- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Despite Q3 Misses, American Eagle Is A Strong Value Stock

Shares of American Eagle Outfitters (NYSE:AEO) gained 2.42% on Wednesday despite missing both top and bottom line estimates in its third-quarter.

American Eagle reported Q3 earnings of $0.37 per share, which missed our Zacks Consensus Estimate of $0.39 per share. On top of that, the company’s $960.4 million in revenues missed top-line expectations by almost $5 million. Yet, the clothing company saw its stock price climb.

This movement is due in large part to the fact that American Eagle reported comparable store sales that jumped 3% from the year-ago period. This vitally important metric helped show investors that the company might be headed in the right direction during these changing retail times.

What’s more, American Eagle reported record third-quarter sales. And now the company projects it will post fourth-quarter EPS in the range of $0.42 to $0.44.

More Fundamentals

Looking forward, the company’s sales are expected to grow 4.76% in its fourth-quarter to hit $1.15 billion, based on our current Zacks Consensus Estimates. For the full-year, AEO’s earnings are projected to hit $3.72 billion, which would mark 3.16% year-over-year growth.

These aren’t eye-popping numbers, although they aren’t too shabby for a well-established company such as American Eagle. But what should get American Eagle investors excited is that the company currently offers outstanding bang for their buck at these price levels.

This clothing retailer, which has been a staple at American malls for years, currently rocks an “A” grade for Value in our Style Scores system.

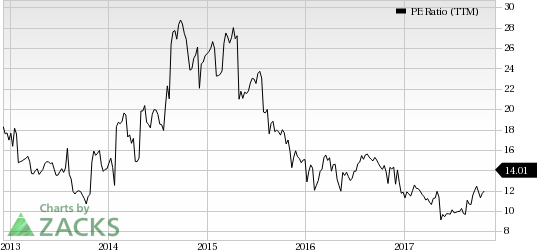

American Eagle is currently trading at just 14.23x earnings, which marks a discount compared to the “Retail – Apparel and Shoes” industry’s average. Furthermore, AEO’s strong P/E ratio crushes its rivals Urban Outfitters (NASDAQ:URBN) and Abercrombie & Fitch (NYSE:ANF) and compares favorably to the S&P 500’s average.

The teen-focused retailer’s 0.78 P/S ratio also helps demonstrate its value for inventors, as they pay less than $0.80 for every dollar of American Eagle sales. The company’s P/B ratio of 2.54 is also solid compared to some of its biggest competition.

American Eagle is currently a Zacks Rank #2 (Buy) and rocks an overall “A” VGM Grade, which is bolstered by its “B” Momentum grade in our Style Scores system. Shares of American Eagle have soared 26.16% in the last four weeks alone.

Better yet, even with today’s gains, shares of American Eagle rest over 10% below their 52-week high. This means that the retailer still has room to climb without the added burden of having to break into a new range.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.