- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

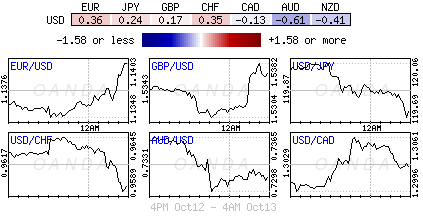

Dollar Takes Beating From Fed Rhetoric

Risk off sentiment currently dominates all asset classes. The overnight mixed China trade report has done little to support more substantial equity gains. The mighty buck and yen are again the favored safe haven currencies, mostly at the expense of high-beta commodity FX pairs (AUD, CAD and NZD). In EM pairs, the market is focusing on SGD ($1.40) ahead of tomorrow’s MAS decision. The Singaporean authorities are poised to ease monetary policy for the second time this year in an effort to revive dwindling growth.

China’s mixed results: Last month’s trade figures showed a seven-month high on terms of trade ($60.3B vs. $48.2B E), but continued declines in exports and imports (putting pressure on stock and commodity markets). The drop in the former was less than expected, while the latter was wider than expected. Shipments to U.S rose, but those to Europe were down marginally and Japan fell by nearly -5%. The People’s Bank of China (PBoC) as expected explained away the exports decline – due to policy and external orders – and added that Q4 will likely see exports return to growth and imports decline to continue to narrow. The PBoC remains cautions, noting that there’s still concern over falling demand in the real economy, with weak demand in credit market severely affecting lending.

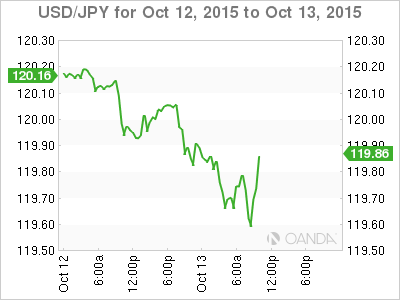

Bank of Japan (BoJ) minutes reveal little: Japan’s Finance Minister Aso maintained an upbeat view on Japan’s economy, noting that there is a trend of “recovery.” September’s minutes (where policymakers cut they assessment on exports and industrial output) were surprisingly neutral, with many members expressing confidence that the +2% inflation target will be achieved. The BoJ added that there’s still a need to maintain QE to help encourage companies to raise wages. The focus now shifts to the October 29 BoJ’s meeting (¥119.64).

Aussie politics plays its part: Aussie NAB business confidence figures printed a three-month high (115) and has managed to recover strongly from Septembers two-year lows mostly in part to “political transition” in the coalition government. Details suggest that Aussie employment is improving, turning positive and is increasing to its highest level in four years. Other particulars suggest that the services sector continues to outperform. The rates market will be focusing on the Reserve Bank of Australia (RBA). Do they have cut on the cards before Xmas? RBA Deputy Governor Lowe indicated that still have flexibility on interest rates if needed, but that domestic fundamentals are strong (AUD$0.7304).

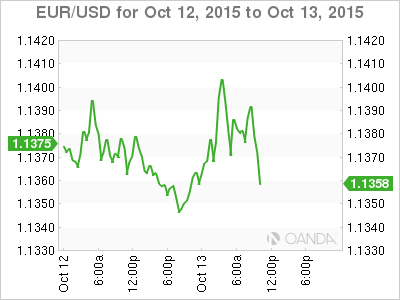

German confidence plummets: Economic confidence in Germany took a hit this month with the ZEW index down to 1.9 vs. 12.1 last month. Most disappointing is the currant conditions index also falling to 55.2 from 67.5. The Volkswagen (DE:VOWG_p) emissions scandal and weaker growth in EM are considered to be the main culprits. Nevertheless, with the domestic economy and eurozone continuing to show signs of economic recovery there is a strong argument that Europe’s strongest economy will avoid sliding into a recession. The Euro continues to flirt with the €1.1400 handle, supported by its elevated safe-haven status and on ECB commentary that more QE is “not” warranted at this time as policy makers believe that regional inflation should pick up by year-end. The same cannot be said for the U.K economy.

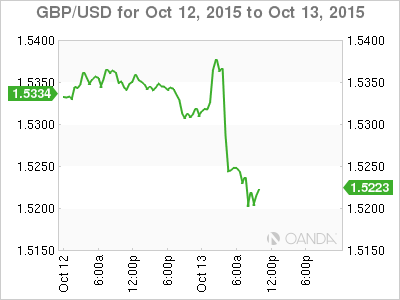

Pound remains under all sorts of pressure: More proof that global expansionary policies are not capable of stoking inflation. Under a year ago the Bank of England (BoE) was expected to be the first of the major CB’s to tighten monetary policy. After todays U.K inflation numbers that seems a distant possibility. Annual inflation has again turned negative for the second time this year, and supports FI dealers that U.K rates will be pegged at lower for longer for the foreseeable future. The BoE’s first-rate hike is being priced in for the end of H1, 2016. Sterling (£1.5205) has dropped just under two big figures after data this morning showed that U.K inflation fell -0.1% m/m in September. However, the BoE’s rhetoric remains the same. Despite inflation remaining close to zero throughout this year, Governor Carney and company believes inflation will rise again towards their mandated +2% target in the medium term. Similar to other CB’s, the MPC is wary of hiking until it knows that the Fed is too. It seems that the markets will need to adjust their definition of ST, MT and LT!

Fed is consistent with its mixed messaging: For Ms. Yellen, it’s like herding cats when its come to providing transparent signals from FOMC members. Yesterday, FOMC member Brainard stated that the Fed should “not” raise rates before global economic conditions improve. He is of the view that the Fed needs to be prudent and take its time. Unlike his colleague Lockhart, who continues to sound more optimistic about a rate hike taking place this year. He stated that the Fed would have more data to evaluate before its December meeting. The failure for the Fed not to communicate a clear message will be expected to pressure the USD even further.

Crude and Bonds suffer same fate: Risk aversion trading and global equities seeing red is again putting pressure on short to medium term yields, specifically in the U.S and Japan. U.S 10-year yields have fallen a tad shy of -5bp from Friday’s close (2.04% vs. 2.09%) as equities struggle. Oil prices (WTI $46.94) are trying to rebound following the positive import numbers out of China; however, investors should expect the longer-term problem of a global glut to continue to act as a resistance into 2016 (IEA sees the market remaining oversupplied next-year). This will not bode well for the loonie bulls in the medium term (C$1.3074).

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

Today marks a further large step into Donald Trump's America First Agenda. Substantial tariffs are being imposed on Canada and Mexico. Additional tariffs have gone in on China....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.