- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Daily Currency Outlook: USD/CAD And EUR/CHF : May 25,2018

USD/CAD Daily Outlook

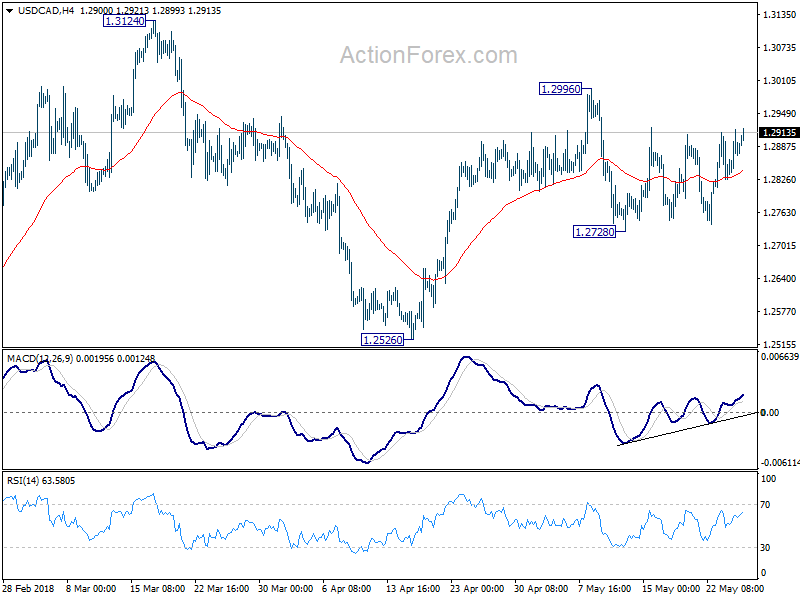

Daily Pivots: (S1) 1.2788; (P) 1.2856; (R1) 1.2905;

Intraday bias in USD/CAD remains neutral as it’s bounded in range of 1.2728/2996. We’d maintain our view that price actions from 1.3124 as a corrective move that could be completed at 1.2526 already. Break of 1.2996 will turn bias to the upside and extend the rise from 1.2526 to 1.3124 key resistance next. However, break of 1.2728 will dampen this bullish view and bring deeper fall back to 1.2526 and possibly below.

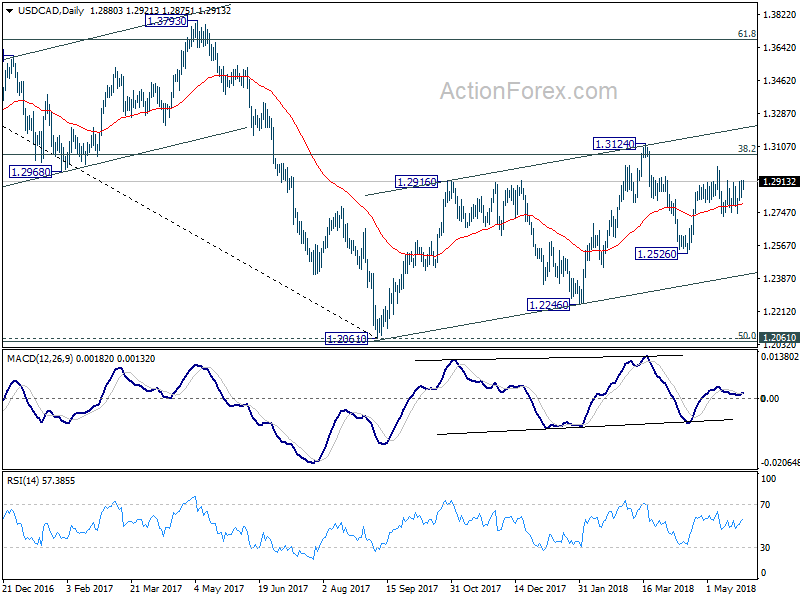

In the bigger picture, we’re favoring the case that that rebound from 1.2061 has not completed yet. Focus is back on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048.

