businesses, including Aftermarket, Off-Road, On-Road and Industrial Filtration Solutions, will continue to act as solid growth drivers. Favorable market conditions, particularly in its Industrial Filtration Solutions business as well as strong momentum in Engine Products segment, are likely to act as tailwinds.

In addition, going forward, this Zacks Rank #2 (Buy) company’s strategic investments in sales-driving initiatives, expanding technology portfolio and strengthening infrastructure bode well. Donaldson is also building an e-Commerce platform, which will enable easier customer engagement. In terms of expansion of core business, the company’s programs in Engine air and liquid market enjoy a win rate of over 75% which has the potential to generate minimum half a billion dollars in future revenues.

This apart, improving operational efficiency through relentless efforts remains one of the main focuses of the company. For instance, the company’s profitability has benefited significantly from restructuring actions that were implemented in the last 12 months. Going forward, ERP implementation is anticipated to improve inventory management, pricing and processes, adding to Donaldson’s strength.

Other Stocks to Consider

Some other top-ranked stocks from the same space include Deere & Company (NYSE:DE) , Briggs & Stratton Corporation (NYSE:BGG) and Acco Brands Corporation (NYSE:ACCO) . While Deere & Company and Briggs & Stratton sport a Zacks Rank #1 (Strong Buy), Acco Brands carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 19.5%.

Briggs & Stratton has outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 8.6%.

Acco Brands has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 81.9%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Deere & Company (DE): Free Stock Analysis Report

Briggs & Stratton Corporation (BGG): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.