Is Dollar General Corporation (NYSE:DG) part of your portfolio? If not, this is the right time to add the stock as it looks very promising. Moreover, the underlying factors are capable of carrying the momentum further. The stock with a Zacks Rank #2 (Buy) has a long-term earnings growth rate of 14.9%, which highlights its inherent strength. Also, the stock price has surged roughly 29% year to date. We believe that Dollar General offers a sound investment opportunity, as evident from its VGM Score of “A”.

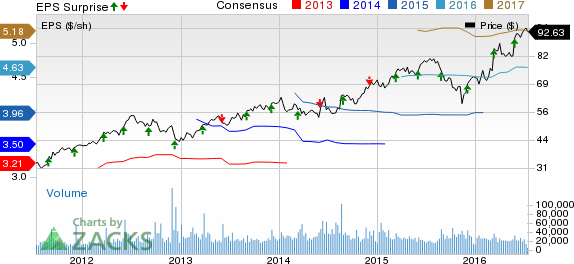

The Zacks Consensus Estimate has witnessed an uptrend over the past 60 days as analysts raised their estimates. Analysts polled by Zacks are convinced about the stock’s upbeat performance. Over the said time frame, the Zacks Consensus Estimate of $4.63 and $5.18 for fiscal 2016 and fiscal 2017 has increased 6 cents and 2 cents, respectively.

Hidden Catalysts

Dollar General continues to witness growth on the back of better price management, merchandise, cost containment and operational initiatives. Moreover, in order to increase traffic, the company has been focusing on both its consumables and discretionary categories. All these endeavors helped Dollar General to post the fifth straight quarter of positive earnings surprise when it reported first-quarter fiscal 2016 results. We believe that the aforesaid initiatives undertaken by the company will drive sales and margin trends.

Other Strategic Endeavors

Notably, the rollout of tobacco has been a key factor in boosting traffic. Also, the company is expanding its cooler facilities to enhance the sale of perishable items, and rolling out the DG digital coupon program. Sales at the consumables division continued to improve in the first quarter of fiscal 2016. Dollar General’s model includes earnings per share annual growth target of 10–15% and net sales increase of 7–10%.

Store Expansion

Dollar General is on a store opening spree. The company opened 700 new outlets and remodeled or relocated 915 stores during fiscal 2014. In fiscal 2015, it opened about 730 new stores, and relocated or remodeled about 881 stores. The company plans to open about 900 new stores and relocate or remodel around 875 stores in fiscal 2016. During fiscal 2017, it intends to open about 1,000 stores and remodel or relocate approximately 900 stores. The company is now focusing on smaller format stores as they require less capital expenditure and will help cope with space constraint.

Other Favorably Ranked Stocks

Apart from Dollar General, there are other stocks too that have advanced at a double-digit rate and carry a favorable Zacks Rank. These include Burlington Stores, Inc. (NYSE:BURL) , ULTA Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) and Wal-Mart Stores Inc. (NYSE:WMT) , all of which hold a Zacks Rank #2 and have surged 57%, 38% and 20%, respectively, so far in the year.

WAL-MART STORES (WMT): Free Stock Analysis Report

DOLLAR GENERAL (DG): Free Stock Analysis Report

ULTA SALON COSM (ULTA): Free Stock Analysis Report

BURLINGTON STRS (BURL): Free Stock Analysis Report

Original post