EUR/CHF Daily Outlook

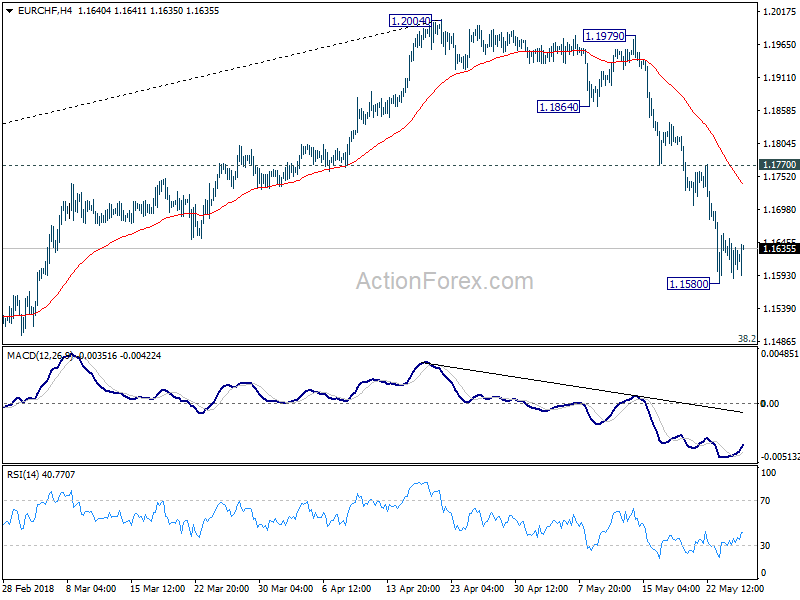

Daily Pivots: (S1) 1.1583; (P) 1.1624; (R1) 1.1660;

A temporary low is in place at 1.1580 and intraday bias is turned neutral first. Some consolidation would be seen in EUR/CHF but deeper fall is expected as long as 1.1770 resistance holds. Below 1.1580 will target key support level at 1.1445. We’d expect strong support from there to bring rebound, at least, on first attempt. Meanwhile, firm break of 1.1770 will suggest that the pull back from 1.2004 is already completed and turn bias back to the upside for stronger rebound.

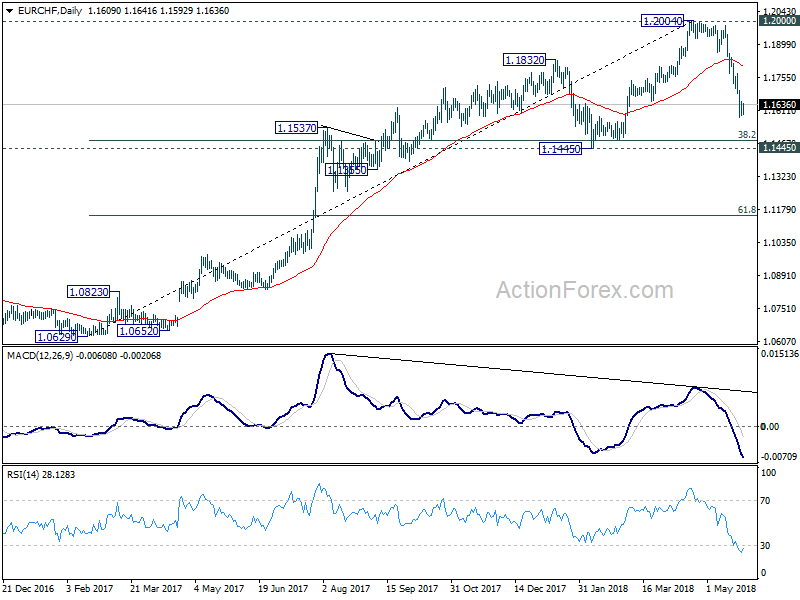

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 could be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Hence, for now, deeper fall could be seen back to 1.1445, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern.

Related Articles

The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure. Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish...

U.S. economic growth fears mount as data disappoints, weighing on USD European data surprises fuel optimism, boosting EUR/USD Bond markets signal diverging growth outlooks for...

CHF/JPY Forex Strategy is Bearish: We are currently @ 166.78 in a range. If we can break slope support, we are looking for a continuation to the ATR target @ 165.97 area, with a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.