- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CSX Hits 52-Week High On Several Tailwinds, 2017 View Upbeat

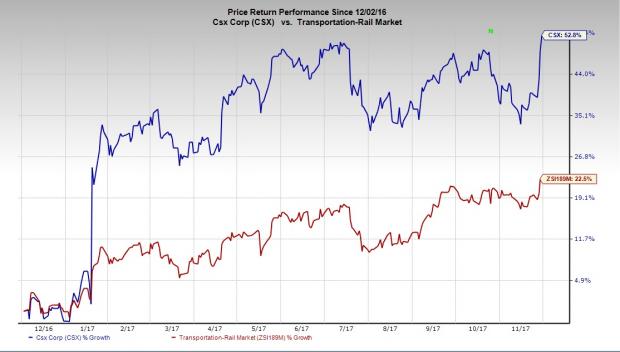

CSX Corporation (NASDAQ:CSX) hit a 52-week high of $56.17 per share during the trading session on Nov 30, before retracing a bit to close the session at $55.75. Notably, the company’s shares have performed very well in a year. The stock has surged 52.8%, comfortably outpacing the industry’s gain of 22.5%.

Catalysts Behind the Upsurge

The precision scheduled railroading model adopted by CSX’s CEO Hunter Harrison to improve its efficiencies has helped the company make a substantial progress over the last few months. Evidently, its third-quarter 2017 earnings improved 6.3% year over year. Revenues in the period too rose owing to core pricing gains. The 10% increase in coal revenues is also encouraging.

The company’s 2017 outlook is impressive as well. Driven by improved efficiencies, the company expects its bottom line to expand between 20% and 25% in 2017 on a year-over-year basis. Operating ratio is expected in the high end of mid-60s in 2017. Additionally, the company expects free cash flow before dividends (excluding restructuring costs) of around $1.5 billion in the year.

The company has been making continued efforts to improve efficiency. To this end, it has laid off more than 2,000 employees so far this year. The workforce is further expected to be trimmed by the year-end.

CSX’s efforts to reward shareholders through dividend payments and buybacks also raise optimism in the stock. The company had earlier announced an 11% dividend hike in 2017. The new quarterly dividend is 20 cents a share. Further, the company has bought back shares in excess of $1.3 billion so far this year.

Zacks Rank & Key Picks

CSX carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Transportation sector are Gol Linhas Aereas Inteligentes S.A. (NYSE:GOL) , International Consolidated Airlines Group (LON:ICAG) SA (OTC:ICAGY) and SkyWest, Inc. (NASDAQ:SKYW) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Gol Linhas, International Consolidated Airlines and SkyWest have surged more than 100%, 57% and 42%, respectively, in a year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY): Free Stock Analysis Report

CSX Corporation (CSX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.