- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar General (DG) Q4 Earnings Beat Estimates, Increase Y/Y

Dollar General Corporation (NYSE:DG) reported better-than-expected fourth-quarter fiscal 2019 results, wherein both the top and the bottom line continued to improve year over year. Also, the company witnessed sturdy same-store sales performance. Impressive performance prompted this Goodlettsville, Tennessee based company to provide decent fiscal 2020 view.

Management stated that as of now it does not expect supply chain disruptions caused by coronavirus outbreak to materially impact fiscal 2020 results.

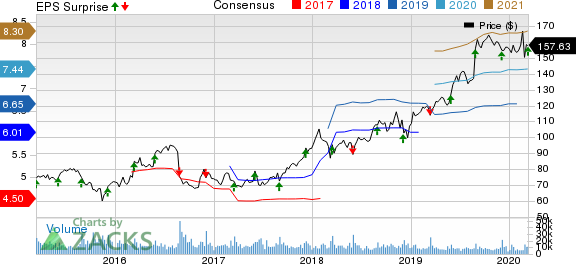

Notably, in the past three months, shares of this Zacks Rank #3 (Hold) company have advanced about 2% against the industry’s decline of 6.4%.

Let’s Delve Deeper

Quarterly earnings came in at $2.10 per share that surpassed the Zacks Consensus Estimate of $2.02 and increased 14.1% from the prior-year period. The year-over-year increase in the bottom line can be attributed to higher net sales and share repurchase activity. Notably, this was the fourth straight quarter of positive earnings surprise.

Net sales of $7,157.6 million increased 7.6% from the prior-year period and came ahead of the Zacks Consensus Estimate of $7,145.9 million for the seventh quarter in row. Contribution from new outlets and same-store sales growth favorably impacted the top line.

Dollar General’s same-store sales increased 3.2% year over year primarily owing to rise in average transaction amount and customer traffic. Consumables, Seasonal, Apparel and Home categories favorably impacted the metric.

Sales in the Consumables category increased 8.4% to $5,471.6 million, while the same in Seasonal category witnessed a rise of 4.3% to $917 million. Home Products sales rose 5.9% to $460.2 million, while Apparel category sales grew 6.3% to $308.9 million.

Gross profit advanced 9.7% to $2,272.8 million, while gross margin expanded 60 basis points to 31.8%. Higher initial markups on inventory purchases and a lower LIFO provision were offset by increase in markdowns as a percentage of sales, higher proportion of sales from Consumables category and increased distribution costs.

Meanwhile, operating income rose 12.9% to $720.9 million, whereas adjusted operating margin increased 47 basis points to 10.1%.

Store Update

During fiscal 2019, the company opened 975 new outlets, remodeled 1,024 stores and relocated 100 stores. In fiscal 2020, the company intends to open 1,000 new stores, remodel 1,500 stores, and relocate 80 stores.

Other Financial Details

Dollar General ended the quarter with cash and cash equivalents of $240.3 million, long-term obligations of $2,911.4 million and shareholders’ equity of $6,702.5 million. The company incurred capital expenditures of $785 million during fiscal 2019. For fiscal 2020, it anticipates capital expenditures in the range of $925-$975 million.

The company bought back 8.3 million shares for $1.2 billion during fiscal 2019. The company intends to repurchase shares worth $1.15 billion during fiscal 2020. The company’s board of directors recently raised the quarterly dividend by 12.5% to 36 cents a share.

Outlook

Management expects fiscal 2020 earnings to increase 10% compared with fiscal 2019 adjusted earnings of $6.73 per share. Dollar General projects net sales growth of 7.5-8% and same-store sales increase of 2.5-3% for the fiscal year.

3 Hot Stocks to Consider

Macy's (NYSE:M) has a long-term earnings growth rate of 12% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Signet (NYSE:SIG) has a long-term earnings growth rate of 8% and flaunts a Zacks Rank #1.

Costco (NASDAQ:COST) has a long-term earnings growth rate of 8.4% and carries a Zacks Rank #2 (Buy).

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Dollar General Corporation (DG): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Signet Jewelers Limited (SIG): Free Stock Analysis Report

Macy's, Inc. (M): Free Stock Analysis Report

Original post

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.