- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Campbell Down 10% In A Month: Can It Overcome Industry Woes?

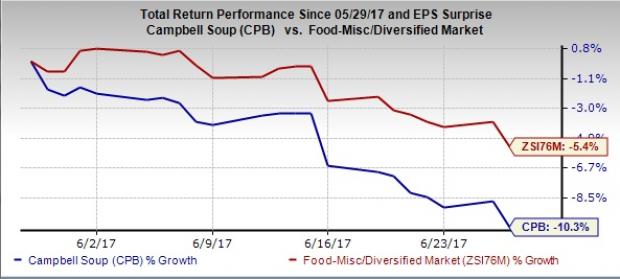

Campbell Soup Company (NYSE:CPB) has been losing investors’ confidence of late. Shares of this premium food products provider have plunged 10.3% in the last one month, compared with the Zacks categorized Food – Miscellaneous/Diversified industry’s drop of 5.4%. The company has been bearing the brunt of a challenging macroeconomic scenario in the food industry, which was also the primary reason behind its dismal third-quarter fiscal 2017 performance that was reported little over a month back.

Nevertheless, this Zacks Rank #3 (Hold) company has been striving to revive performance through its focus on strategic imperatives and robust cost savings plan.

Stock Falls Prey to Industry Headwinds

The food industry business has been grappling with headwinds like food deflation, stiff competition, and aggressive promotional environment of late. Traditional grocery rivals are strengthening their franchises and outside players are offering alternative outlets for food and other staples. Ranked among the bottom 39% of over 250 Zacks industries, the Food – Miscellaneous/Diversified industry has also lagged the broader market over the last one month. This is evident from the chart below.

.jpg)

While food and beverage is one of the most attractive and largely profitable markets in the world, it remains vulnerable to alterations in consumers’ tastes and preferences, worldwide demographic changes and the adverse effect of technological advancements. Unfortunately, Campbell fell prey to these headwinds that plagued the industry in the third quarter.

The industry was troubled by a general softness in the consumption patterns. Notably, consumer spending grew at its lowest rate in about eight years, during Campbell’s last reported quarter. This largely hampered the company’s top line. Moreover, results were marred by continued competition from the rising e-Commerce trends – a major retail hurdle that is expected to linger and pressurize grocery and mass networks.

Dismal Q3 Hurts the Stock

The aforementioned obstacles and lingering softness in Campbell-Fresh (C-Fresh) division, weighed upon the company’s third-quarter fiscal 2017 performance. Both the top and bottom line declined year over year, alongside missing the Zacks Consensus Estimate. As mentioned above, results were also hurt by continued softness in C-Fresh, which stemmed from lingering constraints from the Bolthouse Farms Protein PLUS drinks recall made in Jun 2016. While the company has been undertaking various initiatives to revive C-Fresh’s performance, management continues to expect capacity constraints through the final quarter, which we believe is likely to hurt the overall top line.

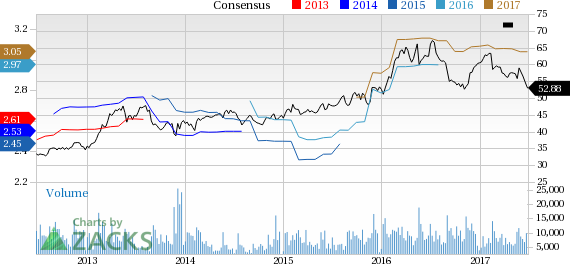

Given these factors, and a tough operating environment, management lowered its fiscal 2017 sales outlook, anticipating sales growth to range from negative 1% to flat, compared to the old forecast of flat to a 1% increase. Since the outcome, Campbell’s shares have tumbled 7.1% on the index.

Can the Growth Strategies Provide Respite?

Talking of strategic imperatives, Campbell is on track with its four key plans aimed to achieve profitable and sustainable growth. The company intends to raise its level of transparency about the food that it produces and the ingredients used. Next, with respect to portfolio diversification, Campbell aims to focus on packaged fresh innovation, alongside enhancing organic and clean label product portfolio in center store. The company revealed plans to particularly invest in Campbell Fresh products. Thirdly, the company’s shift toward advertising via mobile and digital devices highlights its focus on development of digital and e-Commerce capacities. Finally, Campbell unveiled intentions to strengthen the presence of its growing snacks brands across geographies, mainly in the Asian region.

Moving to cost savings, Campbell is progressing well with its plan, which was announced in fiscal 2015. The company’s strategy of concentrating on supply chain efficiencies, along with curtailing costs and reinvesting part of these savings in areas with high growth potential is likely to drive growth. Gaining from the solid progress on this front, the company anticipates cost savings worth $450 million by fiscal 2020-end. In this regard, Campbell generated savings of $20 million in the third quarter, which fared better than management’s expectations. Also, this took the company’s total savings to $295 million, as of May 19. Despite an overall drab quarter and curtailed sales view, management raised the lower end of its EPS and EBIT projections for fiscal 2017, reflecting confidence in its ongoing cost-savings program.

We believe that all these factors, along with focus on achieving growth via acquisitions and introduction of innovative products, reflect Campbell’s commitment toward establishing a differentiated and significant position in the consumers’ community and the food industry. So, let’s see if these solid growth strategies can boost the company’s performance and help its stock revive.

3 Key Picks in Campbell’s Space

Even amid this difficult landscape, investors can place safe bets on better-ranked stocks like Nomad Foods Limited (NYSE:NOMD) , SunOpta, Inc. (NASDAQ:STKL) and B&G Foods, Inc. (NYSE:BGS) .

Nomad Foods has seen its earnings estimates for 2017 trend upward in the last 30 days. Also, the stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SunOpta, flaunting a Zacks Rank #1, has long-term earnings per share growth rate of 15%.

B&G Foods, with long-term earnings per share growth rate of 10%, carries a Zacks Rank #2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Campbell Soup Company (CPB): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

SunOpta, Inc. (STKL): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.