WTI Crude has pushed higher, as crude futures trade at $37.69 per barrel in Tuesday’s North American session. In economic news, CB Consumer Confidence surged to 96.5 points, well above expectations.

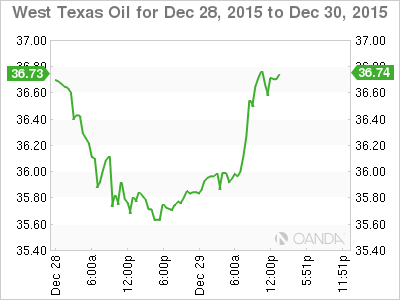

Crude oil has gained ground on Tuesday, trading close to the $38 level. This upward movement has erased the losses sustained on Monday. With thin liquidity in the markets marking the last week of 2015, some choppiness from WTI/USD is to be expected. Global oil supplies continue to far exceed demand, and oil-producing nations continue to produce at high levels, hoping to hold onto market share even as oil prices continue to drop. Crude has plummeted about 30% in 2015, and the sharp descent could continue into 2016, with some analysts predicting that the commodity will drop below the $30 level.

CB Consumer Confidence sparkled, as the key indicator jumped to 96.5 points, up sharply from 90.4 points a month earlier. This easily beat the estimate of 93.9 points. This follows a solid UoM Consumer Sentiment, which improved to 92.6 points, above the forecast of 92.1 points and marking a 4-month high. Consumer confidence indicators are closely monitored by analysts, as stronger consumer confidence often translates into increased consumer spending, a key driver of economic growth. Strong consumer demand has been an important factor in the strength of the US economy, which led to the historic rate hike by the Federal Reserve last week.

WTI/USD Fundamentals

Tuesday (Dec. 29)

- 13:30 US Goods Trade Balance. Estimate -60.9B. Actual -60.5B.

- 14:00 US S&P/CS Composite-20 HPI. Estimate 5.6%. Actual 5.5%

- 15:00 US CB Consumer Confidence. Estimate 93.9 points. Actual 96.5 points

*Key releases are highlighted in bold

*All release times are GMT

WTI/USD for Tuesday, December 29, 2015

WTI/USD December 29 at 17:30 GMT

- WTI/USD 37.69 H: 37.88 L: 36.61

WTI/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 30.00 | 32.22 | 35.09 | 37.75 | 39.87 | 42.59 |

- Crude has been on a slow but steady downward trend throughout the day.

- 37.75 was tested earlier and remains a weak resistance line.

- 35.09 is providing support

Further levels in both directions:

- Below:35.09, 32.22 and 30.00

- Above: 37.75, 39.87, 42.59 and 47.05