Wrap Up

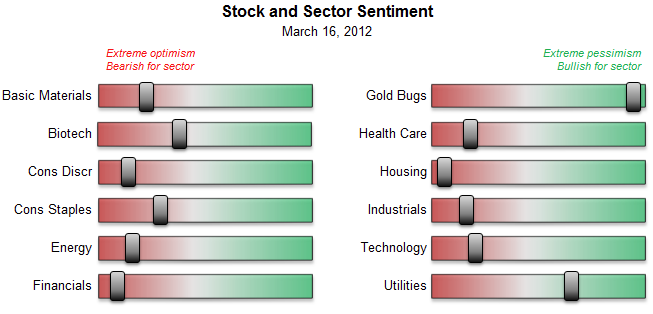

Broad sentiment (per sentimentrader.com data) is over bullish. Does it matter?

Gold stock sentiment is extremely pessimistic (bullish). Does it matter?

Hulbert’s gold sentiment index (of newsletter writers) shows bearishness approaching an extreme even as gold resides well above important support in the 1570’s.

Broad market corporate insiders continue to dump their stock in relentless fashion while various dumb money components remain over bullish, although off the highs after the correction that never really was cleaned out sentiment a couple weeks ago.

These imbalances will be corrected one day.

Meanwhile…

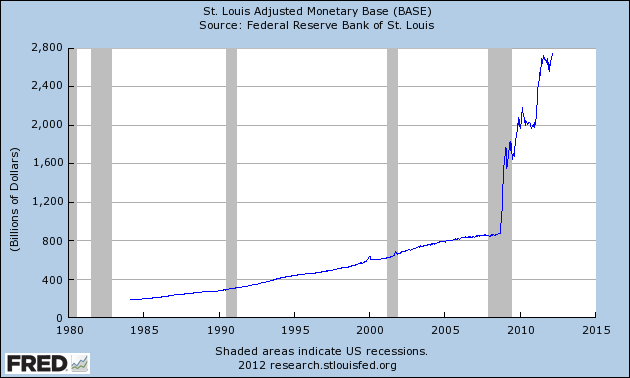

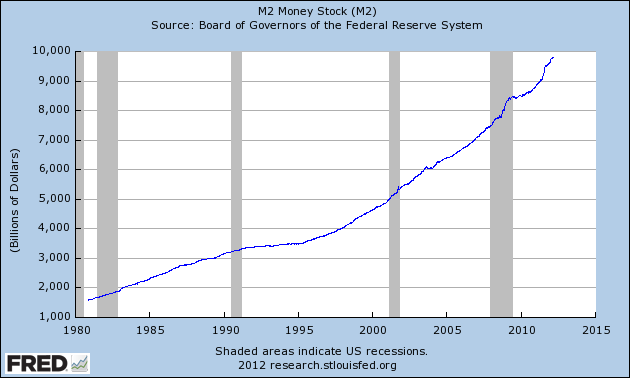

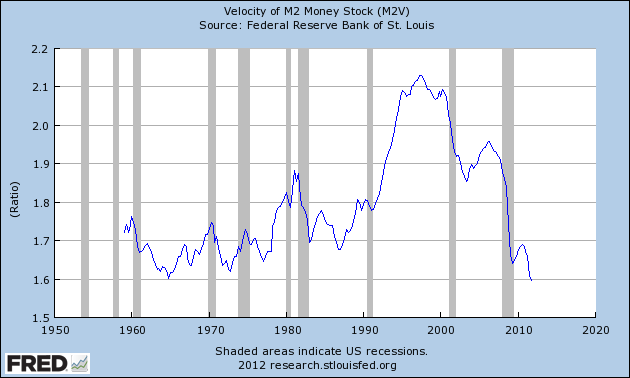

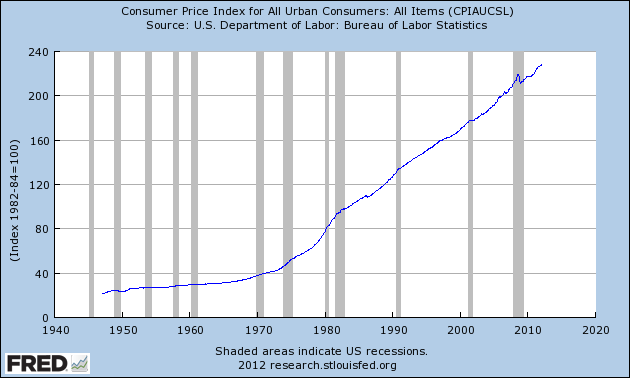

Inflation is not a problem. See, these graphs are offset by the Velocity of Money data that the deflation camp continues to argue, and rightly so.

