- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Currency Markets In Flux

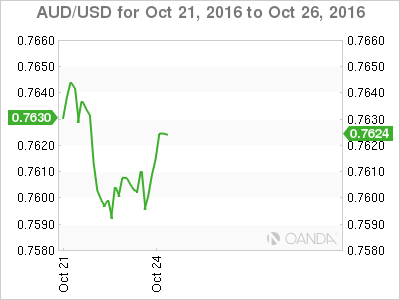

Australian Dollar

The broader risk-off move that kicked in late last week has triggered currency sell-off in the EM complex while weighing negatively on risk currencies such as the Australian dollar. Add in the greenback flexing its muscle on the back of mounting US rate hike speculation, and it’s clear why the Aussie is struggling near .7600 this morning. However, the Aussie is by no means out of the woods as there could be more pain delivered from this week’s Q3 CPI print that could impact the odds of an RBA rate cut. The tail risk is that a weaker CPI will cause a deeper re-pricing on RBA rate cut expectations, which would add further pressure to a reeling Aussie dollar.

While the RBA have emphasised the importance of the national CPI data, the expectation for a tepid print is running low on last week’s stronger-than-expected CPI data in New Zealand. So unless there is a major shocker to the downside, given the very limited expectations for any imminent change to RBA policy, the Aussie dollar should overcome this near-term hurdle.

RBA Governor Lowe said that “recent data suggest that the economy is adjusting reasonably well and he is watching employment and stability of financial system when setting rates. He said that inflation expectations have declined, but not at unprecedented lows; there is a need to guard against inflation expectations falling to land:”. My take is Dr Lowe is adopting Glenn Stevens moniker as the reluctant cutter, in the sense that interest rates are already accommodative and there is little economic benefit gained by lowering rates at the risk of creating financial instability.

Regardless of subtle shifts in the domestic economic landscape International events, primary the US interest rate curve, and the US election premium will continue driving Aussie dollar sentiment. Currently, the US dollar is king as investors increase wagers on the likelihood the Federal Reserve Board are preparing to raise rates in December. And while we’re entering a period of broader consolidation the potentially high volatility US election tail risk could be a massive game changer.

In early trade, the Aussie sits perched just above the .7600 level

US Election Tail Risk

With three weeks to go, we are counting down to US Elections Day. Although polls have shown Democrat candidate Hillary Clinton to be consolidating a lead in polls over Donald Trump, there are two main tail risks surfacing.

A) The polls are completely wrong, and Trump wins. A massive equity rout ensues, and a gold rally takes off, with typical safe haven assets flourishing

B) Clinton’s lead widens and consolidates closer to the election, resulting in the Democrats winning the House, which guarantees big fiscal spending, creating inflation, inducing a US bond market to sell off

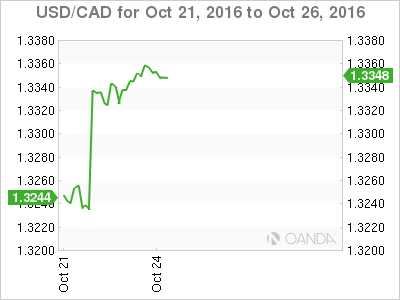

Canadian Dollar

While Friday’s CPI release was in line, Canada retail sales for August moved into negative territory at -0.1% m/m versus +0.3% expected, was especially painful for the ‘loonie’. If Governor Poloz needed any further read on the economy to justify a rate cut, Friday’s horrendous retail sales print likely sealed that deal. We should expect mounting pressure on CAD, and if the OPEC deal falls flat, the Canadian dollar could be in a world of pain. We’re seeing early pressure on WTI oil this morning, which is spilling in the CAD, pushing against the key 1.3350 level.

The Canadian dollar continues getting knocked around by oil price volatility. On Friday, Oil prices were erratic as weekend risk mounted, with Russian and Saudi oil ministers scheduled to meet Saturday and Sunday. Despite there not being any major news from the meeting, there have been mounting calls for non-OPEC support from both Iran and Venezuela, suggesting that Russia and non-OPEC member co-operation is needed for this production cut to stick. Venezuelan President Nicolas Maduro even suggested that the US should be invited to the output meeting, realising that without the US shale producers on board, supply concerns are likely to linger.

Outside of inventory and Baker Hughes-influenced price zig zags, we should expect oil markets to remain in a holding pattern between now and November’s OPEC meeting.

In the absence of any substantial production cut news, near-term price movement is influenced by broader USD moves, especially with the greenback showing some muscle these days.

