WTI crude is slightly lower on Tuesday, as crude futures trade at $36.36 per barrel in the North American session. In economic news, there is just one minor release on the schedule, Total Vehicle Sales. On Wednesday, the US will release the FOMC minutes of its December policy meeting as well as ADP Nonfarm Payrolls. The markets will be paying close attention to both of these market-movers.

Crude has endured a tough start to the New Year, having fallen 3.4 percent since Monday. Much of the drop can be traced to a disappointing reading from Chinese Caixin Manufacturing PMI. The key indicator slipped to 48.2 points in December, short of the forecast of 48.9 points. The index managed to break above the 50-point level only once in 2015, pointing to ongoing contraction in the Chinese manufacturing sector. China boasts the world’s second-largest economy, so signs of a continuing slowdown has sent investors scurrying to the safe-haven US dollar, at the expense of commodity-based currencies as well as crude oil. Earlier in the week, oil prices briefly moved higher, after Saudi Arabia cut diplomatic relations with Iran following the execution of a cleric which led to the ransacking of the Saudi embassy in Tehran. However, fundamentals have outweighed geopolitical concerns, leaving crude oil prices under strong pressure.

The US economy heads into 2016 in good shape, and received a crucial vote of confidence from the Federal Reserve, which raised interest rates just before the end of the year. At the same time, certain sectors have lagged behind the recovery, such as the manufacturing industry. Recent manufacturing releases have missed expectations, and the negative trend continued on Monday. ISM Manufacturing PMI, a key indicator, slipped to 48.2 points, well short of the forecast of 49.1 points. This weak reading is raising concerns, since it marks back-to back releases below the 50-point level, which separates expansion from contraction. It is also the sixth consecutive month that the PMI has softened. As well, ISM Manufacturing Prices dipped to 33.5 points, well below expectations.

WTI/USD Fundamentals

Tuesday (Jan. 5)

- All Day – US Total Vehicle Sales. Estimate 18.1M

*Key releases are highlighted in bold

*All release times are GMT

WTI/USD for Tuesday, January 5, 2016

WTI/USD January 5 at 16:30 GMT

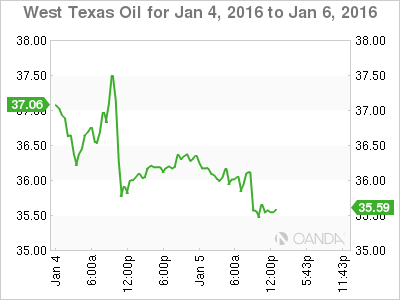

- WTI/USD 36.36 H: 37.09 L: 36.06

WTI/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 30.00 | 32.22 | 35.09 | 37.75 | 39.87 | 42.59 |

- Crude was uneventful in the Asian and European sessions, and has posted slight losses in North American trade.

- 37.75 remains a resistance line

- 35.09 is providing support

Further levels in both directions:

- Below: 35.09, 32.22 and 30.00

- Above: 37.75, 39.87, 42.59 and 44.01