WTI crude continues to have an uneventful week, as crude futures trade at $36.32 per barrel in the North American session. In the US, Final GDP posted a solid gain of 2.0%. Existing Houses Sales disappointed, while the Richmond Manufacturing Index beat expectations.

Oil prices remain mired at low levels, with prices close to their lowest levels since February 2009. US crude futures have plunged a remarkable 25 percent since the start of November, as oil supplies continue to far exceed demand, which has fallen sharply due to weak global economic conditions. There doesn’t seem to be much relief in sight, as depressed prices could continue well into 2016, although if geopolitical crises arise which threaten the supply of oil, oil prices could rebound in a hurry. With OPEC in disarray and Iran biting at the chomp to sell its oil after years of international sanctions, there isn’t much to attract investors to oil, which some analysts are predicting could slip below the $30 level next year.

After months of indecision, the US Federal Reserve took the plunge last week and raised interest rates by 0.25 percent last week, the first upward move since June 2006. The Fed dropped a broad hint in its October policy meeting about a rate hike before the end of 2015, and predictably, investors and traders were busy trying to guess whether the Fed would indeed press the rate trigger. To the credit of Fed chief Janet Yellen and her colleagues, the Fed put into place a carefully-crafted strategy, sending a steady of stream of signals that it was intending to tighten monetary policy, if economic conditions remained positive. This gave the markets ample time to price in a rate hike, and currency market volatility was not excessive after the US rate hike, the first in almost 10 years. Although a hike of 0.25 percent is expected to have limited economic impact, the psychological aspect of the rate move cannot be overemphasized, as the Fed has given the US economy a critical vote of confidence. As well, this move is expected to be the first in a series of incremental rate hikes over the course of 2016.

WTI/USD Fundamentals

Tuesday (Dec. 22)

- 13:30 US Final GDP. Estimate 1.9%. Actual 2.0%

- 13:30 US Final GDP Price Index. Estimate 1.3%. Actual 1.3%

- 14:00 US HPI. Estimate 0.4%. Actual 0.5%

- 15:00 US Existing Home Sales. Estimate 5.32M. Actual 4.76M

- 15:00 US Richmond Manufacturing Index. Estimate -1 point. Actual 6 points

*Key releases are highlighted in bold

*All release times are GMT

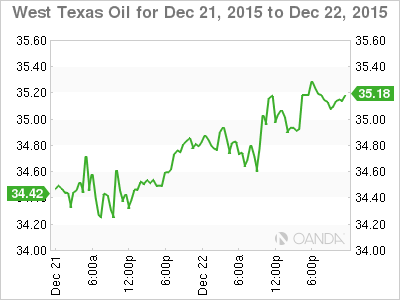

WTI/USD for Tuesday, December 22, 2015

WTI/USD December 22 at 17:45 GMT

WTI/USD 36.32 H: 36.53 L: 35.66

WTI/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 30.00 | 32.22 | 35.09 | 37.75 | 39.87 | 42.59 |

- Crude has shown marginal movement during the day

- 35.09 is providing support

- There is resistance at 37.75

Further levels in both directions:

- Below: 35.09, 32.22, 30.00 and 27.60

- Above: 37.75, 39.87 and 42.59

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.