- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Darden (DRI) Q3 Earnings Top, View Withdrawn Due To Coronavirus

Darden Restaurants, Inc. (NYSE:DRI) reported third-quarter fiscal 2020 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate. The company reported better-than-expected earnings for the fifth straight quarter. Despite reporting robust results, the company’s shares are down 7% in pre-market trading session as it withdrew outlook and suspended dividends due to the coronavirus outbreak.

In the quarter under review, adjusted earnings came in at $1.90 per share, which outpaced the Zacks Consensus Estimate of $1.88. The bottom line also improved 5.6% year over year. Earnings were aided by the company’s relentless efforts to augment the basic operating factors of the business — food, service and ambiance.

Total sales of $2,346.5 million beat the consensus mark of $2,322 million. Moreover, sales improved 4.5% from the prior-year quarter driven by the addition of 40 net restaurants and an improvement of 2.3% in blended comps.

Sales by Segments

Darden reports business under four segments — Olive Garden, LongHorn Steakhouse, Fine Dining that includes The Capital Grille and Eddie V's, and Other Business.

Sales at Olive Garden increased 3.5% year over year to $1,169.3 million. Comps grew 2.1% at the segment, higher than the prior-quarter’s comp growth of 1.5%. Traffic increased 0.2%. Pricing improved 1.8% and menu-mix increased 0.1%.

Sales at Fine Dining improved 8% to $188.4 million. Comps at The Capital Grille climbed 4.2% compared with growth of 1.8% in second-quarter fiscal 2020. Further, Eddie V's reported comps growth of 3.9%, higher than 0.5% improvement in the prior quarter.

Sales at Other Business grew 4.3% year over year to $478.1 million. Moreover, comps at Seasons 52 rose 3% in the reported quarter against a comps decline of 3.5% in the prior quarter. Comps at Yard House inched up 1.8% compared with 0.7% increase in the previous quarter. However, comps slipped 0.5% at Bahama Breeze compared with a decline of 3.4% in the preceding quarter.

At LongHorn Steakhouse, sales advanced 5.7% to $510.7 million. Comps at the segment increased 3.9%, compared with comps growth of 2.6% in the year-ago quarter. Traffic improved 1.6%. Further, pricing and menu mix grew 1.9% and 0.4%, respectively.

In the reported quarter, comps at Cheddar's decreased 1.6% compared with a decline of 1.2% in the prior-year quarter.

Operating Highlights & Net Income

In the fiscal third quarter, total operating costs and expenses increased 4.4% year over year to $2,068.2 million. The rise can be attributed to an overall increase in food and beverage costs, restaurant expenses, and labor costs.

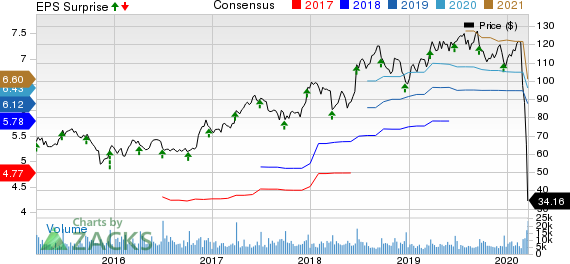

Darden Restaurants, Inc. Price, Consensus and EPS Surprise

Balance Sheet

Cash and cash equivalents as of Feb 23, 2020, totaled $321.7 million, down from $457.3 million as of May 26, 2019.

Inventories totaled $229.6 million at the end of the reported quarter. Long-term debt as of Feb 23, 2020, was $928.5 million, up from $927.7 million as of May 26, 2019.

During the fiscal third quarter, Darden repurchased approximately 0.6 million shares of its common stock for roughly $69 million.

Withdraws Fiscal Outlook

Due to coronavirus outbreak the company has withdrawn 2020 guidance. The company announced for the fourth quarter to date through Sunday, Mar 15, sales declined 5.9%. Moreover, in the first three weeks of the quarter, same-restaurant sales were up 3%, down 2% and 20.6%, respectively. The company has also suspended the quarterly cash dividend.

Zacks Rank & Key Picks

Darden has a Zacks Rank #4 (Sell). Some better-ranked stocks worth considering in the same space include Chipotle Mexican Grill, Inc. (NYSE:CMG) , Domino's Pizza, Inc. (NYSE:DPZ) and Brinker International, Inc. (NYSE:EAT) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chipotle Mexican Grill, Domino's Pizza and Brinker International have an estimated long-term earnings growth rate of 19.3%, 13.4% and 6.5%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Brinker International, Inc. (EAT): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.