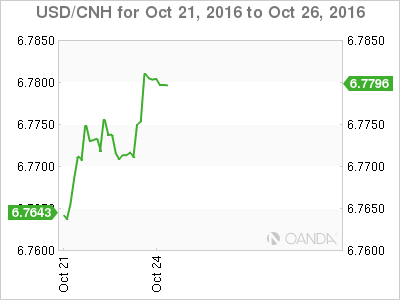

China and Asia EM

As if on cue, post-SDR, after a quiet quarter on the news front, the local market was side swiped by bad news: mounting inflationary pressure (PPI), horrible exports (Trade Data) and the ever expanding probe, with local investors scurrying for US dollars as a hedge and equity exposure in Hong Kong

On Friday, the Yuan fell to a six-year low as the PBOC apparently signaled a green light (weaker Fix) for further Yuan depreciation amid broader USD strength and the collapse in exports.

After a midweek breather on the back of solid China data, EM Asia fell under modest pressure to end the week as the CNY fixing broke through 6.75 and USD/CNH traded to fresh year highs.

While the drop in the Euro after the ECB meeting was the primary driver, capital outflow likely exacerbated the frenzy. With year-end dollar demand pressure mounting, traders and hedgers alike will be watching this week’s PBOC fixings for any signs of intervention, especially with the Six Plenum taking centre stage on the mainland.

I think the general Asia-basket will suffer near term as Fed rate hike expectations mount, but with the added China risk premium, USD Asia currencies that are more sensitive to China currency policy, like the SGD, will underperform the carry oriented pairs like the IDR and INR.

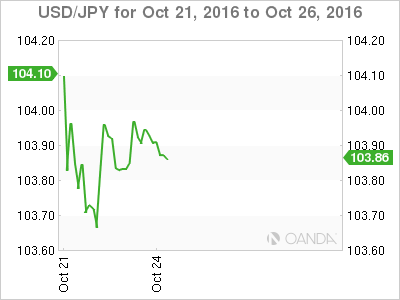

Japanese Yen

The USD/JPY continues trading off the US curve. While there has been some BoJ tapering, comments in the press have kerbed USD/JPY momentum higher and there is little desire to push USDJPY lower given the broader USD strength. JPY remains gridlocked, and a bit of a sideshow, as the focus remains on euro, EM and the Commodity Complex.

The probability of a Fed rate hike is now priced in at 70%. It is hard to see the USD/JPY making much headway above 105 at this stage as we are more likely to see exporter offers layered between 104 and 105, providing additional topside resistance.

On the data front, JAPAN OCT PRELIM PMI MANUFACTURING: 51.7 V 50.4 PRIOR; 2nd straight month of expansion; 9-month high– SourceTradeTheNews.com but there has been little follow through on the data print as focus remains on external drivers.

Japan’s exports fell for the 12th consecutive month, but less than traders feared, but still highlights the nation’s economic woes amidst a stronger YEN. Market impact was muted

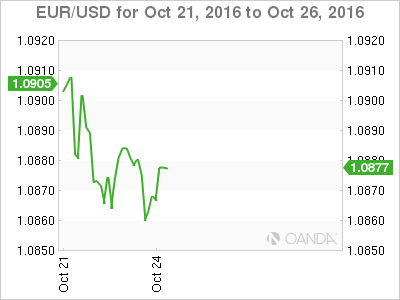

ECB and the EURO

While the debate will rage on about the QE extension until the December ECB meeting, traders have already voted that more Euro easing is coming, as the Euro trades at sub 1.09. In the wake of the ECB announcement, dealers that were hedged for an ECB taper quickly headed for the exit rows, with new Euro shorts getting positioned in anticipation of a Fed rate hike, amidst the heightened risk of European financial instability.

Fed Speak

Extremely light Global economic calendar today so traders attention will turn the 4 Fed speakers, with two voting members -- Dudley and Powell -- as well as a 2016 voter Bullard and a 2017 voter Evans taking to the airwaves . With the market pricing in a stronger possibility of a Fed hike, investors will look for further affirmation the December hike is on a course. Both Dudely and Powell are speaking of the US Treasury market, but Q&A sessions may generate some mention on Monetary Policy.

Malaysian Ringgit

Opposition lawmakers walked out as Prime Minister Najib Razak unveiled a 2017 national budget Friday that is up 3.4% from this years. Mr, Najib made no reference to the state investment fund 1Malaysia Development Bhd, which frustrated opposition members. However, with no real surprise in the Budget, we’re likely to see the MYR trade on broader US dollar moves. However, in the face of the resurgent Greenback and weaker commodity prices, the MYR is showing some bravado with GDP predicted to fall between 4 and 5 % in 2017. Although interest differentials will work against the MYR short term when the Fed hikes in DEC, Malaysian growth differentials should continue attracting foreign investors and should support the MYR medium term.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.