WTI Crude is uneventful on Friday, as crude futures trade just above $34 per barrel in the European session. In the US, there is just one minor event on the schedule. The markets will also be listening closely to remarks from FOMC member Jeffrey Lacker, the first Federal Reserve Bank President to speak publicly after the historic rate hike of 0.25 percent.

On Wednesday, the Federal Reserve raised interest rates by 0.25%, the first upward move since June 2006. The Fed dropped a broad hint in its October policy meeting about a rate hike before the end of 2015, and predictably, this led to tremendous speculation in the markets. To the credit of Fed chief Janet Yellen and her colleagues, the Fed put into place a carefully-crafted strategy, sending a steady of stream of signals that it was intending to tighten monetary policy, if economic conditions remained positive. This gave the markets ample time to price in a rate hike, and although the US dollar has posted gains against rival currencies and commodities this week, there hasn’t been a stampede by investors in the direction the dollar.

Although the small rate hike has not shaken up the currency markets and is expected to have limited economic impact, the psychological angle of the rate move cannot be overestimated, as the Fed has given the US economy a critical vote of confidence, and has indicated that additional rates are likely over the course of 2016. The Fed’s strategy contrasts sharply with the bungled approach of Mario Draghi at the ECB, who hinted that the ECB would take significant easing steps at its December meeting, but failed to deliver as the ECB did little more than extend the current QE program for another six months. This led to complete turmoil in the markets, resulting in a sharp ascent by the euro.

Down, Down, Down. That’s the sound of crude oil prices, which have sunk to their lowest levels since February 2009. US crude futures have plunged a whopping 25 percent since the start of November, as oil supplies far exceed demand, which has fallen sharply due to weak global economic conditions. Oil storage facilities on land are so full that dozens of tankers remain at sea, laden with oil and unable to discharge their cargo. The recent OPEC meeting, in which members couldn’t agree on any cuts and failed to even issue a production target, has only made matters worse. With Russia continuing to produce at high levels and Iran waiting in the wings to export its oil, prices could continue to head south as we head into 2016, with some analysts predicting prices below $30 a barrel. Meanwhile, the well-respected Moody’s rate agency sharply lowered its oil price assumptions on Tuesday, reflecting the huge disparity between supply of and demand for oil. The bottom line? There isn’t much of a case to make for buying oil at present, as oil prices could continue to soften.

There was good news from the US labor market on Thursday, as Unemployment Claims fell to 271 thousand last week, down from 282 thousand. The US labor market has improved nicely, as the economy is close to full employment, with jobless claims and the unemployment rate at low levels. Impressive employment numbers was a major reason that the Federal Reserve felt comfortable pressing the rate trigger at this week’s policy meeting. Still, weak spots remain in the US economy, among them the manufacturing sector, which continues to struggle. This was underscored by the Philly Fed Manufacturing Index, a key manufacturing indicator. The index came in at -5.9 points, its third decline in four months.

WTI/USD Fundamentals

- 14:45 US Flash Services PMI. Estimate 55.9 points

- 18:00 US FOMC Member Jeffrey Lacker Speaks

*Key releases are highlighted in bold

*All release times are GMT

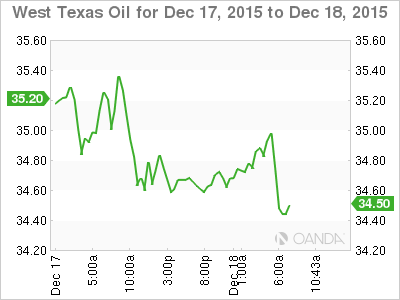

WTI/USD for Friday, December 18, 2015

WTI/USD December 18 at 11:25 GMT

- WTI/USD 34.45 H: 35.09 L: 34.45

WTI/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 27.60 | 30.00 | 32.22 | 35.09 | 37.75 | 39.87 |

- Crude was flat in the Asian session and has posted slight losses in European trade.

- 32.22 is providing support

- 35.09 remains busy and has switched to a resistance line

Further levels in both directions:

- Below: 32.22, 30.00 and 27.60

- Above: 35.09, 37.75, 39.87 and 42.59