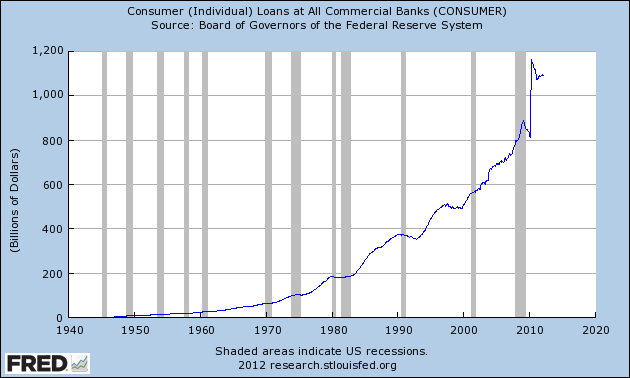

This is a picture of the dreaded beast that the heroic Bernanke continues to fight. This is a picture of a natural system’s ongoing attempt to cleanse itself. Policy makers will not let it do so, as they continue to employ new and unusual methods of trying to trick the public into believing that natural cycles can be remotely managed to any kind of positive outcome.

Rising money supply with still declining money velocity hints at a future of the worst kind; continued inflationary price effects in the things of unlevered value, and price destruction in things lacking unleveraged value.

More items, since I am having fun combing through the St. Louis Fed’s website…

Case closed, only people who like rising prices like strict fiat monetary policy systems.

I have to believe that some sort of neo-socialist disaster response program is behind that flagpole that drove up loans to individual consumers. If they don’t have job security and they are under water on their home, how else can money be getting thrown at them so aggressively?

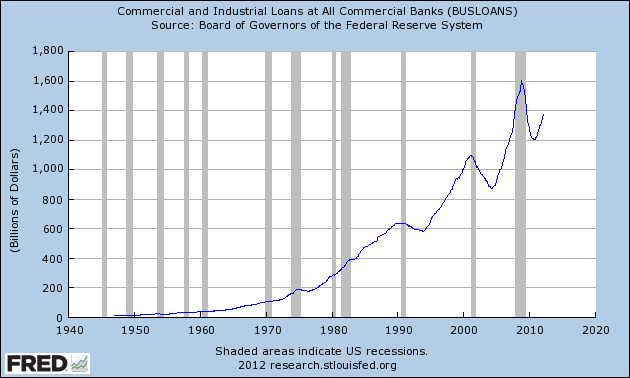

This graph supports a fact we have noted lately that the economy is improving (to some degree) and sales of big ticket capital equipment (machine tools) is relatively brisk of late; business loans are indeed on an upswing, post 2008 disaster. The clock on the 7-year span that separated the last two recessions is now 3 years and counting, with no assurance that it will take 4 more before the coming recession/depression arrives. In fact, with debt and leverage piled ever higher than it was in the quaint old days of Greenspan, I would argue it could come at any time, due to increasing systemic risk. Target is 2013 to 2014.

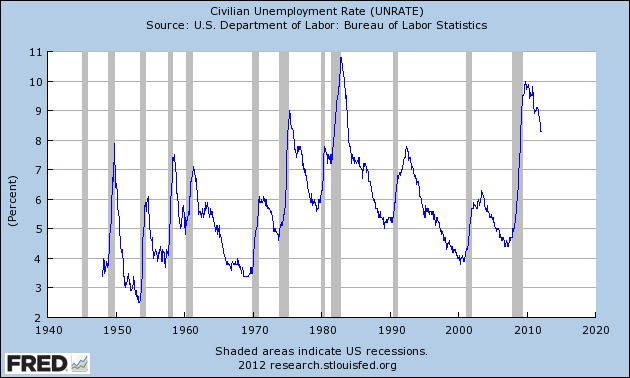

Behold the two massive spikes in the unemployment rate. The early 80’s spike erupted as Paul Volker had committed to taming inflation come hell or high water. Jobs be damned, his Federal Reserve was going to get the inflationary beast that had been systematically killing the economy under control.

The 2008 spike however, came despite years of mostly accommodative and inflationary policy and the credit bubble it activated. This is what happens when people try to ‘manage’ the unmanageable. Near total destruction, which was met by yet more intense inflationary policy. This is Wonderland, not some normal economy, normal financial system or normal policy making.