Coty Inc. (NYSE:COTY) has been benefiting from strong consumer demand in the Luxury segment. Moreover, the company has made several acquisitions to enhance its brand portfolio. Also, it is on track with its transformation plans and cost-saving initiatives. However, the Consumer Beauty segment has been sluggish for some time.

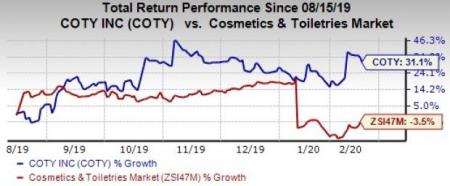

Nevertheless, the aforementioned upsides aided the company’s performance in second-quarter fiscal 2020, with earnings and revenues beating the Zacks Consensus Estimate. In fact, we note that the company’s shares have gained 8.5% since its earnings release. Further, shares of this Zacks Rank #3 (Buy) company have rallied 31.3% in the past six months against the industry’s decline of 3.5%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

What’s Driving Coty’s Performance?

Coty’s Luxury segment has been performing well for quite some time, backed by solid brand performances, innovations and strong consumer demand. Like for Like (LFL) revenues inched up 1.3% in the segment during fiscal second quarter. The unit’s LFL sales were driven by growth in ALMEA and Europe regions along with Travel Retail. Also, robust product innovations under brands like Burberry, Gucci, Tiffany (NYSE:TIF) , Hugo Boss and Lacoste drove growth during the quarter. Management is committed toward bolstering performance in the Luxury segment, which contributed 43% to Coty’s revenues in fiscal second quarter.

Also, Coty, which shares space with Estee Lauder (NYSE:EL) , has made several acquisitions to enhance its brand portfolio. In this regard, the company’s buyout of the iconic Burberry brand, in the second quarter of fiscal 2018, is noteworthy. This acquisition has been supporting growth in the Luxury segment. Other instances in this regard include the buyout of Good Hair Day or ghd, which has been aiding growth at Coty’s Professional Beauty. Additionally, the company’s buyout of Procter & Gamble Company’s (NYSE:PG) global fine fragrances, salon professional, cosmetics and retail hair color businesses along with select hair styling brands (the P&G Beauty Business) has been yielding results for quite some time.

Apart from these, Coty is on track to turn around its operations. The company is building and streamlining operations, upgrading systems, optimizing manufacturing and logistics as well as simplifying overall operations. Simultaneously, it is focused on investing in brands and transforming digital capabilities to drive sustainable growth. Prudent promotional tactics are an important part of the company’s efforts to build brands. Moreover, management is committed to optimize the overall cost structure, which is helping Coty witness margin expansion. Stringent cost control along with adjusted gross-margin expansion contributed to Coty’s adjusted operating margin in fiscal second quarter.

Can Consumer Beauty Softness be Countered?

Coty’s Consumer Beauty segment has been reporting soft organic sales for a while. The segment continued to be under pressure in fiscal second quarter, with revenues declining 17.4% to $799.7 million and LFL sales falling 6.7%. Revenues in North America were under pressure due to reductions in shelf space and persistent weakness in the mass beauty market in this particular segment. Further, revenues declined across color cosmetics, retail hair, body care and mass fragrances categories.

Nevertheless, the company is focused on reviving this unit. In this context, the company divested its 60% stake in Younique in September 2019 to focus on areas with greater potential. Also, Coty is on track with various working media strategies in the Consumer Beauty unit.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

The Estee Lauder Companies Inc. (EL): Free Stock Analysis Report

Tiffany & Co. (TIF): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Original post

Zacks Investment Research