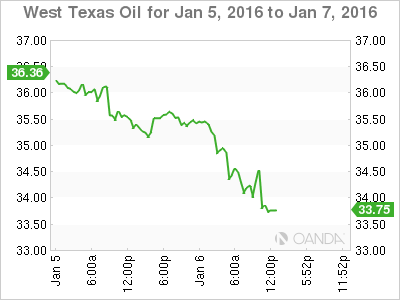

WTI Crude is sharply lower on Wednesday, as crude futures trade at $34.60 per barrel in the North American session. On the release front, ADP Nonfarm Payrolls was outstanding, posting a gain of 257 thousand. There was more good news from the US Trade Balance, which beat the estimate. However, the ISM Non-Manufacturing PMI missed the estimate. Later in the day, the Federal Reserve releases the minutes of its December policy meeting.

Crude oil is in trouble, as prices have plummeted in the New Year. The commodity has lost over 8 percent of its value so far this week. Crude’s troubles started with a disappointing reading from Chinese Caixin Manufacturing PMI. The key indicator slipped to 48.2 points in December, short of the forecast of 48.9 points. The index managed to break above the 50-point level only once in 2015, pointing to ongoing contraction in the Chinese manufacturing sector. China boasts the world’s second-largest economy, so signs of a continuing slowdown has sent investors scurrying to the safe-haven US dollar, at the expense of commodity-based currencies as well as crude oil. Earlier in the week, oil prices briefly moved higher, after Saudi Arabia abruptly cut off relations with Iran following a violent protest which damaged the Saudi Arabian embassy in Tehran. However, fundamentals have outweighed geopolitical concerns, as oil prices continue to fall. Oil prices were at $115 back in June 2014, but prices have plunged due to a global surplus of oil, which far exceeds demand. Oil producers have been unable to reach any agreement on lower production ceilings, as underscored at a recent OPEC meeting which ended in stalemate.Instead, oil exporters continue to produce at high levels in a desperate attempt to maintain market share, adopting the mantra of “every man for himself”.

The Federal Reserve will again find itself on center stage on Wednesday, with the release of the minutes of the momentous December policy meeting. At that meeting, the Fed opted to raise interest rates for the first time in over nine years, by 0.25 percent. The Fed has hinted that the December move will kick-off a series of incremental hikes in 2016, and the markets will be looking for confirmation, or at least a hint that this is the Fed’s monetary strategy. Meanwhile, employment data started off 2016 in style, jumping to 257 thousand in December. This crushed the forecast of 193 thousand, and was the strongest gain since June 2014. The markets will thus have plenty of data to sift through during the day, so we could see some further movement in the currency markets during the North American session.

WTI/USD Fundamentals

Wednesday (Jan. 6)

- 13:15 US ADP Non-Farm Employment Change. Estimate 193K. Actual 257K

- 13:30 US Trade Balance. Estimate -44.0B. Actual -42.4B

- 14:45 US Final Services PMI. Estimate 55.1 points. Actual 54.3 points

- 15:00 US ISM Non-Manufacturing PMI. Estimate 56.0 points. Actual 55.3 points

- 15:00 US Factory Orders. Estimate -0.2%. Actual -0.2%

- 15:30 US Crude Oil Inventories. Estimate 0.7M. Actual -5.1M

- 19:00 US FOMC Meeting Minutes

*Key releases are highlighted in bold

*All release times are GMT

WTI/USD for Wednesday, January 6, 2016

WTI/USD January 6 at 14:25 GMT

- WTI/USD 34.55 H: 36.35 L: 34.50

WTI/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 26.64 | 30.00 | 32.22 | 35.09 | 37.75 | 39.87 |

- Crude was flat in the Asian session, and has posted considerable losses in European and North American sessions.

- 32.22 is providing support

- 35.09 has switched to a resistance role as crude continues to lose ground

Further levels in both directions:

- Below: 32.22, 30.00 and 26.64

- Above: 35.09, 37.75 and 39.87