- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coupa Software (COUP) Q4 Earnings, Revenues Top Estimates

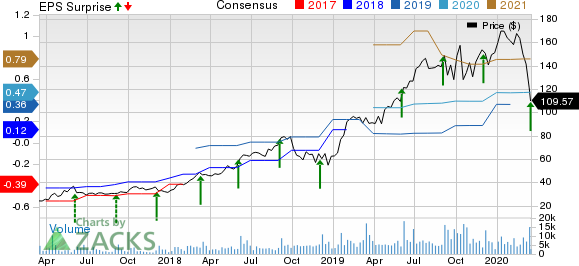

Coupa Software Inc. (NASDAQ:COUP) reported fourth-quarter fiscal 2020 non-GAAP earnings of 21 cents per share that surpassed the Zacks Consensus Estimate of 5 cents. Further, the bottom line soared 320% from the year-ago quarter’s figure.

Revenues of $111.5 million outpaced the Zacks Consensus Estimate by 8.45%. Further, the figure surged 49% from the year-ago quarter.

Subscription revenues (88.5% of total revenues) improved 46% year over year to $98.6 million. Meanwhile, Professional services & other revenues (11.5%) climbed 73.5% year over year to $12.8 million.

The top line was primarily driven by robust adoption of the company’s Business Spend Management (BSM) offerings and traction witnessed Coupa Pay offerings.

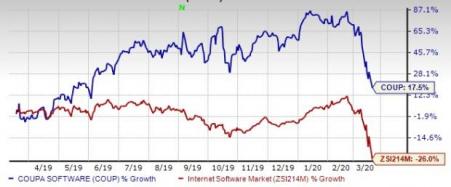

One Year Price Performance

Notably, the stock has returned 17.5% in the past year, against the industry’s decline of 26%.

Expanding Clientele Remains Noteworthy

Coupa Software’s customer base continued to expand in the reported quarter. Notable new deal wins in the quarter are AstraZeneca, Fox Corporation, Grupo Planeta, Three Ireland, among others.

During the fiscal fourth quarter, Coupa Software acquired Seattle-based Yapta, with an aim to strengthen Coupa BSM Platform’s Travel and Expense offering with travel price optimization capabilities and offer travel savings to businesses in real-time.

We believe that innovation and product enhancements will enable Coupa Software to strengthen its position in the BSM market amid ongoing digital transformation.

Margin Details

Non-GAAP gross margin expanded 50 basis points (bps) from the year-ago quarter’s level to 73%.

Non-GAAP operating income soared to $13.3 million from $2.4 million reported in the year-ago quarter. Non-GAAP operating margin came in at 12% compared with year-ago quarter’s figure of 3.1%.

Balance Sheet & Cash Flow

As of Jan 31, 2020, Coupa Software had cash and cash equivalents and marketable securities of $767.2 million compared with $842.3 million as of Oct 31, 2019.

Cash flow from operations came in at $22.3 million compared with $25.8 million in the last reported quarter. Free cash flow totaled $20.2 million during the fiscal fourth quarter compared with negative free cash flow of $22.1 million in the last reported quarter.

Guidance

For first-quarter fiscal 2021, revenues are anticipated in the range of $111.5-$112.5 million. The Zacks Consensus Estimate for revenues is currently pegged at $107.86 million. Subscription revenues are expected between $101.5 million and $102.5 million, while professional services revenues are anticipated to be approximately $10 million.

Non-GAAP income from operations is estimated in the range of $4.0-$5.5 million. Non-GAAP net income is projected in the band of 6-8 cents per share. The Zacks Consensus Estimate for earnings is currently pegged at 7 cents per share.

For fiscal 2021, Coupa Software anticipates total revenues between $488 million and $490 million. The Zacks Consensus Estimate for revenues is currently pegged at $487.58 million.

Non-GAAP income from operations is anticipated in the range of $21-$23 million compared with the previous range of $10-$13 million. Non-GAAP net income is expected in the band of 30-33 cents per share. The Zacks Consensus Estimate for earnings is currently pegged at 47 cents per share.

Zacks Rank & Other Key Picks

Coupa currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth considering in the broader sector are Microsoft (NASDAQ:MSFT) , Applied Materials (NASDAQ:AMAT) and Garmin (NASDAQ:GRMN) . All the three stocks currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microsoft, Applied Materials and Garmin is currently pegged at 13.22%, 9.94%, and 7.35%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

COUPA SOFTWARE (COUP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.