- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coupa Software (COUP) Gears Up For Q4 Earnings: What To Expect?

Coupa Software (NASDAQ:COUP) is scheduled to report fourth-quarter fiscal 2020 results on Mar 16.

For the fiscal fourth quarter, the company expects earnings in the range of 3-6 cents per share. The Zacks Consensus Estimate for earnings has been steady over the past 30 days at 5 cents per share, in line with the year-ago quarter’s reported figure.

Revenues are anticipated in the range of $101.5-$102.5 million. The consensus mark for fiscal fourth-quarter revenues is pegged at $102.77 million, suggesting growth of 37.2% from the prior-year quarter figure.

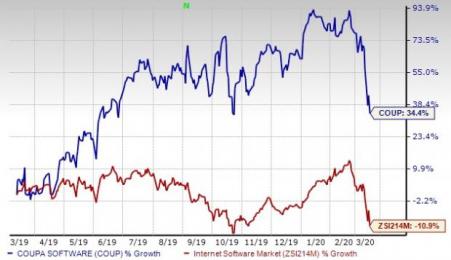

One Year Price Performance

Notably, the stock has returned 34.4% in the past year, against the industry’s decline of 10.9%.

Factors Likely to Have Influenced Q4 Results

Coupa Software’s fiscal third-quarter performance is likely to have benefited from robust adoption of Business Spend Management (BSM) offerings and an expanding customer base.

Efficient and smart spend-control programs that provide enhanced reporting and analytics have been the primary catalyst for Coupa Software’s expanding clientele. Such factors are likely to have contributed to the company’s subscription services revenues in the quarter to be reported.

Coupa Software anticipates Subscription revenues between $91.5 million and $92.5 million. The Zacks Consensus Estimate for Subscription revenues is currently pegged at $93 million, suggesting growth of 37.7% from the prior-year reported figure.

Notably, the company anticipates professional services revenues to be approximately $10 million. The Zacks Consensus Estimate for Professional services and other revenues is currently pegged at $10.44 million, suggesting growth of 41.5% from the prior-year quarter.

Moreover, ongoing momentum in solutions such as Accelerate, Invoice payments and Virtual Cards for Pos is likely to have driven the fiscal fourth-quarter top line. It has extended these solutions to partners like American Express (NYSE:AXP), Citibank, Transfermate, Stripe and PayPal.

Further, the company has been adding new capabilities to Coupa Supplier Insights and Coupa Source Together solutions, which is anticipated to have bolstered adoption and generated incremental revenues in the quarter under review. Notably, the company strengthened Coupa Pay solution with support for Expense Payments.

Introduction of Coupa CLM Advanced on synergies from integration of Coupa BSM platform with Exari's technology amid ongoing digital transformation is expected to have strengthened the company’s position in the BSM market.

However, rising operating expenses are likely to have weighed on the company’s fiscal fourth-quarter margins.

Key Development in Q4

During the fiscal fourth quarter, Coupa Software acquired Seattle-based Yapta, with an aim to strengthen Coupa BSM Platform’s Travel and Expense offering with travel price optimization capabilities and offer travel savings to businesses in real-time.

What Our Model Says

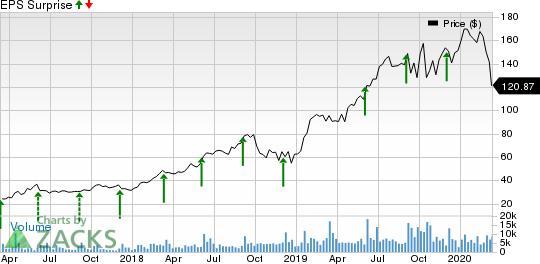

Our proven model does not conclusively predict an earnings beat for Coupa Software this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Although Coupa Software currently has a Zacks Rank #1, an Earnings ESP of 0.00% makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few stocks that you may consider, as our proven model shows that these have the right combination of elements to post an earnings beat.

Micron Technology, Inc. (NASDAQ:MU) has an Earnings ESP of +5.05% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tencent Holdings Limited (OTC:TCEHY) has an Earnings ESP of +6.03% and a Zacks Rank #2.

Lululemon Athletica Inc. (NASDAQ:LULU) has an Earnings ESP of +0.27% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Micron Technology, Inc. (MU): Free Stock Analysis Report

lululemon athletica inc. (LULU): Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis Report

COUPA SOFTWARE (COUP): Free Stock Analysis Report

Original post

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.