- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crane Co. To Buy Crane Currency, Reaffirms '17 Earnings View

Crane Co. (NYSE:CR) recently agreed to acquire 100% equity stake in Boston-based Crane & Co., Inc. (Crane Currency). Buyout consideration has been fixed at $800 million. Additionally, the company lowered its GAAP earnings guidance for 2017 while reaffirmed its adjusted earnings projections. Forecasts for 2018 were also offered.

Crane Currency designs and manufactures secure and highly-engineered banknotes for more than 50 central banks in the world, providing employment to nearly 1,100 people. Also, it engages in substrates manufacturing and providing advanced micro-optic security technology to its customers. The firm, founded in 1801, is anticipated to generate $500 million revenues in 2017, with roughly one-third sourced from the U.S. operations and rest internationally. Its adjusted earnings before interest, tax, depreciation and amortization (EBITDA) are likely to be $94 million. Its addressable market size is $4.4 billion.

Details of the Buyout

Complying with the terms of the buyout agreement, Crane will acquire the equity stake in Crane Currency from Lindsay Goldberg — a private equity firm, Crane’s family members and other shareholders. The completion of the transaction is currently subject to receipt of regulatory approvals and fulfilment of customary closing conditions.

The buyout consideration of $800 million represents roughly 8.5x of Crane Currency’s estimated adjusted EBITDA for 2017. The company intends to finance the transaction with available cash and funds secured from additional debts.

Crane Co. anticipates closing the acquisition in the first quarter of 2018.

Synergistic Benefits From Crane Currency Buyout

The Crane Currency buyout is expected to strengthen Crane Co.’s foothold in the currency and payments market. The combined business will have enhanced resources and technological expertise to leverage benefits from future growth opportunities.

Crane Co. anticipates that the Crane Currency buyout will add roughly 15 cents to earnings per share in the initial year post completion. This accretion is projected to increase to $1 by 2021. Further, the company believes that this transaction will enable it to grow its earnings per share by more than 10% in the years ahead.

Over time, Crane has acquired meaningful businesses and disposed non-core assets to improve its business portfolio. In May this year, the company acquired Westlock Controls — a specialist in manufacturing and distribution of switchboxes, position transmitters and other solutions for use in networking, monitoring and controlling process valves.

Earnings Guidance

Crane Co. kept its adjusted earnings guidance for 2017 intact at $4.45-$4.55 per share. However, expecting higher transaction related costs in the fourth quarter, the company lowered its GAAP guidance to $4.38-$4.48 from the earlier forecast of $4.41-$4.51.

In addition, the company issued preliminary projections for 2018. Earnings, excluding the impact of Crane Currency buyout, are projected to be within the $4.85-$5.05 per share range. Core sales are estimated to increase in the 2-4% range.

In the last three months, Crane Co’s shares have yielded 14.3% return, outperforming 0.6% decline of the industry.

Zacks Rank & Stocks to Consider

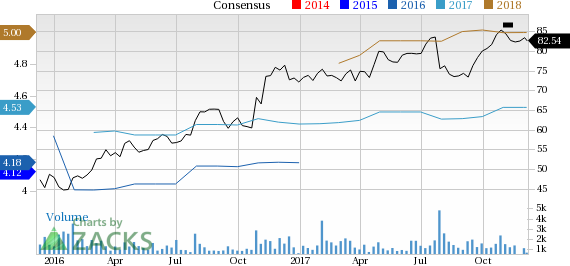

With a market capitalization of nearly $4.9 billion, Crane Co. currently carries a Zacks Rank #3 (Hold). The stock’s earnings estimates for 2017 were revised upward by five brokerage firms in the last 60 days while that for 2018 were raised by two and lowered by one. Currently, the Zacks Consensus Estimate is pegged at $4.53 for 2017 and $5.00 for 2018, representing growth of 1.3% for 2017 and no change for 2018 from their respective tallies 60 days ago.

Crane Company Price and Consensus

3M Company (MMM): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Crane Company (CR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.